At the end of our prior articles: https://www.markettamer.com/blog/a-free-market-or-macau-with-margin-part-I; https://www.markettamer.com/blog/a-free-market-or-macau-with-margin-part-ii) I promised readers a follow-up regarding various vehicles through which to trade the mammoth equity markets in China. During the entire week of July 20 through July 24, I struggled with the concept of my personally appearing to encourage (much less actually enable[1]) anyone to trade a market I have come to look upon with great caution – with several touches of suspicion.

This is the building within which the Shanghai Stock Exchange facilitates the daily buying and selling of A-Shares.

At that point, however, I began to lecture myself regarding my actual function as an investment-focused writer. I never intentionally present myself as one who tells any reader into which stock or fund she or he should invest. My responsibility is to provide information, observations, and insights and then trust that each reader will process that content appropriately for their own personal circumstances. Therefore, it would be arrogant and/or irresponsible for me to exclude China ETFs as a legitimate topic, since China’s economy and markets have risen to an elite status within global finance – the second biggest economy and (at least through the middle of June) the second largest capitalized equity market in the world.

Consider these simple facts:

1) The Chinese economy has been viewed as the world’s “growth engine” ever since the crushing impact of the Great Recession (2008-present) took hold. We have all experienced how nervous the global markets have gotten in recent years following even one poor economic report out of China.

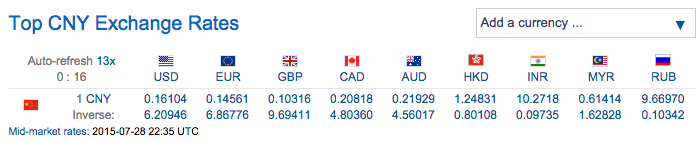

2) The Chinese are intent upon securing more widespread global recognition of its currency – the Chinese Yuan Renminbi ….

For those who are interested, the exchange ratio between the Renminbi (CNY) and other global currencies on July 28th was:

Obviously, Beijing’s ambition is to have the Renminbi become as widely accepted as the U.S. Dollar… if not replace the Dollar as the world’s primary “Reserve Currency.”

3) If one places any importance upon the “invisible hand” of the free market, it is telling that absolutely no single “emerging market” economy has as many ETFs that focus exclusively on companies/stocks within it’s border as does China! At one point recently, there were 35 separate funds targeting the China market (and its subsets) … and that doesn’t even include “Hong Kong funds”![2] Obviously, interest in Chinese equities is widespread and building.

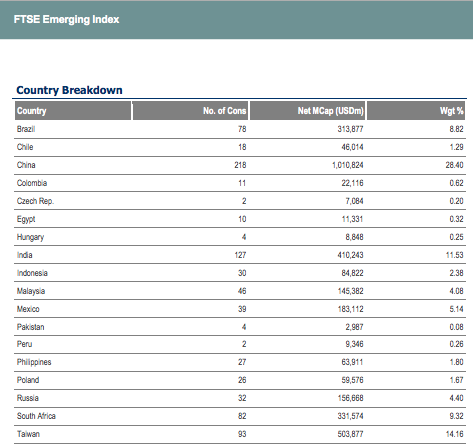

4) Because the FTSE (Financial Times Stock Exchange – a subsidiary of the London Stock Exchange and a joint venture between the Financial Times and the London Stock Exchange. It is usually referred to phonetically as the “Footsie”) includes within its Emerging Market Index[3] stocks that are listed on the People’s Republic of China exchanges located in Shanghai and Shenzhen (the so called “A-Shares” market)

while the much older MSCI Emerging Market Index[4] just reaffirmed on June 8th that it was not yet ready to incorporate A-Shares within its indices … that bifurcation has become a significant focus within the Emerging Markets “space”.

The popular premise is that once MSCI does incorporate A-Shares, a sizable inflow of international funds will pump up the equities trading in the Shenzhen and Shanghai markets[5].

Currently, the FTSE Emerging Market Index weights China at almost 28.50 of its total portfolio[6] (the biggest by far)… with Taiwan adding another 14%.

In contrast, the MSCI Emerging Markets Index[7] weights China at less than 24.5%… with Taiwan adding just 12.5%… and no A-Shares are included in that index!

Based on the chart data that we shared in our prior articles, that means that (at least from the start of June through the present) the MSCI Emerging Markets Index has been less volatile than the comparable FTSE Index!

It may prove useful for you to read “why” the MSCI officials chose to postpone the addition of A-Shares to its index (from a June 9th Forbes article):

“The verdict is out. China is not ready for the big time…just yet. MSCI decided against including the A-shares in the MSCI Emerging Markets Index ….

