Let’s start off with a quiz:

“What is the significance of ‘Coscia’?”

1) An island off the southeast coast of France;

2) The birthplace of Napolean Bonaparte in August of 1769;

3) The former New Jersey home of mobster Simone DeCavalcante;

4) A Napolean “wannabe” who just made news in Chicago.

The correct answer appears in Footnote 1.[1] Meanwhile, let’s review the multiple choices offered above.

Answers 1) and 2) identify the same Island off the coast of France – “Corsica” (rather than “Coscia”.

In August of 1869, Napolean was born in Ajaccio, on the west coast of Corsica.

Napolean Bonaparte... born in Corsica, rose rapidly within the French military ranks in 1795 and continued gaining more and more power until be became emperor and tried to conquer Europe. He was 5 foot six inches tall.

Of course, Napolean became the infamous Europe conqueror of world history books:

Choice 3) was utterly made up. Mr. DeCavalcante was indeed a New Jersey mobster, but he was not born in “Coscia” (there is no such New Jersey town). In addition his crime family has been connected with Elizabeth, New Jersey. The DeCavalcante family is reputed to be the one upon which the HBO hit series “The Sopranos” was based.

Answer 4) refers to Michael Coscia, a 53-year old from Rumson, New Jersey, who has recently become famous as the very first trader convicted of the “Anti-Spoofing Legislation” included within the expansive 2010 “Dodd Frank Act” passed by the U.S. Congress in reaction to the trauma wrought by the financial industry between 2007 and 2009.

Mr. Coscia has described himself as an embodiment of the proverbial “American Dream” – personally pushing himself throughout his life to lift himself as far above his humble blue-collar New Jersey heritage as he could. He was proud that he managed to become a self-made millionaire – including the $1.4 million he infamously “earned” during a brief 9-week period in late 2011.

It was that 9-week period that was the focus of a major U.S. District trial in Chicago this fall – a trial closely watched by major players in the U.S. Futures Industry. The U.S. Attorney’s office relied upon the portion of the huge “Dodd Frank Act” of 2010 that is referred to as “Anti-Spoofing Legislation” – proscribing the manipulation of futures prices through the use of high speed computer programming that creates over-sized orders that move the price one way, followed within a few thousandths of a second by a small order on the “other side” of that trade and the cancellation of the initial trade. The result is the realization of “small” profits from this “High Speed/High Frequency” legerdemain.

Court documents detail how Coscia developed his trading programming and then executed high-speed trades through his Panther Energy Trading business. Over the course of that 9-week period in 2011 — Coscia managed enough successful trades to aggregate a $1.4 million profit.

Of all the resources I reviewed on this topic, the one I found most helpful comes straight from the FBI itself[2]:

[Coscia] …”designed his programs to place several layers of “quote orders” on the other side of the market from his trade orders ― either to buy contracts at a price higher than the prevailing offer, or to sell contracts at a price lower than the prevailing bid ― to create the illusion of market interest. The quote orders would typically be the largest orders in the market within three ticks (the minimum price increment at which a futures contract could trade) of the best bid or offer price, usually doubling or tripling the total quantity of contracts within the best bid or offer price.

“The indictment alleges that Coscia designed his programs to cancel the quote orders within a fraction of a second automatically, without regard to market conditions, even if the market moved in a direction favorable to the quote orders. He programmed the quote orders to cancel because he did not intend for them to be filled, but instead intended to trick other traders into reacting to the false price and volume information, it adds. Further, Coscia designed his programs to cancel all fraudulent and misleading quote orders immediately if any of them were even partially filled, because he intended them only to trick other traders into reacting to what appeared to be a substantial change in the market.

“After Coscia filled his trade order through the use of fraudulent and misleading quote orders, he immediately entered a second trade order on the other side of the market and repeated his steps with misleading quote orders, causing the second trade order to be filled. As a result, Coscia allegedly profited on the difference in price between the first and second trade orders.”

If you compare the body build and rounded face of Napolean and Michael Coscia, there is at least the hint of a resemblance. There is much more resemblance between the two with regard to ambition, self-image, and ego.

Of particular interest to all those who trade currency options or futures (or Forex), here is a description of one of the specific trades from which Coscia profited in 2011 (the text comes from the FBI release to which I referred above):

“The indictment details an example through trades that Coscia placed milliseconds apart in the Euro FX market during the early morning on Sept. 1, 2011. By entering large orders that he intended to cancel at the time he placed them, and caused to be canceled before other traders could fill them, Coscia made a profit by buying 14 contracts at 14288 ticks and selling them at 14289 ticks less than one second later.”

