For our work together in this article, here is a quick analogy for you to consider:

1) You love your home. It is perfect. However, the expiration of a government easement on that property is coming soon, which means you will lose over half your home. Therefore, you need to find a new option quickly.

2) You do find an outstanding alternative! It fits your specifications almost perfectly.

3) A huge bonus is that, through a quirk in the law, you will be able to write off the cost of your property tax and mortgage interest and take a deduction for each of those as well. [As I said, it is a “quirk”… for which few qualify].

a) However, that “quirk” has gotten topline attention from the U.S. Treasury Secretary and Congress.

b) They are incapable of mounting enough bipartisan cooperation to rub two sticks together to start a fire… but they sure know how to produce loud and impressive sound bites about how despicable the people are who are making use of this quirk!

c) They are deadest on eliminating this quirk as soon as possible – perhaps retrospectively.

4) Therefore, you feel urgency in getting a deal done!

5) You make an initial offer on the nearly “dream home”… 3% over the Zillow (Z) estimated value!! REJECTED.

6) You make a higher offer. REJECTED.

7) Frustrated and sensing the clock “ticking”, you make an offer over 17% higher than your first offer!!! REJECTED.

8) Your agent tells you that the lead agent on your “target” home is a veteran “high stakes” negotiator with over 30 years of experience, and has been in charge of her company’s global real estate division in recent years.

a) You curse your bad luck…

b) But you still feel compelled to bid higher!

c) Your fourth offer is almost 30% higher than your first!

d) REJECTED!

9) However, you have managed to converse with a couple of the family members who share ownership of the home… and they have started pressuring that agent to sell!

a) With renewed energy and hope, you make one more bid.

b) Almost 33% higher than the first offer!! ACCEPTED!!

You have just absorbed the (oversimplified) essence of the story behind the efforts of AbbVie Inc. (ABBV) to acquire Shire plc (SHPG). What follows is my effort to encapsulate for you the major storylines and facts behind that takeover campaign. Obviously, our Case Study exercise from Part I came directly from this ABBV/SHPG news story. So now you know which company it was for which you served (momentarily… and “virtually”) as CEO. Did ABBV’s actual CEO (Richard Gonzalez) handle these issues the way that you would have handled them?

ABBV CEO, Richard Gonzalez, is on the right, standing next to the Abbott Labs (ABT) CEO, Miles White, that spun ABBV off in 2013!

Let’s review the SWOT[1] analysis on ABBV:

STRENGTHS:

1) Exceptional Performance:

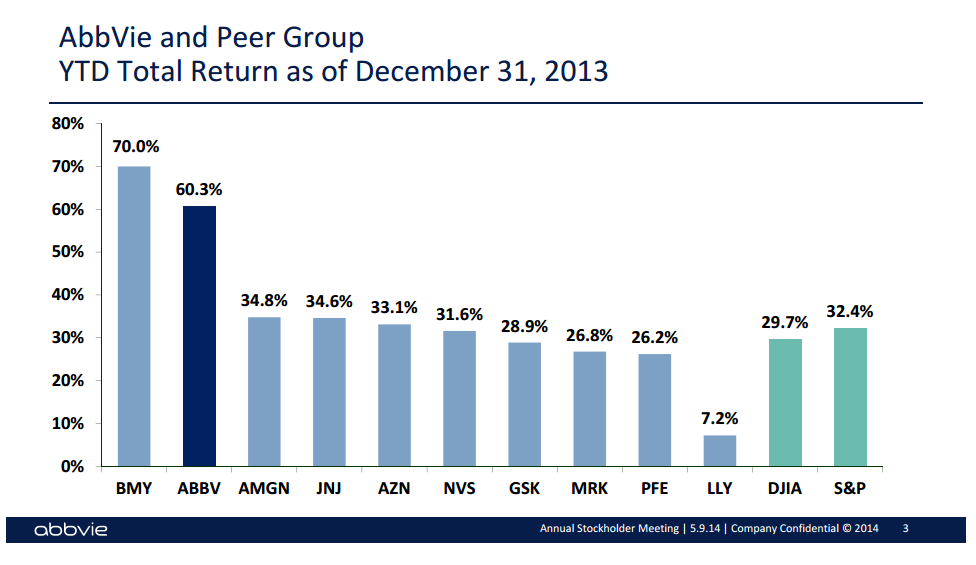

- ABBV was spun off from Abbott Labs (ABBT) In January of 2013.

- Its top-notch corporate heritage has been reflected in its performance since then, trailing only Bristol-Meyers Squibb (BMY).

3. Recent financial metrics amplify excellent ABBV management:

1st Quarter Adjusted Gross Margin was 78.40%

Return on Equity (ROE) exceeds 100%

Total Sales expected in FY 2014: $19 B (up 3.2% YoY[2])

Operational Cash Flow is $5.7 B

Accumulated Cash/Cash Equiv.: $9.6 B

Since 1/3/13, the stock price has moved up by almost 60% (vs. 30% for the S&P 500).

Market Cap has grown from about $55 B to (at a recent high) over $92 B (a 67% increase)

67% of the stock float is held by institutions.