[From Remy Briand, MSCI Managing Director/Global Head of Research] ‘Substantial progress has been made toward the opening of the Chinese equity market to institutional investors. In our 2015 consultation, we learned that major investors around the world are eager for further liberalization of the China A‐shares market, especially with regard to the quota allocation process, capital mobility restrictions and beneficial ownership of investments.’

[Experts suggested to Forbes that…] MSCI would likely back off on including the A-shares until the Shenzhen stock exchange is connected to Hong Kong, and further details about the quota system have been ironed out….

“Bringing the A-shares into the MSCI Emerging Markets Index is the same as acknowledging that the Chinese mainland stock market has matured and is ready for serious, long-term investors.”

In light of Mr. Briand’s comments and MSCI’s decision, it is extremely ironic (but in no way causative) that within just four more days, the Shenzhen Market peaked and then started to tumble so severely that the Beijing government made “saving it” a top priority.

Following Beijing’s massive intervention (that was detailed in our prior pieces), prices within the Shanghai and Shenzhen Markets stabilized and began a modest upswing. However, Monday, July 27th witnessed a seeming stampede out of the market – with mainland stocks suffering their worst downdraft since June of 2007! I always approach “news reports” explaining why markets move one way or the other with great skepticism. But just so you’ll know, “news” reports on that day suggested that the precipitating factor for that steep drop was a Chinese manufacturing report showing a 0.3% Y-O-Y drop in industrial profits (per the National Bureau of Statistics). My own hypothesis is that investors in China have become extremely nervous – even skittish. Once downward momentum takes hold at any given point, few are willing to step on the “buy” side of the tracks when it looks as though a huge locomotive is barreling toward them from the sell side!

Here is just a small sampling of ETF performances from the 27th:

FXI -6.9 iShares China Large-Cap ETF

CN -7.5 Deutsche X-trackers MSCI All China Equity ETF

ASHR – 8.7 Deutsche X-trackers Harvest CSI 300 China A-Shares

CNXT -11.8 Market Vectors ChinaAMC SME-ChiNext

The relative downdraft within these ETFs reveals a very helpful sense of relative risk among these four significant “China” ETFs.

FXI could be considered (by most criteria), the least volatile among these four China ETFs, This can be accounted for by virtue of several key factors:

1) Scale: it is the largest and most heavily traded Chinese ETF available within U.S. exchanges;

2) It carries 52 holdings traded in Hong Kong (and for the most part, on the mainland)… but interestingly, the Hong Kong issues (ie. the “H-Shares”) carry a much more modest valuation relative to the (inflated) valuations of parallel issues traded in Shanghai and Shenzhen (A-Shares)!

3) It carries a 30-day SEC Yield of 1.21%… and a average P/E Ratio of 16.4 (lower than the S&P).

4) Review the top holdings within this ETF, and you’ll find some familiar names:

Next, CN could be considered the next least volatile among the four ETFs. Here is some background on it:

1) It is a broad cap-weighted index that’s inclusive of all Chinese shares, regardless of their exchange listing location (for more balance).

a) In fact, CN was the first ETF that provided this broad exposure to China… from A-Shares through H-Shares, Red Chips, P-Chips, and N-Shares.

2) Its exposure to A-Shares comes indirectly (through a diversified portfolio) by owning shares of its cousins within the Deutsche Wealth Asset Management Group: ASHR (larger cap A-Shares) and ASHS (smaller cap A-Shares).

3) In fact, when you review its top holdings, lots of “household names” appear there, much as was the case with FXI (Alibaba, Baidu, China Mobile, Tencent Holdings, China Bank):

ASHR dropped a scary 8.7% on July 27th. However, it is the oldest of all the “A-Shares focused” ETFs. Here are some basic details:

ASHR dropped a scary 8.7% on July 27th. However, it is the oldest of all the “A-Shares focused” ETFs. Here are some basic details:

1) The ASHR website shows that it holds only about 600 million in assets, so it doesn’t have the “security of scale” of FXI – with its 6.6 billion in assets.