As most of you know, Chicago has historically been the “futures and options capital of the world”, so it was fitting that this seminal, precedent-setting case was tried within the Chicago District.

One of the most entertaining aspects of this trial was the widely divergent interpretation of Coscia’s market activity by the U.S. prosecutors versus that of his defense attorney:

One of the most entertaining aspects of this trial was the widely divergent interpretation of Coscia’s market activity by the U.S. prosecutors versus that of his defense attorney:

Assistant U.S. Attorneys Renato Mariotti and Sunil Harjani described Mr. Coscia as a “con man” who was able to use his jacked up computer to trick even huge trading firms like HTG and Citadel by “making it look like something big was happening in the market.” The prosecutors even illuminated one of the undeniable shortcomings of the replacement of the old “Open Outcry” trading system (face-to-face trading in the “Chicago trading pits”) by electronic trading, suggesting that if Coscia had tried to pull off this same strategy in the pits, “he'd have developed quite a reputation … nobody would have traded with him!” As things stand now, Coscia was able to “hide behind” his high-powered computer and act anonymously.

The most telling quote from prosecutors, however, was this indictment of Coscia:

“The only reason he was able to trick all these billion-dollar companies is that he was willing to do something they weren't — break the law.”

For her part, Attorney Karen Patton Seymour, who represented Coscia, tried (in vain) to help both the jury and the public believe that Coscia was simply a “stand-up guy” who should be applauded for the ingenuity needed to develop a “clever way to beat far bigger, better-resourced rivals”. Quite frankly, such a defense could reasonably be characterized as morally flawed… similar to defending such infamous outlaws of the past as Jesse James, Robert Leroy Parker (aka “Butch Cassidy”), and Harry Alonzo Longabaugh (aka “the Sundance Kid”) as really nice guys who were clever enough to make a mockery of bank security.

A picture of the "Butch Cassidy & Sundance Kid Gang". Sundance is seated at the far left while Cassidy is seated at the far right. (I can't help but note that they do not bear much resemblance to Paul Newman and Robert Redford.)

However, that was hardly the most controversial quote from Coscia’s attorney. Demonstrating the premise that although law school may instill a knowledge of statutes, law books, legal precedent, judicial terminology, and courtroom etiquette … it may very well still leave its graduates without a clue regarding moral nuance or public relations. To wit:

Attorney Seymour argued that Coscia’s alleged crimes were “victimless”, under the premise that if HTG and Citadel lost money trading with Coscia because they “misinterpreted” Coscia’s actions, that was the fault of HTG and Citadel, not Coscia!!

Then she offered the quote that will likely reign as the “foot-in-mouth” quote of the trial (referring to traders at the big HFT firms) :

“They did not just fall off a turnip truck[3] — these were very sophisticated professionals.”

Of course, what Seymour failed to recognize is that individual traders such as “Joe Euro” or “Sally Dollar” could easily have been negatively impacted by the disruption Coscia regularly brought to what would otherwise have been “normal” trading. Therefore, by implication, “Joe” or “Sally” could interpret Seymour’s comment as labeling them as the ones who “just fell off a turnip truck”!!

With all due respect to Attorney Seymour, given the content and style of her defense, it is no surprise to me that the jury needed only one hour to return a verdict: “Guilty” of all twelve criminal acts of fraud and “spoofing” with which he was charged. He will be sentenced in 2016 and could face as many as 25 years in prison.

INVESTOR TAKEAWAY:

Any reader who doesn’t already know that “mischief” within the world of finance and trading is, unfortunately, a widespread occurrence would need to bear some resemblance to an ostrich[4].

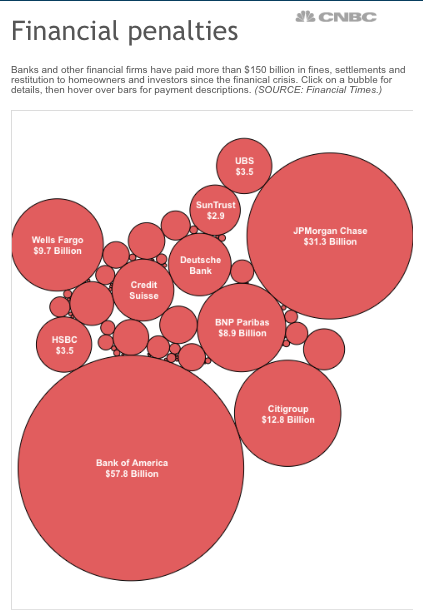

Below you can see an image of the massive amounts of federal fines levied against finance companies operating in the United States since 2007:

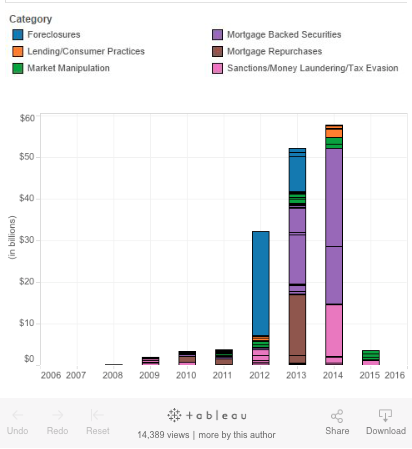

As you have likely guessed, the largest bulk of those fines have been assessed due to “non-trading” activities, such as “Foreclosures”, “Lending Practices”, “Mortgage Repurchases”, and “Money Laundering/Tax Evasion”.

That being said, it is worth noting that 2012, 2013, 2014, and (in particular) 2015 have witnessed a marked increase in regulatory action related to “Market Manipulation” (the green color in the image above). And we should recognize that the “Mortgage Back Securities” category incorporates crimes that are often a hybrid between mortgage fraud and market manipulation.

Therefore, we can celebrate that, at least to some extent, the government has been active in bringing some “consequence” to financial misbehavior.

That being acknowledged, critics almost universally agree on two points:

1) Fines assessed against banks the size of Bank of America (BAC) and J.P. Morgan Chase (JPM) have not been big enough to serve as a strong incentive against “stretching the bounds of the law”. Many critics charge (in considerable frustration) that CEO’s such as Jamie Dimon (at JPM) merely accept such fines as a natural and ordinary “cost of doing business”.

2) Related to management attitudes, critics regularly ask when the government will finally bring charges against the CEO at one of these chronic regulatory violators, instead of allowing CEO’s to remain unsullied while underlings get disciplined and/or fired.

Therefore, it may be encouraging to many observers that Michael Coscia’s conviction goes far beyond a mere fine and sets up a legal precedent (in connection with the “Anti-Spoofing” provisions of “Dodd Frank”) for additional charges against those who make a mockery of free and transparent (not to mention “honest”) financial markets.

In fact, on October 18th, charges were brought against trader Igor Oystacher (and his firm, 3Red Trading LLC) in connection with (allegations of) cheating while trading within the Chicago Mercantile Exchange,

the New York Mercantile Exchange, the Commodity Exchange and the Chicago Board Options Exchange. The allegations include specific reference to “spoofing” that took place over 51 trading days between December of 2011 and January of 2014. From the U.S. Commodity Futures Trading Commission website comes this excerpt from its statement regarding this case, indicating that the trader and his firm:

the New York Mercantile Exchange, the Commodity Exchange and the Chicago Board Options Exchange. The allegations include specific reference to “spoofing” that took place over 51 trading days between December of 2011 and January of 2014. From the U.S. Commodity Futures Trading Commission website comes this excerpt from its statement regarding this case, indicating that the trader and his firm:

“[created] the appearance of false market depth” to benefit their own interests “while harming other market participants”.

It will be helpful, of course, to place High Frequency Trading (HFT) into a larger context. Depending upon which expert you rely upon or what source you cite, the relative importance of HFT within the entire trading universe varies widely:

1) Ramanurthy Guruvayurappan

“Different studies have given different estimates. Generally High Frequency Trading is more in futures trading. It can be roughly put at 40 percent in equity trades, and 60 percent in futures trading.

2) A U.S. Securities and Exchange Commission report published on March 18th of last year consumes some 37 pages to warn of the difficulty involved in precisely defining HFT, without confusing it with other distinctive forms of “Algorithmic Trading”. It also distinguishes between “Active” HFT and “Passive” HFT… as well as HFT within large cap securities versus mid or small-cap securities… and higher priced securities versus lower priced securities.[5]

3) The newspaper article from which I drew the bulk of my information about the Coscia case stipulates this statistic about HFT: “which now accounts for half of all trading volume.”

4) The CFTC itself reports that it gets multiple reports of spoofing weekly. And yet (as we’ve seen) enforcement actions have been rare. However, that being acknowledged, it may be significant that Aitan Goelman (the Director of Enforcement for the CFTC) has recently spoken with seeming conviction:

“Spoofing seriously threatens the integrity and stability of futures markets because it discourages legitimate market participants from trading… The CFTC is committed to prosecuting this conduct and is actively cooperating with regulators around the world in this endeavor.”

Now take a deep breath, folks! While all of these well-informed folks have reported the observations you have read above, the Assistant U.S. Attorneys in Chicago strenuously claim that Michael Coscia was a “lone wolf”, whose actions were “highly unusual. To which I want to say right out loud (perhaps even within the court room…) “Really? Are you serious?? Give me a break!”