Offers a 3.2% yield

ABBV must utilize extremely gifted accountants, since its effective income tax rate for 2013 was just 22% (13% lower than the statutory U.S. rate).

The S&P has granted ABBV an “A” credit rating

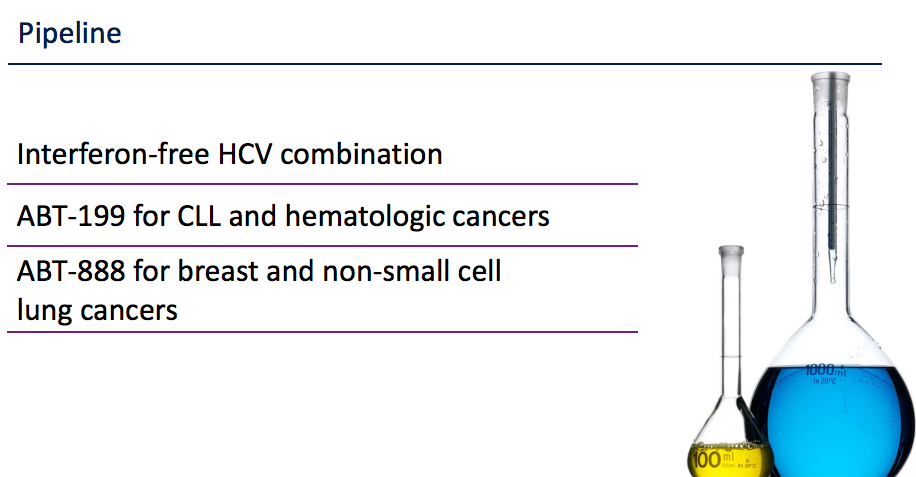

4. ABBV has two very promising new drugs in the final stages of trial prior to approval

The first drug will address a global market for Hepatitis C — which the World Health Organization reports afflicts 130-150 million people globally

A) There are 3-4 million new cases each year

B) This drug has a 99% cure rate

C) It has received “accelerated approval” status in Europe, with the possibility that sales can commence during the 2nd Q of 2015.

ABT 888 will treat patients suffering from locally advanced breast cancer[3]

A) The current trial is a randomized, double-blind study enrolling 270 breast cancer patients….

B) The drug is also being evaluated for several other oncology indications — Including non-small cell lung cancer.

WEAKNESSES:

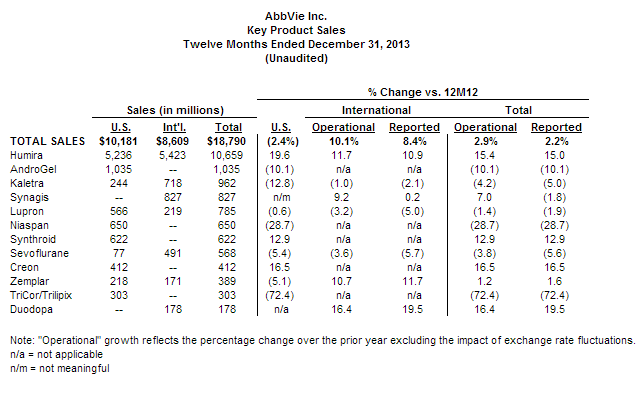

1) Humira, the world’s biggest selling blockbuster drug (over $10 B) accounts for 57% of ABBV total sales[4]

HUMIRA is a genuine "blockbuster" drug -- over $10 B in annual sales. Originally approved to treat rheumatoid arthritis, its therapeutic value has expanded.

- That product recently grew sales YoY at 15% (superb performance)

- However, its patent exclusivity (in US) runs out in December 2016[5]

- Even though it is a biologic drug, the ACA-related legislated act titled “Biologics Price Competition and Innovation Act” makes it significantly simpler for a Generic Drug manufacturer to create and receive approval for a generic version of your drug.[6]

2) ABBV’s next two best-sellers accounted for only 5.5% and 4.4% of sales

A. Neither of those products showed growth YoY in 2013!

B. Because of this preponderant reliance upon Humira for Revenue, ABBV stock quite likely trades at a lower P/E multiple than it would otherwise.[7]

3) ABBV’s Hepatitis C drug (point C under Strengths) is coming on the market over one year after Gilead Sciences (GILD) commenced sales of its competing product; therefore, GILD has momentum:

It is expected that ABBV’s treatment (all oral) will be less expensive – a significant advantage

4) Of ABBV’s accumulated cash totaling almost $10 billion, most of it is overseas, limiting its access to employing that cash without exposing it to a second layer of income tax – with that added layer coming at the U.S. corporate statutory rate of 35%… the world’s very highest rate[8];

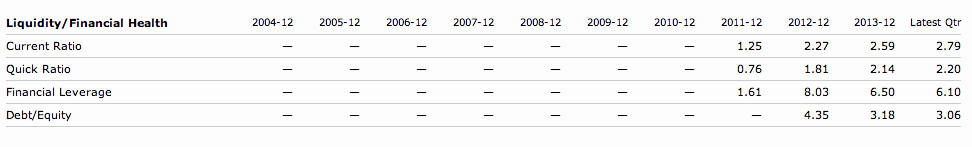

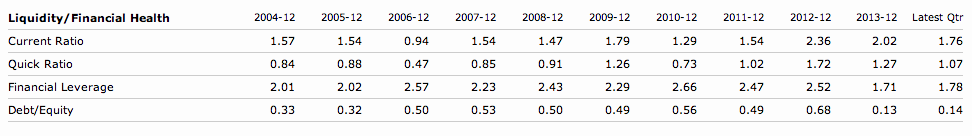

5) ABBV carries $14.7 B of total debt, resulting in a Debt-to-Asset Ratio of 50.