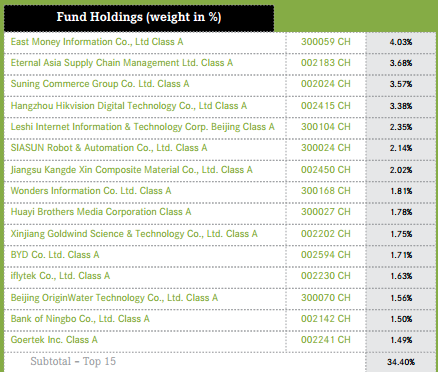

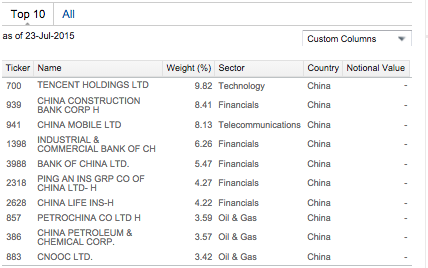

2) You might be put off when you review its top holdings (not exactly names broadly known in the U.S.):

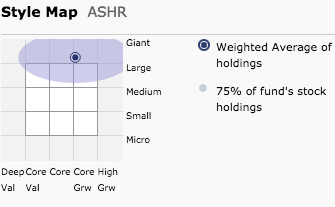

3) However, you could take some comfort from its “Style Box” within the A-Shares market… definitely in the “Giant to Large Cap” within the market cap boxes… albeit you might shy away from its heavy growth tilt.:

4) It holds over 300 different securities… so in that sense it is diversified.

Not to use a pun… but next we have the ETF that focuses on the ChiNext Market. A helpful way to describe ChiNext is for me to ask you to picture “NASDAQ” as it was when it was around 1977… six years after it was founded. Then picture “growthy, innovative” companies soon after they first went public [8]. I suggest this kind of imagery because the ChiNext (a subsidiary “Board” within the Shenzhen Stock Exchange) first started trading in October of 2009. As of June of this year, over 460 stocks traded within ChiNext. Not surprisingly, the listing standards for this part of the Shenzhen market (it actively tries to attract innovative, fast growing companies) are not nearly as stringent as for Shenzhen’s Main and SME Boards.

As you saw above, the ticker for this particular ETF is CNXT. And as you saw, it dropped almost 12% on July 27th.

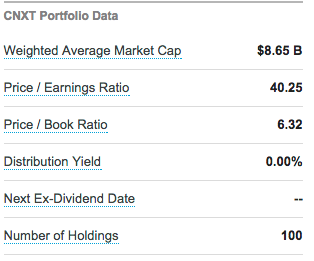

1) As you can see below, the CNXT website shows a 40.2 P/E Ratio… and a portfolio of 100 stocks. As you’d expect, Information Technology dominates the sector allocation at almost 32%.

2) Here is a list of its top holdings. I’ve previously heard of only a couple of them.

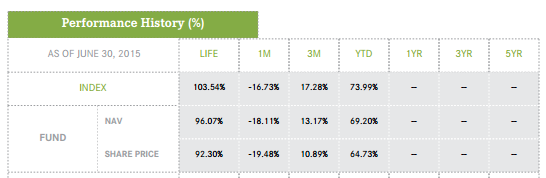

3) Lest you wonder why anyone would risk investing in CNXT… take a look at this… as of 6/30/15, the ETF had appreciated almost 65% since January! (But please have an ample supply of “Tums” handy if you invest!)

3) Lest you wonder why anyone would risk investing in CNXT… take a look at this… as of 6/30/15, the ETF had appreciated almost 65% since January! (But please have an ample supply of “Tums” handy if you invest!)

You may think that several of the ETFs above are too volatile for you – in which case I totally understand. But among our readers there are some who actually embrace volatility… seeing it as “opportunity”. For those traders who enjoy price movement on steroids[9], inverse and leveraged products are available:

1) The simplest among these is the single inverse ETF… trading the same index as does ASHR and attempting to deliver the inverse of that Index’s return over any given period.

Direxion Daily CSI 300 China A Share Bear 1x Shares (CHAD),

2) For those who want to juice up their bullish opinion, the next product (the first levered A-Shares ETF trading in the U.S.) is:

Direxion 2x Daily CSI 300 China A Share ETF (CHAU)

3) For enthused bears, there is a triple levered ETF available:

Direxion Daily FTSE China Bear 3X Shares (YANG)

Imagine having been prescient enough to have bought YANG at the closing price on Friday, June 24 at $82.80… then seeing your investment move up to as high as $93.90 on Monday! However, Lord help you when Beijing jacks the market back upwards.[10]

4) Finally, for overactive bulls, a triple levered product is also available:

Direxion Daily China 3x Bull (YINN)

I would be remiss if I did not remind you that you may gain significant “China Exposure” through any one of a number of emerging market funds or ETFs… including two previously mentioned:

1) iShares MSCI Emerging Markets ETF (EMM) – remember it uses the MSCI Emerging Market Index (lower China allocation; no A-Shares);

2) Vanguard Emerging Mkts Stock Index ETF (VWO) – and this one uses the FTSE Emerging Markets Index (higher China allocation, including A-Shares).

