Since January of 1964, cigarette packages sold in the United States have carried a warning[1], currently worded as follows: “SURGEON GENERAL’S WARNING: Smoking Causes Lung Cancer, Heart Disease, Emphysema, And May Complicate Pregnancy.”[2] I personally prefer the blunt economy of the warning labels used in Germany, which (translated) means: “Smoking Is Lethal!”

I cannot deny that the SEC requires that almost all investment material disseminated to the public include some form of disclosure or warning. For example, ads for mutual funds must include a warning such as: “past performance does not guarantee future results” and/or “investors could lose money in the fund.” However, according to a 2010 article in Forbes, at least one academic study has demonstrated that study participants who read those warnings were no less likely to actually buy the fund than those who did not see the warning! The reason suggested by the study that such warnings are ineffective is simple: the language used is exceptionally weak. A parallel, of course, can be seen in the contrast between U.S. and German cigarette warning labels.

Why am I concerned about this? Wall Street is about to ramp up another all-out effort to brainwash investors regarding the latest and greatest “can’t miss… sure thing” investment. When that happens, investors need someone to serve as an objective “reality check”, because invariably, 90% of financial media stories, 90% of CNBC segments, and 99% of broker phone calls will not be balanced… after all, their interests are not identical with your interests!

So just sit back and think of me as your trusted, wizened, crash-tested[3], and (above all) honest big brother, ready to tell it to you as it actually is – rather than how promoters want you to believe it is. I have no agenda and no interests other than what is most likely to help you grow your investment balance!

Let’s start by presenting you with a Quiz. OK? And keep in mind that this Quiz is integral to the central content and significance of this article, so (please) take some time to read and reflect upon each question. Would you be willing to buy a stock if you knew any or all of the following facts in advance:

1) The company’s founder and then CEO engaged in self-dealing over four years ago, personally buying a subsidiary at a price below market value without informing the Board or company partners;[4]

2) Unlike other “big name” internet/mobile tech firms, whose founder and/or CEO has possessed a tech or engineering pedigree (AAPL, GOOG, ORCL, QCOM, AMZN, etc.), the founder of this internet company admits he is not a tech expert;

3) The company’s founder has admitted: “I had always wished that I was born in a period of war. I could have been a general. I thought about what I could have achieved in war;”

4) Blending the event related in 1) with the insight revealed in 3), the company’s founder justified his action in 1) by likening it to the powerful leadership exercised by Deng Xiaoping during the deadly government crackdown on protesters at Tiananmen Square on 6/4/89; [5]

5) The company’s founder twice failed the entrance exam for the university of his choice;

6) The company’s Executive Chairman has publicly declared that his priority for resource allocation and attention/concern is as follows: 1) customers; 2) employees; 3) shareholders;

7) The available, publicly traded stock does not vest the owner with direct ownership of a portion of the company, but is rather a “Variable Interest Entity” (VIE) the validity of which is dependent upon future determination(s) of third world regulators;

8) The accounting practices of this company’s home country make the quarterly accounting machinations of J.P. Morgan Chase (JPM) CEO, Jamie Dimon, appear to be as honest and forthright as the legendary Abraham Lincoln (by comparison);

9) The company stock was priced at a very significant premium over an objectively calculated “fair value” level;

10) As a corollary to 9), this relatively young company is priced at levels that place its market cap above 95% of the stocks within the S&P 500 Index.

If your answer to all of the above questions was “No, I would not buy the stock”… consider this exercise a warning to you.

If your answer to some of the questions was “Yes” and “No” to the others, then you may want to seek out more details about the company before making a final “Buy” decision (read my follow-up article, for example).

And if you answered “Yes, I would buy the stock” on all of the questions… then congratulations! Further research will be unlikely to deter you from buying the stock… when (that is) it becomes available!

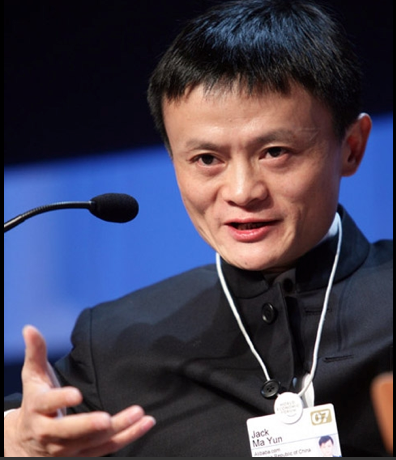

I imagine that, by now, most of you have deduced which stock I have described above! Question 1 offered a strong hint, while Question 4 practically gave the company’s identity away! It is the already famous Alibaba Holdings, whose founder (and until recently, CEO) is Ma Yun (more commonly referred to as Jack Ma).