A. Leverage can be complicated, and should only be compared within the same industry.

B. Here we see leverage data for ABBV and ABT. As you can see (directly related to the Spin-off) ABBV has much higher leverage than ABT.

Compared with ABT, the leverage used by ABBV appears much larger. (One could presume that this leverage is directly related to the original spin-off).

6) The dividend Payout Ratio is higher than ideal at 62%.

THREATS:

1) ABBV has increased its Research and Development budget by a significant amount in order to quickly diversify its product portfolio. However, it was running out of time before the Humira patents expired. Therefore, there was urgency behind ABBV’s effort to acquire a solid pharmaceutical company.[9]

2) As ABBV competitors continue to buy out smaller, more rapidly growing biotech and drug companies, there was a shrinking field of good candidates from which to choose for a strategic acquisition.

3) The U.S. government has become increasingly likely (after the November 2014 Election, of course) to “close the door” on the ability of U.S. global companies to legally change their tax domicile in order to avoid double taxation on global income (and cash).[10]

OPPORTUNITIES:

1) In today’s market, the most common strategy employed by major Pharma companies that need new products to replace “run outs” on patent expirations has been to acquire smaller firms with a drug portfolio that can provide a “good fit” (either supplementary or complimentary);

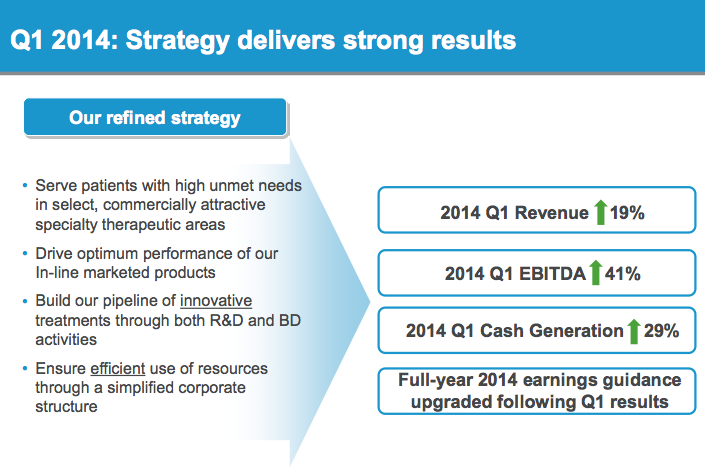

2) Shire plc (SHPG) is a mid-sized, steadily growing firm that is (titularly) domiciled in Ireland (through registration in the Channel Islands[11]). [12]

A. SHPG has come a long, long way from its first product (Calcichew-D3– chewable Calcium supplement to treatment osteoporosis)

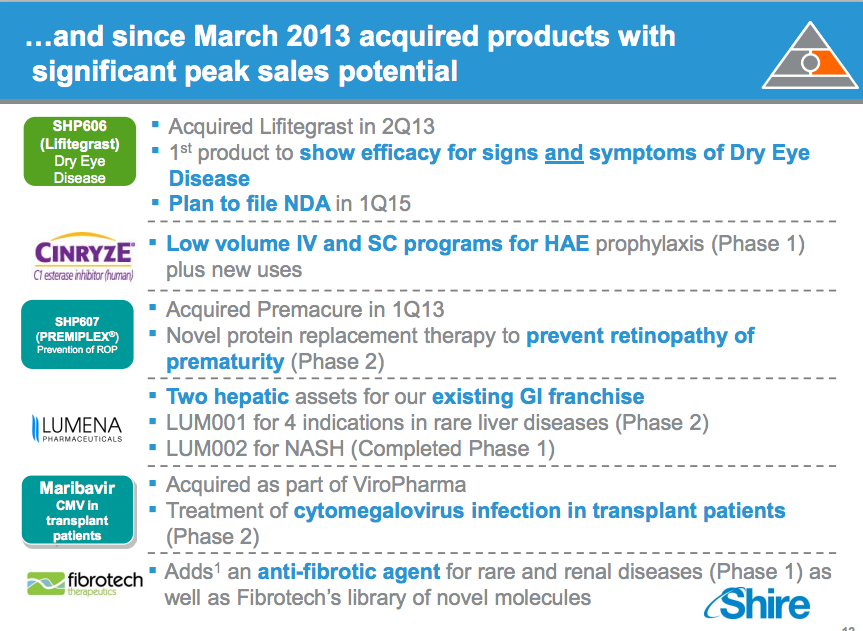

B. In recent years it has accelerated its growth through acquisition

It purchased four firms in 2013;

It has purchased one firm thus far in 2014.