If you would prefer having some exposure to China, but at an even lower level of volatility than a full-fledged China ETF or even a diversified emerging markets fund… you can elect to invest in the

iShares MSCI Emerging Markets Minimum Volatility ETF (EEMV)

The EEMV invests in a broad basket of emerging market stocks that have demonstrated through years past a lower level of volatility than have comparable stocks within their respective countries and industries. It is worth noting as well that this ETF enjoys a relatively modest expense ratio (0.25%).

If you still haven’t found your personal level of comfort with Chinese equities, just wait a bit longer for the availability of an emerging markets ETF that excludes Chinese stocks altogether! In June, the folks at Emerging Global Advisors filed a document with the SEC that presents their vision for the

EGShares EM Core ex-China ETF (ECXC)

Their intention is to track a cap-weighted underlying index that covers between 100 and 300 companies, all with market capitalizations above $100 million. Given what has happened in China since June… this product idea should not be surprising to anyone!

Let me wrap up by offering key insights I have run across in my research:

1) Regarding the CSI 300 Index (traded by ASHR): the top sector in this index is relatively low priced financial companies… averaging a 17 P/E versus the 40 P/E at which they were trading in 2007. Why the huge difference? The economic boom pushed by Beijing since 2009 has loaded many of those banks up with lots of debt – some of which is of dubious quality (“Non-Performing Loans”). However, recent (new) reforms from Beijing have led to significant improvement in aggregate loan quality… so some observers think these stocks are under-valued. For its part, ASHR carries a 17.2 P/E … because over 40% of its portfolio is invested in financials.

2) With the caveat that it is more a promotional video than a strictly informative video… you may want to take a couple of minutes to watch

https://etfus.deutscheawm.com/US/EN/Homepage

Scroll a bit down from the top of the page and find “The Continued Evolution of the Chinese Market”:

3) To offer perspective on small caps in China, Deutsche X-Trackers Harvest CSI 500 China A-Shares Small Cap Fund (ASHS) (a cousin to ASHR) is trading at over a 43 P/E ratio. The CNXT ETF mentioned much earlier trades at a P/E ratio almost that high. Meanwhile, the U.S. Russell 2000 Index recently traded at an average P/E of just over 20.

4) I will not repeat the commentary from Kinger Lau (see the prior articles). But Sean Yokota of SEB Bank (head of Asia strategy) is not nearly as sanguine about China as is Mr. Lau:

“Until the margin buyers are gone, we don’t expect a stabilization or possibility for the market to start heading higher again. We are only one-third of the way through [deleveraging].”

5) A much more positive spin comes from Anson Chow of Deutsche Asset and Wealth Management[11] (V.P. of Passive Asset Management for Asia Pacific):

This is Anson Chow, V.P. of Passive Asset Management for Asia Pacific at Deutsche Asset and Wealth Management

“China’s economy is expected to decelerate gradually, but it should still be amongst the highest in the world in terms of GDP growth rate. However, DB Research does not expect a hard landing, because it is well managed by authorities. Expected further monetary and fiscal easing, alongside aggressive privatization programs, should also help avoid a hard landing.” He noted several positives:

a) Consumption could account for a greater portion of gross domestic product growth. China added 13.2 million urban jobs last year, which suggests increased urbanization and a potential for continued consumption growth.

b) Greater migration into cities would add to economic growth (through the increased demand for infrastructure and services).

c) The “Investment-to-GDP Ratio” has edged lower, indicating that the Chinese are buying more (instead of saving).

d) Many portfolio managers (and investors) remain under-allocated to mainland China.

i) Specifically, Chow points out that foreign ownership as a percentage of the domestic market was 1.5% for China — excluding securities listed overseas … or 11.4% including securities listed overseas.

ii) “Due to foreign investment restrictions, China remains underrepresented among global investors’ portfolios.” Obviously, if the MSCI Index folks ever decide to invest in A-Shares, that would boost China’s market capital.