During the first full week of May, Alibaba filed a F-1 with the SEC for a United States IPO. The SEC is currently reviewing the F-1 and its widely expected to provide authoritative feedback on the filing as soon as June 7th. At this point, the most widely referred to IPO date is early in August of 2014.

In this world, within which it is commonly acknowledged that only three things are “certain”[6], there is now a fourth certainty between now and August: we will all become sick and tired of hearing about Alibaba and Jack Ma by the time August rolls around! Wall Street (especially the underwriters of the IPO) will want us all to think our portfolio will be deficient without shares of Alibaba and (at least at times) Jack Ma will be made to sound as though he could “walk on water!”

Although you all know that I am in no way omniscient, I can safely assure you (without reservation) that neither of those premises is actually true. In fact, your portfolio will not (necessarily) be deficient without shares of Alibaba stock, and Jack Ma most decidedly would sink into the water if he tried to walk on it!

Let me hasten to add that Jack Ma is in no way a bad person, or of questionable character!! Nor is Alibaba anything less than an incredible “story stock”… with financial and sales metrics that will blow you out of the water! However, please filter all you read and hear about both Ma and his company in the months ahead through my famous “BS Filter”.[7]

To help you get your “BS Filter” fully operational, let’s take a closer look at Ma Yun (aka Jack Ma). Mr. Ma was born on October 15th of 1964 (he is now 49 years old) in Hangzhou of Zhejiang Province, about 1 hour southwest of Shanghai (see map). His family name (see the Chinese character) was (as of a 2006 report) the 14th most common name in the Chinese mainland.[8]

After he graduated from what we call high school, he aspired to enroll in the Hangzhou Teacher’s Institute. However, he failed the requisite entrance exam twice. At that point he demonstrated a trait that has served him well ever since: he is tenacious! His third try at the entrance test was successful, and he studied at the Institute (now known as Hangzhou Normal University) – graduating in 1988 with a Bachelor’s Degree in English.

”] During this university period, three important things developed that have proven to be integral to Ma’s later success with Alibaba:

During this university period, three important things developed that have proven to be integral to Ma’s later success with Alibaba:

1) He demonstrated his political aptitude by becoming elected “Student Chairman” at the Institute;

2) He became extremely adept with the English language… enabling him to (ever since) interface directly with Wall Street financiers, analysts, and reporters;

3) Following graduation, he secured a position at the Hangzhou Dianzi University as an English (and “International Trade”) teacher.[9]

Keep all of these developments in mind as I unfold more of Ma’s story.

During these teaching years, Ma followed with great interest the evolution of computer technology and the Internet. He used the latter for the first time in 1995, searching for the words “beer” and “China”. He received “no results”. That experience prompted Ma to collaborate with a tech savvy friend on the creation of a basic web page that offered Chinese translation services. Within just hours, Ma received inquiries via email from locations around the world. He became “hooked”.

Next (remember his skill with English) he began working with tech skilled friends from the U.S. to build websites for Chinese friends. Regarding the birth of his attachment (personal and professional) to the Web, Ma recalled (in a 2005 article from the New York Times): “the day we got connected to the Web, I invited friends and TV people over to my house [and on a very slow dial-up connection] we waited three and a half hours and got half a page…. We drank, watched TV and played cards, waiting. But I was so proud. I proved (to my house guests that) the Internet existed.”

From there, Ma founded what many experts consider to be the first “Internet-based” company in China – the “China Pages”. In those early days, one of Ma’s colleagues, Cui Luhai, who was then operating a computer animation business, met with Mr. Ma at the office of China Pages, hoping to learn about Ma’s longer-term plan for the website. Luhai has offered a “window” into those early days:

“I can still remember the first scene I saw when I walked into his office. It was a pretty empty space with only one desk set up in the middle of the room. There was only one very old PC desktop surrounded by a lot of people.”