3) SHPG is relatively rare (among growing, mid-sized drug firms) because it does not have any controlling shareholder(s).

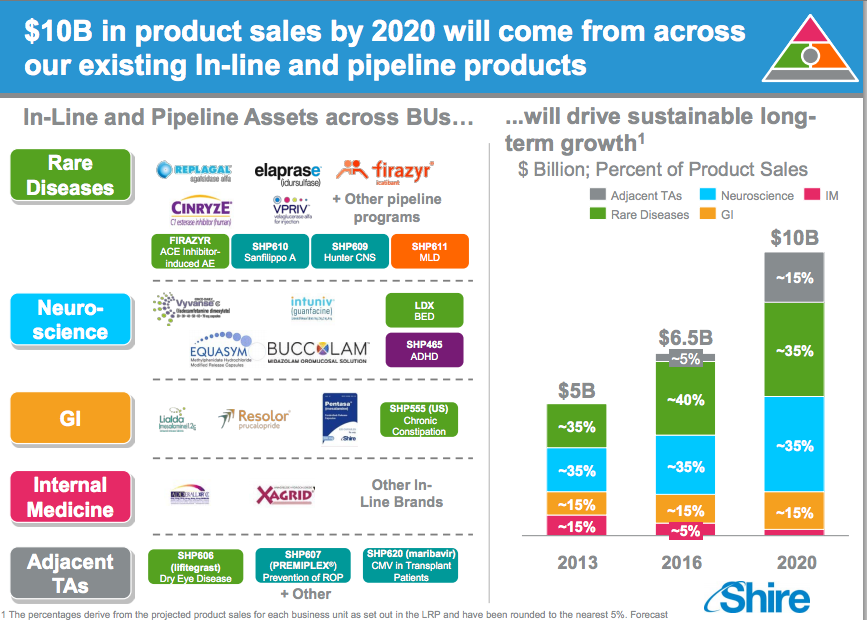

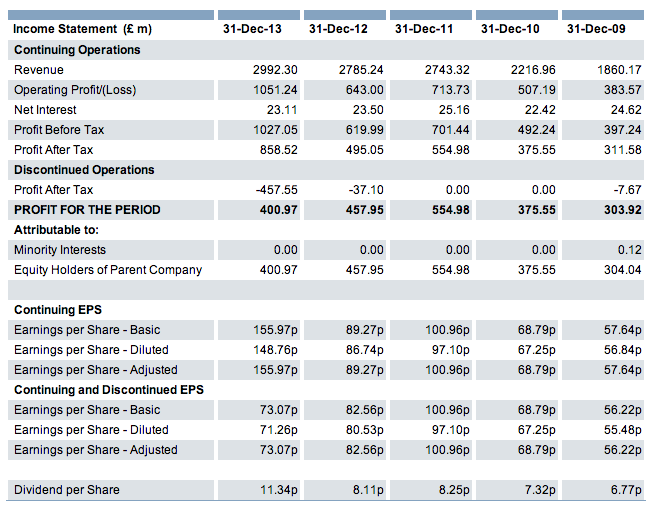

A. It reported almost $5 B in Revenue for 2013 (up 9% YoY)

B. Not including “discontinued operations”, it reported $1.42 B in Earnings (up 75% YoY)

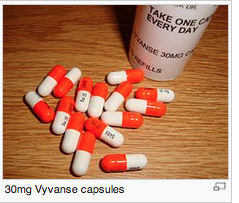

C. It has three major drug products

- Here is a view of the sales metrics on SHPG's top selling drugs.

Vyvanese (treats ADHD) reported over $1 B in Sales

Vyvanese is the top seller (by far) for SHPG. It treats ADHD. (It may soon begin to be used to treat "Binge Eating Disorder".)

Two others reported Sales of just over $0.5 B

D. It has numerous products closing in on Phase 3 of FDA trials… and the portfolio would broaden the ABBV product line significantly… including products that address several of the highest growing Pharma sectors, including: rare diseases, neuroscience, metabolic diseases, T-cell antagonists, neonatal treatment and multiple emerging oncology programs.