6) For the record, a very well-balanced report (with citations for data) from “Matthews Asia” confirmed Mr. Chow’s analysis of the growing (burgeoning) consumer market in China. We all know how “Retail” has been struggling within the U.S. In contrast, consider these metrics from China:

a) “We estimate that the *tertiary part of the economy, which includes the financials sector as well as other services, rose by almost 9% YoY in the second quarter, while the secondary part, which includes manufacturing and construction, rose by less than 6% YoY. This is likely to be the third consecutive year in which the tertiary part of China’s economy will be larger than the secondary part.”

b) Consumption accounted for 60% of China’s GDP growth in the first half of the year, the largest share in six years. The real (inflation-adjusted) growth rate of retail sales was 10.6% in June, the fastest pace in four months and close to last June’s 10.7%. (Think how the U.S. Retail Sector would “die” for a growth rate of 10%!)

7) Finally, to ensure a balanced view of China, here are some thought-provoking comments from two well-known hedge fund managers and the “Bond King”:

a) Paul Singer (the founder of Elliot Management) has opined as follows about the June/July “crash” in China:

“This is way bigger than subprime.” Singer has been disturbed by all the factors I outlined in the two most recent articles – particularly the loss within less than a month of nearly $4 trillion in market capital. He hopes that China’s crisis will not be big enough to cause a global financial market conflagration.

b) Infamous Bill Ackman (Pershing Square Capital Management) recently compared the seemingly endless “Greek Crisis” with the emerging “China Crisis”:

“China is a bigger global threat by far. The Chinese stock market is a fairly remarkable phenomenon and I think kind of a frightening one.”

Specifically, Ackman is worried about China’s lack of transparency … questioning the reliability of its economic statistics. (He is not alone in that skepticism.)

“If you look at the Chinese financial system, you look at shadow banking, you look at the amount of leverage, you look at how desperately they worked to keep the stock market up. It looks worse to me than 2007 in the U.S.”

c) And the “Bond King”, Jeffrey Gundlach, compared the Chinese stock market with the NASDAQ in 1999, 2000 — when technology stocks collapsed.

“China is really kind of concerning… China is far too volatile and murky to invest in.”

INVESTOR TAKEAWAY:

That may be the most appropriate note on which to end this look at investment options in China. Hopefully, I have offered enough detail on various ETF investment options that you can easily find your own comfort level regarding Chinese equities.

It appears that the bottom line on this topic is the is answer to this question:

Which is more important to me:

1) An asset allocation to the world’s second biggest economy, with potentially the most robust consumer growth and GDP growth (relative to the rest of the world) for the next several years; or

2) Avoiding the seemingly out of control volatility demonstrated within the Chinese markets?

Only you can answer that question for yourself and your unique circumstances.

So as suggested by the extremely stark contrast between expert opinions from Ackman and Gundlach (on the one hand) and Anson Chow (on the other hand) … we must each approach this mater in much the same way that Hamlet wrestled with his dilemma in Shakespeare’s classic play (adapting that play’s most famous quote):

“To invest or not to invest. That is the question….

Whether ‘tis nobler in the mind to allocate to the economic giant that is China, and suffer scary ups and downs… or to take cover and allocate ‘Ex-China’[12], sparing my daily P/L the perils of outrageous misfortune.

DISCLOSURE:

The author does not currently own any of the China-centric ETFs discussed above… or any other Chinese stock (although he has in the past). Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

[1] Through specific ticker symbols, ETF names, and detailed information regarding holdings, etc.

[2] Note that ETFs come and go every week… so such metrics change quit a bit!

[3] The Index used by the Vanguard Emerging Market Index ETF (VWO)

[4] Used by the iShares MSCI Emerging Markets ETF (EEM)

[5] Trust me, that thought makes executives at the major U.S. market powers literally salivate…. Not to mention the political leaders in Beijing.

[6] Those stocks include a mix of the Chinese potpourri of share types: “A-Shares”, H-Shares”, “Red Chips”, “P-Chips”, and “B-Shares”

[7] Utilized by iShares MSCI Emerging Markets ETF (EMM)

[8] I’m referring to companies such as Apple (AAPL), Facebook (FB), Amazon (AMZN), Google (GOOGL), Twitter (TWTR), etc. in their very early years!

[9] I refer to them fondly as our Barry Bonds and Sammy Sosa traders!

[10] Don’t hover too long near a window in a high rise on a day like that.

[11] With all due respect to Mr. Chow, I remind you that because Deutsche Bank offers a number of Chine-centric ETFs, he is not entirely an objective expert.

[12] Generally when managers create a portfolio that excludes a country or industry… the fund is call “Index Fund – Ex China” or “Index Fund – Ex Financials.”

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why Micron Technology Stock Bucked the Market Downtrend on Thursday

Why Micron Technology Stock Bucked the Market Downtrend on Thursday