Mr. Luhai discovered that Ma had spent much/most of his money on registering his new business, leaving precious little money for adequate hardware. Realizing the importance of government support [recall his innate political instincts/skill], Ma spent considerable time and effort trying to persuade Chinese bureaucrats of the potential and future importance of the Internet. In fact, for all of us “visual learners”, Porter Erisman’s[10] quasi-documentary about Ma and Alibaba [“Crocodile in the Yangtze”] offers footage of just one of numerous visits made by Ma to Beijing officials during the 1995-1997 period. In the film, Ma is dressed in a button-down blue denim shirt, sitting in a smoke-filled government office trying to explain (with the aid of an aging laptop) his business to an official draped in tie and jacket. Ma said to that bureaucrat:

“Nowadays, foreigners can use computers from any desktop to find products from around the world. They can order directly from Hong Kong, Taiwan, Singapore, but they can't order anything from China because right now there's nothing from China on the Internet. I hope the various [government] departments will support us.”

Not surprisingly, Mr. Ma’s efforts were to no avail. However, Ma Yun is nothing if not determined, resilient and cunningly enterprising. Perhaps putting a new spin upon an ancient adage [“if you can’t beat them, join them”] Ma left China Pages in 1997 and accepted a position within the government itself!! Working within a unit connected to the Chinese Commerce Ministry, he helped to create websites. There, drawing liberally upon his tenacity and his innate political instincts, he began building a professional network. By 1999 (at the age of 35), Ma decided it was time to strike out on his own – exiting the Ministry and founding Alibaba!

The inaugural entity within the Alibaba empire was a “business to business” marketplace (Alibaba.com) that linked Chinese exporters with overseas buyers. This was an effort that enjoyed great success, in large part because it was new, distinctive, and reflected Ma’s ability to think “outside the box”. In those days, the fact was that most Chinese sites were (in effect) knockoffs of existing Western sites. In contrast, Ma’s site was different… specifically attuned to Chinese needs and culture.

In that same year (1999), Ma’s ties within the U.S. and his facility with the English language both proved immeasurably beneficial, because he was able to coax a Taiwan-born, Yale educated lawyer and financier who was (by then) working within the private equity space in Hong Kong [Joseph C. Tsai] to join him in running Alibaba![11] The Ma/Tsai tag team lured Goldman Sachs (GS) and Japan’s Softbank (SFTBY) into offering Alibaba significant financing.

This is Joseph Tsai, who partnered with Ma Yun in 1999 and became CFO of Alibaba. He is now Executive Vice Chairman.

I suspect that everyone (even critics) would have to agree that one the characteristics of Ma that has enabled his success is his recognition of the “leverage” available through collaboration. We’ve already seen that he worked with friends (from the U.S. and China) to develop China Pages and (later) Taobao.com, and he was astute enough to recognize he needed the financial and networking skills of Tsai – bringing him aboard as an integral partner in the enterprise. The “back story” of Tsai’s decision to join with Ma in building Alibaba offers an even detailed view into how Ma managed to build his company from scratch into prominence (from an interview published in January of this year). Recalling his introduction to Ma in 1999, Tsai said: “Jack already was with a group of followers. Basically these were his [English] students…. I just saw this energy. They were working very hard. They seemed happy. They had that glimmer in their eyes. And I thought to myself, ‘Wow, this is a guy who can really get people together. He’s a great leader. He can really build something.’”

During that 1999 period observing Ma Yun with his followers (employees), Tsai recognized that if he decided to join Alibaba, he would be taking a huge risk – forsaking his $700,000 salary to work with a “start up”. Tsai revealed that the deciding factor that convinced him to partner with Ma was this: “You want to follow someone who could work with other people, who could lead, aggregate talent from all over the place.”

It is telling to consider Ma’s self-perception. He has been clear from the start that his primary gift is not as an engineer or a technician, but rather as a strategist and visionary –the “Guiding Force” behind Alibaba. The early design and focus of Taobao provides a revealing demonstration of his willingness to take risks and “stay the course” once he envisions a strategic business opportunity.

Recall that Ma found early success through his inaugural marketplace platform effort – the business-to-business web market provided in Alibaba.com. As he analyzed the broader internet-based marketplace space in China, he saw an opportunity within the consumer-to-consumer space. That prompted him to build Taobao.com, making it available to the public in 2003. I know this development sounds pretty natural and unremarkable (ie. expanding into the consumer to consumer space). However, consider this: by 2003, eBay had already matured into the dominant consumer-to-consumer market platform in China!