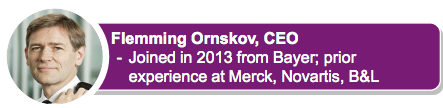

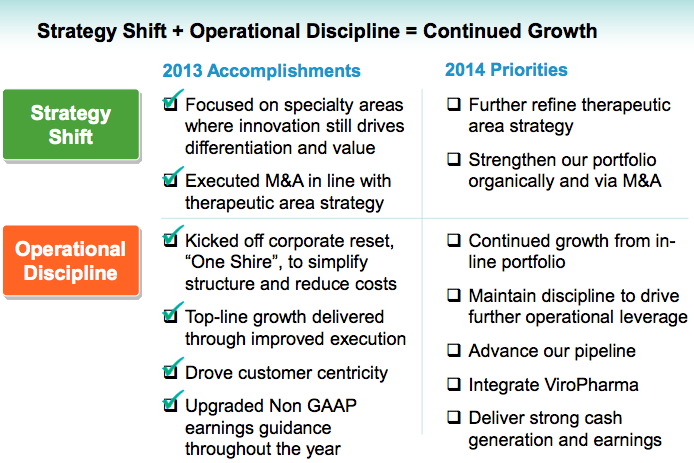

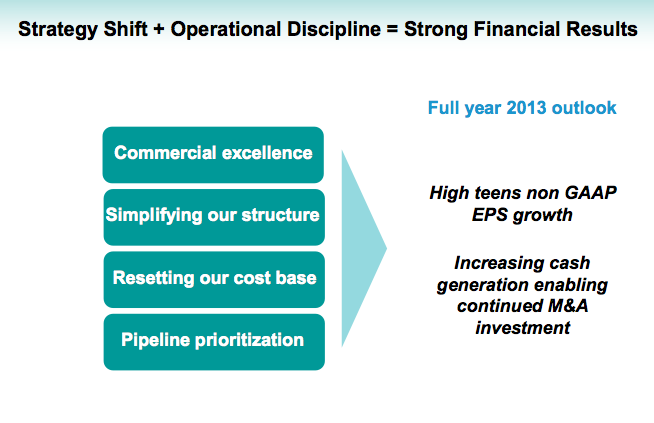

E. During 2013, CEO Flemming Ornskov repositioned and realigned its business… including a strategic focus on rare diseases and greater operational discipline.

The CEO of SHPG is Flemming Ornskov. Once the deal is "closed", he will lead a new "Rare Disease" unit in Switzerland. (He is also getting $9 M to "stay on"!!)

With regard to SHPG’s focus on “Rare Disease” therapies, both Europe and the U.S. FDA offer incentives to drug companies that develop drugs to serve the medical needs of patient diagnostic groups under 200,000 persons.

They provide tax credits and an accelerated approval process.

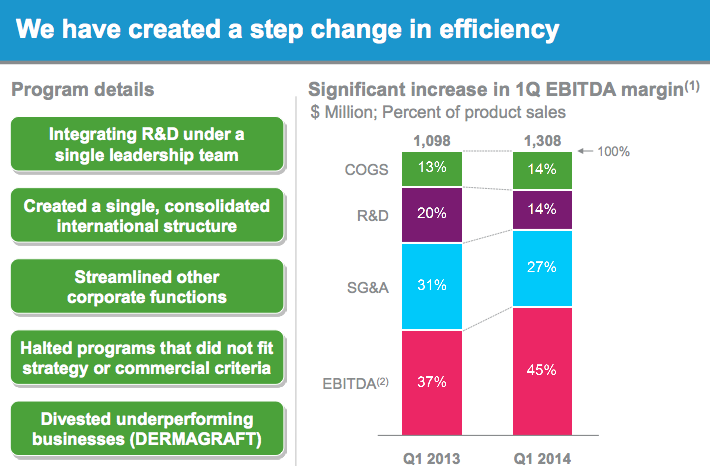

Regarding “Operational Discipline”… SHPG (for example) combined three separate R&D units into one, consolidated unit

That move will produce both interdisciplinary synergies (in research) and

Cost savings (R&D cost as a percent of Revenue moved from 20% to 14%.).

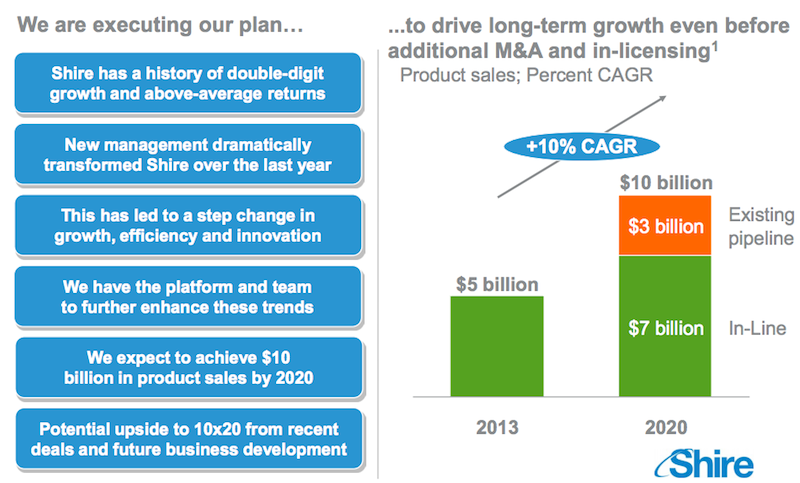

F. Ornskov has projected that SHPG will double revenue (to $10 B) by 2020 – with a 70% increase in Sales from existing products and 30% from drugs newly approved between now and 2020.

Ornskov projects that SHPG sales will double by 2010 -- requiring average sales growth of 10% each year.

For perspective, analysts are projecting just $8.5 B in sales by 2020.

G. SHPG has no debt and $2.2 B in Cash

H. In 2013, the effective tax rate of SHPG was 16.4% (almost 4% higher than the official rate in its domicile).

I. SHPG fits the profile of a Tax Inversion acquisition[13]

ABBV could lower its income tax rate to as low as 13%, but not until 2016.

One analyst projects the first year savings to be $325 M.