And as long as we are touching upon hard to believe stipulations, here is what the “Head of Compliance” for 3Red Trading Group (Greg O’Connor) said in an email statement about the CFTC suit:

“The charges are completely without merit. The CFTC has over-simplified complex trading and is now trying to classify legitimate trading and risk management as a market infraction. We now look forward to presenting our case before the court.”

Mr. O’Connor was likely a very relieved compliance officer when the CME Group Inc. and the Intercontinental Exchange Inc. settled charges against Oystacher earlier this year – without Oystacher being required to confirm any wrongdoing. All it cost Oystacher (and/or 3rd Red Trading) was $275,000 and a one-month “time out” at the CME.[6]

For its part, the CFTC has identified the markets in which Oystacher committed the alleged illegal trading activity as copper, natural gas, the S&P 500 Index, and an options volatility index:

“Despite the presence of thousands of other traders in these markets, Oystacher and 3Red were the largest traders in the respective contracts for copper, natural gas, VIX, and E-Mini S&P 500 futures, and the third- largest trader in the spot month contract for crude oil futures” (measured by number of contracts traded).

Illustrating the incredible speed at which Oystacher’s methodology functioned, the CFTC described a key feature of the trading program as follows:

Through the “avoid orders that cross” functionality… Oystacher placed a large resting order on one side of the market to trick others into thinking prices were about to rise or fall… Then, because the “avoid orders that cross” function was in use, the small order he'd place on the other side of the market would cancel the large resting order within 5 milliseconds.

So what does this news story teach us?

1) Always trade with your eyes wide open. Never take at face value any public statement by Assistant U.S. Attorneys or SEC personnel (or anyone else) that market manipulation does not exist. It does exist, and that is all the more reason why “Risk Management” within your daily trading and investment decisions is always a top priority!

2) It may not help, but it certainly will not hurt to periodically write to your Congressional representative to highlight how important it is to you that in U.S. investment markets are free, transparent, and fair – meaning that all participants operate from a “level playing field”. Yes, hoping for all of that is like asking for “pie in the sky”. However, continuing to tolerate the current level of non-transparency (and inequity) illustrated by Coscia, Oystacher, HFT, Dark Pools, etc. is not a constructive option for the future.[7]

DISCLOSURE:

The author has never engaged in spoofing or HFT… or availed himself of a Dark Pool… or received a Non-Farm Payroll Report a few seconds or few minutes early… or secured access to a market moving earnings report the trading day before it was released… etc. That being said, he has traded positions in the S&P 500 Index… but (trust me) never with any sort of “advantage” over anyone else! Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Choice 4) is the correct answer. Michael Coscia was found guilty on Tuesday, November 6th of “Spoofing” – the first successful prosecution by federal U.S. attorneys of “Spoofing” in the Futures markets.

[2] See https://www.fbi.gov/chicago/press-releases/2014/high-frequency-trader-indicted-for-manipulating-commodities-futures-markets-in-first-federal-prosecution-for-spoofing

[3] Merriam-Webster reports that it has no citations of the whole phrase (“Just got off the Turnip Truck”) earlier than 1988, and no citations of “turnip truck” earlier than 1985. R. J. Valentine writes: “This phrase has been used for many years by Johnny Carson, who hosted The Tonight Show Starring Johnny Carson on NBC from the early 1960s to the early 1990s. He used it in precisely in the context discussed. He may not have originated it, but he certainly popularized it, and began doing so long before 1985.”

[4] hiding their head in the sand.

[5] It notes greater volume of HFT in large cap securities and (relatively lower priced securities…. Where competition is primarily on speed rather than price. Find report at: https://www.sec.gov/marketstructure/research/hft_lit_review_march_2014.pdf

[6] Meanwhile, ICE “told him to stop the practice” (sounds like punishment as doled out in Kindergarten).

[7] Some might add that we should write to the SEC requesting what I described above. I considered that… but then I realized that, within the ecology and mindset of federal government, asking for such things could just as easily result in the imposition of an additional “transactional tax” on trades executed through an exchange. It likely would not occur to anyone to assess the practitioners of HFT, Dark Pools, etc. additional taxes rather than the average small lot traders such as you or me!!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Cathie Wood Expects This Red-Hot Cryptocurrency to Soar by 5,600%, but 1 Member of Congress Has Been Dumping His Stake in Crypto

Cathie Wood Expects This Red-Hot Cryptocurrency to Soar by 5,600%, but 1 Member of Congress Has Been Dumping His Stake in Crypto