Nonetheless, Ma was convinced that he could out-market, outperform, and outlast eBay! How did he do this? He did it by designing an online market that more faithfully reflected the Chinese culture and the expectations/images Chinese consumers have regarding a “marketplace”. In fact, if you explore the Taobao.com site, you find that it is very colorful and (as you move from page to page) a bit chaotic in ways that can appeal to the viewer.

Early on, Ma recognized (and believed in) the power of market share.[12] What is the surest way to foster and build market share? Low Prices! Therefore, Ma made the decision to keep Taobao “free” (relying strictly upon ad revenue). That decision that was phenomenally successful in growing sales volume, but it was disastrous for the bottom line!! To his credit[13], Ma never backed down from his strategic decision – despite weekly/monthly financials that bled red so badly that a lesser CEO would panic!

Here is how Porter Erisman[14] describes that period: “From a Wall Street investors' perspective, [Ma] was willing to run Alibaba into the ground to defeat eBay — the only thing worse than a smart competitor is a crazy one who is willing to just spend all their money with no hope of making profit!”

Ma’s tenacious marketing strategy worked! By October of 2005, Ma was able to face the press and report that Taobao controlled almost 70% of online shopping in China! Not quite “spiking the ball”, Ma went on to say: “Pretty soon we'll be the only one left. eBay's days are numbered!” Sure enough, during 2006, eBay reported that it had folded its Chinese operations into a Hong Kong-controlled Internet company — thereby conceding defeat.

When reflecting upon the parts of his life that demonstrate strategic insight, decisiveness, and courage (such as the above story), Ma admits that, as a child, he dreamed of being a great general: “I had always wished that I was born in a period of war. I could have been a general. I thought about what I could have achieved in war.”

This is Ma Yun at an International Round Table (hosted by Charlie Rose). Other panelists were England's Gordon Brown and Goldman Sachs' Lloyd Blankfein (among others).

By the time 2009 rolled around, it appears that Ma drew upon his “General” tendencies when he engineered what could be labeled as a “corporate coup.” Allow me to set the scene:

Early on in the growth of Alibaba, Ma’s strategic genius recognized the need for a reliable payments processor with enough scale to dependably handle millions of transactions, since without that secure, “third party” financial intermediary, the internet marketplace is “dead in the water”. As a result, Ma created Alipay[15] in 2004.

Putting it mildly, Alipay was a huge success. It became so successful that it bred other (much smaller) competitors. Although Alipay consistently maintained an approximate 50% share of online transaction volume, new firms kept entering the space. As all experienced “China watchers” know, wherever there is corporate success in China, the Chinese government is certain to watching, analyzing, and (almost always) regulating! The government became alarmed at the mushrooming of online transaction companies. In addition, beyond the growing number of firms involved, the government began focusing on who controlled the firms!

One persistent phobia of the Chinese government is undue influence (ie. control) by foreign investors. Therefore (not surprisingly) Alipay drew suspicion because its parent, Alibaba, was (then) majority-owned by foreign concerns[16]. As the time came for Alipay to secure a government license (2009-10), some form of assurance needed to be provided to officials that Alipay would remain sufficiently independent of foreign control to satisfy regulators.

That in a nutshell presents the background necessary for “the rest of the story”! We have already witnessed Ma Yuan’s political savvy and his pragmatic willingness to do whatever is necessary to ensure government support (including postponing his dream of entrepreneurship for 2 years while he went to work within the government!). Therefore, his “natural” approach to this dilemma was to work with the government to get Alipay securely into the hands of Chinese citizens. The government expressed approval of that solution – and it was carried out![17] Problem solved!

Or was it “solved”? What Ma engineered (with government approval) was the transfer of Alipay into separate entities under the control of (primarily) Ma and Tsai.

There were at least two problems with this “solution” that came to worldwide prominence in 2011, when the financial press first published stories regarding Alipay-related details :

1) Countless analysts reported that Ma engineered this corporate transaction at a price below “market value”![18]

2) The corporate chiefs at both Softbank and Yahoo disclaimed any advance knowledge of the Alipay transfer, or of the negotiations that led to that transfer.[19]

To put it mildly, once the Alipay transfer was formally reported in the press, “all hell broke loose”. Shareholders of SFTBY and YHOO were outraged, and much of the press interpreted this action as an “end around” by Ma to sidestep the complications inherent in any attempt to secure united board action on the matter. In the wake of charges, counter-charges, and lots of corporate “heat” (with very little “light”), many investors became disenchanted or disillusioned. Among such investors was the well-known hedge fund manager, David Einhorn, who sold all of his shares in YHOO, complaining that the atmospherics surrounding the Alipay transfer “wasn’t what we signed up for!”