4) Cautions

A. SHPG sales are heavily concentrated in therapies that treat ADHD (Attention Deficit Hyperactivity Disorder) – accounting for 37% of total firm Sales!.

B. Since ADHD treatment is controversial in the eyes of many doctors, many potential acquirers have been put off by that concentration in years past.

However, SHPG’s product line would serve to reduce Humira’s share of total sales (within the combined company) to just 45%.

The combined companies would also serve to reduce dependence upon ADHD drugs!

C. An additional factor at play in this ABBV acquisition quest was that SHPG had already been in talks to be acquired by Allergan Inc. (AGN) [as a part of their efforts to escape being acquired by Valeant (VRX)]… but negotiations did not progress toward a concrete offer.

KEY LEARNING POINTS:

As I reveal in my “Disclosure” (below), I had a keen interest in the ongoing effort by ABBV to acquire SHPG. I have read (and often reread) so many articles, presentations, interviews, etc. that I lost count many weeks ago.

What have I learned?

1) In general, material easily available to the broad public (more often than not) only provides a few “sound bite-like” facts, thoughts, and/or insights in any given story.

a) Much worse, it often appears that writers are “falling into step” behind some sort of “consensus” story rather than doing independent work.

b) That consensus story about ABBV/SHPG tended to focus (solely) upon:

Tax Inversion;

Humira’s 57% share of total sales;

SHPG’s incredible price growth since 2013

It stood at $92.74 on 1/2/13.

By the date the deal was announced, it had climbed to $257.

All of you math whizzes immediately recognized that it therefore appreciated by 177% in just 18.5 months!

2) Because it has become a “hot issue” in Washington DC, as well as among CNBC reporters and other pundits who prefer “catchy” storylines to “real world perspective” facts, the innocent reader might think that a tax inversion can offer a company some sort of miraculous “super boost”.

a) This is far from the truth. Under appropriate circumstances, tax inversion can be a productive strategy for a company that generates considerable profits overseas.

b) However, we all know that tax policy is complicated, and tax inversion is no exception. This strategy is incalculably more complicated than most reporters care to know.

c) The key point here is that “Inversion” is useful only under “appropriate conditions”.

Therefore, wise leaders like Miles White (ABT)) have no interest in rushing into a tax inversion for its own sake![14]

One analyst (within a Seeking Alpha) article pointed out the following:

ABBV’s tax rate for 2013 was only 22%;

The SHPG tax rate was 16.4% (almost 4% above the Irish statutory rate!

That is a much narrower gap than 22.5% (the difference between U.S. and Irish rates)

The merged company will list its stock in the U.S. but have its tax domicile in England (13% statutory rate). That may seem strange to many (why not “go Irish” at 12.5%?). But England does not require withholding tax on dividends (thereby reducing an annoyance for U.S. holders of ABBV within a retirement account!).

This analyst projected first year tax savings of about $325 million.

That isn’t much savings vis-à-vis a $55 billion acquisition (with related loan(s) that require annual servicing)!!

3) One significant insight that I gleaned from John Paulson (and referred to by no one else in connection with ABBV) was the importance of April 10th and April 22th of this year within the Pharma Stock space. Do you remember what happened then?

a) Bill Ackman reached 9.5% ownership in AGN (4/10)… which was publically disclosed by April 22nd.

b) Therefore, those dates saw a rise in the activity surrounding potential drug company acquisition candidates… including SHPG!

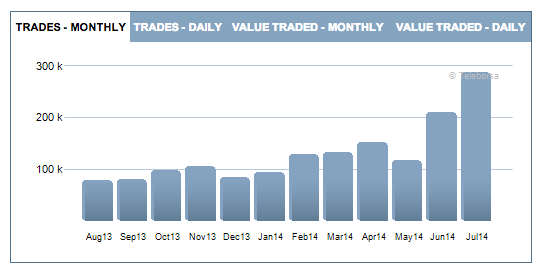

Here is SHP trading volume (London) on a monthly basis. Note the pickup in volume during April... and a drop in May before the volume increased steadily through the negotiations.

4) It became obvious quite early on that there aren’t many U.S. reporters who have a solid grasp on the business model of SHPG?

a) My first impression of the proposed deal was quite negative (I thought ABBV was overpaying);

b) However, the more information I sought out regarding SHPG, the more impressed I became. I am guessing (by now) that you may be rather impressed as well!

c) LESSON? Never think you know “enough” until you have read an awful lot of material!!

5) Playing very much into the dynamics of this acquisition effort was the July 18th deadline for the finalization of a deal that was imposed by U.K. law!

a) That definitely accelerated the pace of negotiations!

b) ABBV (obviously) wanted the deal very much and felt time literally “slipping away”.

c) SHPG shareholders knew they were being offered a huge premium on their stock (most accounts peg the premium paid vis-a-vis the “pre-bid” stock price at about 53%!).

d) Those shareholders also knew that the price of AstraZeneca (AZN) zoomed upward by about 25% once Pfizer (PFE) started bidding on it… then collapsed by 11% when PFE dropped its bid. SHPG holders didn’t want to lose a good thing!

6) Never ever assume (no matter how hard you try to keep up on the news) that you are able to glean all you really need to know from the news. It is not possible.

a) Case in point: the first couple of offers from ABBV to SHPG (in early May) were not widely revealed or known at first. They were (at best) “rumored”.

b) In July, I did a fairly exhaustive search for the terms of each of the five offers made by ABBV. Media reports were scarce until the end of May; and I was never able to find or pin down the terms of the 2nd offer!!

7) I was forced to learn more than I chose to learn about the London Stock Exchange (LSE)

a) Shire plc has a London ticker of SHP.

b) London prices are published in “Pence”[15]

c) Therefore, the October price of 2,478 really means 24.78 British Pounds.

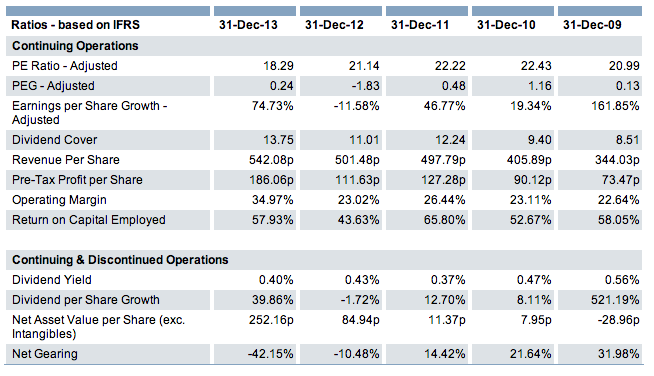

This chart from the LSE Website is instructive on multiple counts. It shows the prices for SHP (the London ticker of Shire plc) for much of the past year.

d) Also note that the price of SHP darn near doubled between October and the price at final acquisition! (Close to 5,000).

e) To their credit, the LSE has a great website. Here is a chart of SHP:

f) And it provides some ratios. Note especially the P/E Ratios (before the run-up), Margin growth, and “Return on Capital Employed”.

Another chart from the LSE site. Note the decreasing P/E Ratio (prior to May) and the increasing Operating Margin and Return on Capital!

g) And a look at Income (study growth in Revenue and Operating Profit!):

8) SHPG had a “secret weapon” in their negotiations with ABBV!!

a) Susan Kilsby was named Chair of the Board on April 29, 2014!!

b) The SHPG Board was either prescient or just flat out lucky, because the first ABBV offer came just days later.

c) Read Kilsby’s brief bio below:

Susan Kilsby's biography is extremely impressive. Whoever recruited her for the SHPG Board is a GENIUS!

d) The bottom line is that Kilsby was mentored to become a top notch M&A expert by some of the best in the industry.

e) Her specialty was in “maximizing the price of a M&A Target”!! [You can’t make this stuff up.]

f) Also note that she has served on other big boards (Coca Cola (KO) and Keurig Green Mountain (GMCR)) and was a key player in enabling their recent deal.

g) Not many drug companies enjoy a fabulously experienced M&A (ex)-Global Banker serving as Chair.

She did graduate from Medical School

But was drawn into Investment Banking.

9) Will the new company that is created from this acquisition prove to be an enticing investment in the years to come?

a. You tell me what assumptions you want to make about the global economy, the prescription drug business, health care reimbursement rules, FDA approvals, lawsuits, and interest rates, and I will give you an answer!!

b. We know that ABBV paid a lot of money for SHPG. Was it too much? See i) above!

That being said, there are some “assumptions” upon which I think we can all agree:

A. If the trend line within SHPG remains on its present course (and doesn’t get bogged down or derailed)… and if

B. The global economy does not get rocked by anything nearly as major as 2007-09… and if…

C. The U.S. Congress doesn’t suddenly become “functional” and actually outlaw (retroactively to May 2014) U.S. companies entering into a “tax inversion” …

Then… a compelling case can be articulated that the combination of ABBV and SHPG presents enviable mutual synergies and opportunities that will result from:

1) ABBV’s strong global infrastructure – (including) a marketing network throughout 170 nations, a depth of experience (from ABT) within the regulatory approval area, a global network of physician and provider networks, and especially ABBV’s wide access and penetration within key emerging country markets;

2) SHPG’s current promising string of “final stage trial products” (that are likely to be the greatest strength of this growing firm)! Its demonstrated ability to scale up existing products is also a big plus!

SHPG products will broaden and diversify ABBV’s current product portfolio (and likely lead to a higher P/E Multiple) and ABBV’s global marketing and regulatory infrastructure can and will expand market demand (and availability)… thereby significantly accelerating sales growth for all SHPG products!

This will, without doubt, be the fastest and most efficient way for SHPG to “scale up” – perhaps even to a level beyond what any member of the SHPG team have yet envisioned!! If all of this comes together, this deal will clearly be a “Win Win” for all!

John Paulson has made very trenchant and helpful observations about the quest by ABBV to acquire SHPG!

Finally, because you should pay much closer attention to Paulson than to Petty, here is what Paulson had to say in June:

“We will have to see how accretive this transaction is to AbbVie. I think based on the numbers we've seen it will be accretive to AbbVie‘s earnings per share. So their earnings per share will go up. If they also get multiple expansion, then AbbVie's stock can rise after the transaction…”

INVESTOR TAKEAWAY:

First of all, be grateful that I “held back” on material. This article would be three times its size if I included all the information I gathered!