Eventually, the tempest died down and (on the surface at least) SFTBY and YHOO came to terms with Alibaba. Mr. Tsai was instrumental in the peacemaking process – which involved agreement upon a set of promised actions that ensured eventual monetization of Alipay for the benefit of existing shareholders. One year later, Tsai also negotiated with YHOO a price at which Alibaba would repurchase part of YHOO’s stake in Alibaba![20] That sale was a desperate attempt by YHOO leaders to extract some level of “face-saving” from the Alipay episode by securing a pile of cash “for shareholders”.[21]

During the Alipay brouhaha, Mr. Ma offered this public “defense” of his actions: “If Alipay were [declared to be] illegal or didn't get the license, Taobao would be paralyzed. If Taobao were paralyzed, how could Alibaba reform and develop?” With all due respect to Mr. Ma and his incredible achievements, this quote is merely a statement of a priori facts[22], having nothing to do with the central issue in dispute – which was how to secure a government license for Alipay. It was the appearance that Ma engaged in backroom dealing with the government, without full board consultation, through a transaction that resembles “self-dealing” that precipitated the major storm in 2011!

Here is an English version of the Alipay website!

This is a page from the Alipay.com website. Notice that I pulled an image from the version of Alipay that includes English subtitles!

That being said, there is no evidence that Mr. Ma has ever come to understand the Alipay episode in those terms. In fact, Mr. Ma has likened his actions in 2011 with the crackdown on government protesters on June 4, 1989 at Tiananmen Square. He compares himself favorably with then Chinese Premier, Deng Xiaoping, describing his analogy in these terms: “As a company C.E.O., no matter if it's the Alibaba incident, no matter if it's splitting off Alipay, at that point, it's just like Deng Xiaoping during 6/4. As the country's highest decision maker, he demanded stability. He needed to make this kind of cruel decision.”[23]

At this point, you might be developing an image of Ma Yun as a “tough as nails, show no quarter” leader. The most insightful among our faithful readers recognize that no one person can ever be quite so simply characterized. In light of that thought, consider this story of Ma’s presentation to a massive employee rally (16,000 attended) in a sports stadium in 2009[24] (celebrating the company’s 10th Anniversary):

Ma appeared on stage wearing a waist-length blond wig, a black leather jacket with red flame and metal stud accents, sunglasses and lipstick.[25] (Sorry, I couldn’t find a photo!) Then he lifted a microphone to his mouth and launched into a spirited rendition of none other than “Can You Feel the Love Tonight?”

If that story doesn’t change your impression of Ma Yun, I’m not sure what could!! I defy you to imagine Tim Cook (AAPL), Paul Jones (QUAL), or Larry Ellison (ORCL) …… much less Steve Jobs (AAPL) or Bill Gates (MSFT) ever presenting himself in similar fashion!

Finally, here are a few other vignettes regarding Ma Yun that might help you form a clearer impression regarding the magnitude of his achievements and what his life might be like:

1) In November of 2007, he purchased a 5-bedroom penthouse duplex on the 52nd floor of a Hong Kong building that encompasses 7,088 square feet. The cost (at that time) was $38.7 million (HK $300 million).[26]

2) In May of 2009, Time magazine identified Ma as one of the world’s “100 Most Influential People” (aka the “Time 100” list). Within the accompanying article, former Time senior editor, Adi Ignatius, described Ma as follows: “Meeting Jack Ma, you might be forgiven for thinking he's still an English teacher. The Chinese Internet entrepreneur is soft-spoken and elflike — and he speaks really good English.”

3) He is the first Mainland Chinese entrepreneur to be featured on the cover of Forbes;

4) By November of 2012, the volume of Alibaba online transactions moved beyond one trillion yuan! Given that milestone, he received a new moniker… “Trillion Hou”, which means “Marquis of trillion Yuans”.

INVESTOR TAKEAWAYS:

I’ll never have the opportunity to receive a summary of reader reaction to any given article; however, in this instance, I would be especially intrigued to know how readers reacted to learning so much about Ma Yun (Jack Ma) and some of the “behind the scenes” stories related to Alibaba. How should we feel about how Ma handled the need to insulate Alipay from foreign control, and (perhaps more significantly) his pride in comparing his decisive decision-making to that of Deng Xiaoping on June 4, 1989? Investment analysts often trumpet “shareholder friendly” actions by company management. Has Ma been “shareholder friendly” or not? I could make arguments either way!

And yet, for all of Ma’s apparent “warts”, no one can deny that he has been a brilliant leader, demonstrating his brilliance in at least these ways:

1) Recognizing from the very beginning that he could never be a “self-reliant” corporate leader. He freely admitted his dependence upon the technical expertise of his students and tech friends, his reliance upon the financial savvy of Joseph Tsai, and his need to maintain the support of the Chinese government for Alibaba and his leadership within Chinese industry! Meanwhile, Ma is completely content with his role of visionary, strategist, team leader, and “public face” for Alibaba.

2) He was humble enough to be generous and loyal. Tsai describes how surprised he was when Ma told him to list all 18 of his early “students/disciples” as co-founders of Alibaba with him and Tsai. Granting that status was not just passing gesture – it meant stock ownership (and now) significant financial gain!

3) Having the visionary conviction and courageous tenacity to chase eBay out of China when eBay dominated the consumer-to-consumer market;

4) It is somewhat ironic that Alibaba is so dominant that its biggest vulnerability is the possibility that another leader/company could “disrupt” Alibaba in much the same way that Ma disrupted eBay back in 2013-2006. And yet, Ma continues to be a “disrupter”. He has not only proved to be a disruptive force in the business-to-business market, the consumer-to consumer market, and the web transaction market by creating new markets or reimagining old ones … he has recently been venturing more deeply into the mobile phone and banking industries (the latter being a particularly staid, government dominated industry). Ma must either be “very tight” with government leaders or naively foolish, because he wrote an opinion piece almost one year ago for the official newspaper of the Chinese Communist Party[27]. His article emphasized: “Innovation in many industries has been triggered by outsiders.” One could discern that his article served as a warning to Chinese state banks, since he (almost) simultaneously introduced Yu’e Bao, a high-interest money-market offering for the use of existing Alipay customers carrying a credit balance in their account. Within less than 8 months, Yu’e Bao had attracted $40 billion in assets from 81 million customers! What other “disruptions” will Ma envision in the years to come?

5) Ma and Tsai (similar to Buffett and Gates) have committed a share of their wealth (over $2 billion at present) to charity. He currently devotes extensive time to the leadership (chairman) of the Nature Conservancy's Board of Directors for China. That non-profit focuses on reversing the devastating impact on Chinese soil and water resources of rampant industrial growth.

As you can see, Ma Yun offers the potential Alibaba investor an intriguing mix of genius, generosity, Machiavellian machinations, and leadership willing to take risks. There is much to commend Ma’s leadership going forward.

Giving any potential much more “pause” before deciding to “buy” should be risks inherent within any investment in China, such as:

1) The absence of universal accounting standards that have anywhere near the credibility of GAAP standards in the U.S.;

2) The tendency of the Chinese government to suddenly make itself felt through regulation within an industry or action against a company (eg. Alipay);

3) Take a look at any chart of short-term interest rates in China during the past three years. Any of those charts could be used as a dictionary graphic for the definition of either “erratic” or “undependable”. The Chinese financial system suffered from such a lack of liquidity during at least one of those spikes that fear spread of the system “seizing up”;

4) And perhaps the most significant reason to be cautious centers on the legal structure/nature of the security that will be made available through the IPO – a “Variable Interest Entity” (VIE). We will cover in more detail why/how that poses a risk in our follow-up article!

DISCLOSURE: I (duh!) do not own Alibaba stock. I have (in the past) owned YHOO and AMZN. I have not purchased anything through Taobao.com or TMall.com, despite the fact that I am a customer of Amazon.com. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions. Finally, I have a serious and heartfelt “bone to pick” with Mr. Ma and his associates. Take a look at this page from Taobao.com:

Ma Yun and Taobao.com know how to rile up the dander of "Mature" males. Isn't "Old Aging Man" a bit over the top?!