Second, it is crucial that we all keep in mind the following:

1) This transaction is not expected to close until the 4th Q of 2014.

2) When it does close and the new, combined British-domiciled company is formally (legally) in place… current SHPG share owners will own about 25% of the new entity.

3) ABBV shareholders will transition into the new company through a taxable (at least in the U.S.) transaction.

4) This means that if you value holding a stock for “long-term” gain – it is already too late to buy existing ABBV stock.

5) In light of the above, many investors/traders may prefer to “play” ABBV strictly through straight calls or puts … or my preferred strategy of credit spreads.

Third, I urge you to remember what it was like to imagine yourself as CEO. I’ll bet some of you realized that it is a lot more challenging than you thought!! And always remember that you will never know nearly enough about any company as you’d like to know (or at least in some cases, need to know).

And finally, it should be fascinating to watch this deal move to its close… and beyond. I expect there will be plenty more written about it between now and the end of the year!

DISCLOSURE: The author has carried a bullish position in ABBV almost constantly since it became a publically traded stock. He does not own SHPG… but sure wishes he had known about it last October!! Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Strengths Weaknesses Opportunities Threats

[2] YoY: Year Over Year

[3] The technical description for this condition is “those suffering from human epidermal growth factor receptor 2 (HER2) negative metastatic”.

[4] The most commonly broadcast ad for Humira these days is for Psoriasis

[5] Expiration of protection in Europe runs out one and a half years later!

[6] An additional learning point: many reporters whose work I read did not understand this important fact and still suggested that the barriers to competing with Humira were relatively high because it is a biologic.

[7] Opinion of John Paulson (Hedge Fund Mgr) from a June 2014 CNBC interview.

[8] Very important! This comes from the “Tax Foundation” [http://taxfoundation.org/blog/us-has-highest-corporate-income-tax-rate-oecd]:

“In today’s globalized world, U.S. corporations are increasingly at a competitive disadvantage. They currently face the highest statutory corporate income tax rate in the world at 39.1 percent. This overall rate is a combination of our 35 percent federal rate and the average rate levied by U.S. states. Corporations headquartered in the 33 other industrialized countries that make up the Organization for Economic Cooperation and Development (OECD), however, face an average rate of 25 percent. Even corporations in high-tax European countries such as Belgium (34 percent), France (34.4 percent), and Sweden (22 percent) face much lower rates than those in the United States. Our largest trading partners—Canada, Japan, and the United Kingdom—have each cut their corporate tax rates over the past few years to become more competitive.”

[9] In addition, there is never any guarantee that drugs currently moving through the standard (three) phases of FDA trials will receive approval and become successful.

[10] Called a TAX INVERSION.

[11] Saint Helier, Jersey… in the channel between England and France

[12] SHPG has a highly unusual history. It was created in 1986 in Basingstoke, Hampshire, England (where it had its official corporate domicile). However, it is currently managed from Cambridge, MA and handles most production at plants in the U.S. (Lexington, MA; Wayne, PA; and San Diego, CA). It still has operations at Basingstoke, but has announced that it will be reducing production activity in England. In 2008, the Labour Party hiked corporate tax regs and SHPG shifted its domicile to Ireland via a charter in Jersey! (Go figure!)

[13] This means that acquiring it would enable your company to create a new, non-US, tax domicile.

[14] Not to pick on CNBC’s Melissa Lee, but here is an excerpt from her June interview with hedge fund giant, John Paulson [http://investing.einnews.com/article/214210842/FBQ1Hoacbu6KK24E]: LEE: “Even though Shire/AbbVie, that's purely — it looks at least — and I think the CEOs would acknowledge, it's purely based on inversion because the overlap in their portfolio is virtually nil.”

PAULSON: Well, there's a couple of strategic reasons for the transaction. So one is the tax inversion issue. Two, there is some overlap in certain key areas. But three, I think the most important issue is that AbbVie is doing extraordinarily well, but a lot of their success is based on one product… Because of their overreliance on that product, the company trades at I would say is a below-market multiple. So by acquiring Shire and broadening the base, it's likely that the combined company will trade at a higher multiple than AbbVie traded at before because of the benefits of diversification of the broader growth platform that they could add more value than they could achieve by themselves.

So I would say there's three reasons why AbbVie is so intent on doing this transaction.”

[Author Note: Mr. Paulson was far too classy to call Ms. Lee out on her overly simplistic [and incorrect] analysis. ABBV didn’t need drugs that “overlap”… but drugs that broaden and diversify the ABBV line!! I think that Paulson, ABBV CEO, Richard Gonzalez, Mr. Ornskov, and Mr. White would all agree that “Inversion” is a nice “bonus”… but not the deal’s “centerpiece”!

[15] You know those English. A quirky bunch to be sure. I mean, “Tea” in the morning?? Really!!? Nothing can beat good old USA style Starbucks (SBUX) to get the engine started first thing in the morning!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Is It Still Good to Invest in Bitcoin?

Is It Still Good to Invest in Bitcoin?