C’mon Ma Yun… gimme a break! Really?? Really?? “Old Men Clothing Suit”!!!!!!! You should be hung by your thumbs for blatant ageism and insensitivity to the tender, weary, worn, and oft-times shattered ego of all of us “old men”!!!

FOOTNOTES:

[1] Initiated by then Surgeon General, Luther L. Terry, M.D.

[2] Of course, our predatory tobacco companies continue to fight any fully effective warning labels, and more graphic labeling continues to be delayed via interminable lawsuits.

[3] I have been invested through “Black Monday” of 1987 (22.6% Dow drop), “Black Monday” of 2008, the “Dot.com Crash”, the “Mortgage Crisis Crash”, the “U.S. Credit Rating Downgrade” slide, and numerous “Flash Crashes”

[4] This is a variation on the strategy Michael Dell tried to pull off in his secret, behind the scenes effort to buyout Dell Computer Corp. at below fair market value (Silver Lake Partners was Dell’s partner in the effort). Dell was blasted for violating his primary fiduciary duty (as CEO) to the Board and shareholders, rather than to serving his own interests!

[5] Ever since referred to as the “6/4 Incident”… much as we refer to the September 11, 2001 events as “9/11”.

[6] Birth, Death, and Taxes

[7] For those that can’t guess, my “BS Filter” operates on the premise that Wall Street rarely presents anything objectively. It is always slanted toward “the buy side”… and the use of hyperbole within Wall Street and the financial press is nearly as pervasive (and misleading) as it is within the realm of sports reporting!!

[8] It is worthy of noting that “Ma” is the most common family name among Chinese Muslims.

[9] You may not be impressed by this… but consider how Joseph Tsai describes university English students in China: “The kind of students who enroll in “English” at a university are engineers and import-export people”. Many of those students became close disciples of Ma Yun!

[10] Erisman is a former employee at Alibaba… an American who is skilled in the Mandarin language.

[11] Most of us would consider Mr. Tsai to have been “insane” when he left a $700,000/year position to work with Ma for $50/month and “an interest in the business”. By the time of the IPO, Mr. Tsai will have received a great deal of the hoped for “fruit” from his leap of faith in 1999! Tsai has served as CFO, and was elevated to the role of Executive Vice Chairman. And Tsai proved his ability, metal, and resolve through his 2012 negotiations with Yahoo (YHOO) to repurchase a portion of YHOO’s stake in Alibaba. The happy result (for him) is that he will own 3% of Alibaba following the IPO and vaulted into the coveted Forbes’ “Billionaires List” for 2014 at approximately $3 billion!

[12] In the U.S., Jeff Bezos of Amazon.com may be the closest parallel to Ma with regard to elevating attention to market share (and sales volume) above most other priorities. As long as I have alluded to Amazon, it is worth noting that Alibaba’s transaction volume dwarfed Amazon.com in 2012 — $160 billion versus just $86 billion (per RetailNet Group).

[13] At least from our perspective in 2014, that is!!

[14] See Footnote 8!

[15] In U.S. centric circles, Alipay is described as the “Chinese PayPal”

[16] in 2009, Japan-based SOFTBANK (SFTBY) owned 35% of Alibaba and Yahoo (YHOO) owned about 40%.

[17] Ma entered into a series of transactions in 2009-10 that separated Alipay from Alibaba into entities free of foreign control.

[18] In all fairness, discerning a “market value” for any company not publically traded is a challenging process. At a minimum, it will always be subject to differences of opinion… sometimes widely variant!

[19] Ma has asserted (repeatedly) that the Alibaba board was aware of the negotiations.

[20] That sale reduced YHOO’s ownership in the company to the 22% range.

[21] In reality, the episode exposed Yang as the utterly inept CEO he had become… surely hastening his departure. Many probably thought at the time that YHOO would be wise to replace Yang with Ma!

[22] Facts that no one would dispute

[23] This quote appeared in a July 2011 article within the South China Morning Post. Note that the Chinese shorthand for referring to the Tiananmen Square crackdown is “6/4”.

[24] Celebrating the company’s 10th Anniversary).

[25] I deeply regret I could not find a photo!

[26] The penthouse is in the Mid-levels District of Hong Kong. Within the 2007 real estate market in Hong Kong, the per square foot price paid by Ma set a new record high for residential property in Asia (much less Hong Kong).

[27] The People’s Daily

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why Teladoc Health Stock Dived on Friday

Why Teladoc Health Stock Dived on Friday