What do these images have in common?

Each of these images is related to “self-aware technology”: machines that were created by human beings, but evolved quickly on their own — beyond any level that their human creators ever imagined. Therefore, adequate safeguards were never put in place and each of these “technologies” took control of the setting within which it found itself! (For those very few who aren’t familiar with all four, I identify and reference them after the footnotes below!)

These images were the ones that first sprang to mind in late 2012 and early 2013 as I began to read (within those publications that are targeted for the financial adviser community) an accelerating number of stories about so-called “Robo-Advisors”.

Now, just about 2 years later, the pace at which the “Robo-Advising” space is growing, evolving, and even specializing has become almost breath taking!

In fact, the pace at which these “Robo-Advisors” are evolving is so swift that even the usually extremely adept, accurate, and on-target folks at “Investopedia.com” have found themselves a bit “behind the curve”![1]

Let me try to illustrate. Here is the current definition of “Robo-Advisor” from Investopedia.com:

“A robo-advisor is an online wealth management service that provides automated, algorithm-based portfolio management advice without the use [of] human financial planners. Robo-advisors (or robo-advisers) use the same software as traditional advisors, but usually only offer portfolio management and do not get involved in more personal aspects of wealth management, such as taxes and retirement or estate planning.”

Investopedia.com (per usual) then goes on to further “explain” this concept:

“Robo-advisors are typically low-cost, have low account minimums, and attract younger investors who are more comfortable doing things online. The biggest difference is the distribution channel; previously, investors would have to go through a human financial advisor to get the kind of portfolio management services robo-advisors now offer, and those services would be bundled with additional services.”

Well, these aspects of Investopedia’s understanding of “Robo-Advising” are true:

1) They are providers of “online wealth management”. That is, in fact, a much more accurate and helpful description of what is provided than the journalist-promoted (and way overused) term “Robo-Advisor”!

In fact, an even better description would be “Digital Wealth Management”!

2) It is also true that “Robo-Advisers” generally focus on a few specific categories within the sphere of financial planning – with algo-driven portfolio management being the most commonly provided service.

3) However, Investopedia unintentionally over credits the software used by the typical financial planner – because the programming that drives the best among the “Robo-Advisors” is much more sophisticated than that of the average financial planner.

4) In addition, while Investopedia is definitely correct that the “Robos” have not delved in estate planning (estate plan circumstances are so unique, the regulations are so complex, and the (intersecting) variables are so numerous that offering estate planning advice would not be prudent), many of the “Robos” have built “tax-optimization” into the account management software they use!

As for the “financial advisor community”[2], when the subject of “Robo Advisors” first emerged (in 2012 and before) – they were largely discounted (even laughed off) by many advisors and executives at the big firms. However, I have been struck by how advisor “attitudes” toward the “Robos” have seemed to mirror the evolution of the technologies to which I referred at the start of this article: from “harmless”… to “annoying”… then to “geez, look, they are growing”… to “oh Lord, they are becoming more sophisticated”[3] (“self aware”) … to “will they become a threat?”

What developments within society sewed the seeds that have led to the emergence of this new breed of financial advice? There is no simple, single, comprehensive answer to that question.

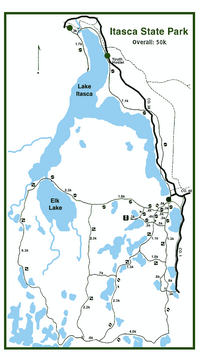

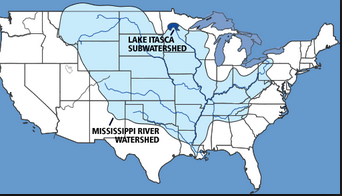

Picture in your mind the Mississippi River. It starts in upper Minnesota, at Lake Itasca.

From there the water flows south and meanders here and there (for 2340 miles), intersecting with (and being fed by) twelve major rivers. It is the confluence of all that water (the largest watershed in North America) that makes the Mississippi “mighty”.

The same is true for “Robo Advising”. It would not be what it is today without all of the following developments “flowing together”:

1) the rapidly evolving capacity of computer technology to not only “crunch numbers”, but also assimilate, categorize, analyze, and differentiate – making higher level “decisions” (based on variables/criteria provided through human input) that can initiate security trading[4]; automatically re-balance portfolios at prescribed intervals; sweep available cash into a return-generating asset on a nightly basis; and prepare portfolio, balance, and performance reports on demand; etc.

2) the emergence of (and exponentially evolving sophistication of) Mobile Technology – bringing the same computer capability to one’s hand or wrist that once[5] required a full room of computer equipment (that generated data which appeared as totally boring numbers on a less than high resolution screen).

3) the “Lost Decade” of the U.S. Stock Market… when billions/trillions of dollars of stock losses from the “Dot.com” bubble and the “Financial Crisis” crash decimated the retirement accounts of millions of investors over 40 years of age – setting back hundreds of thousands of “hoped for” retirement plans.

a. The children and teenagers who witnessed (up close and personal) the crushing blow of those retirement fund losses in their parents’ portfolios are now the members of the “Millennial” and “Gen-Y” generations who are driving the growth of the “Robo-Advisor” space;

b. They yearn for a simplified, systematic, dependable means of investing that minimizes the vagaries of human judgment.

4) the rise of new generations who never knew a time “without computers” … and who have grown up taking for granted the axiom that technology will always evolve more rapidly that their (“fuddy duddy”) parents think is necessary or comfortable.

a. Many “Millennial” and “Gen-Y” members prefer to text, Tweet, Facebook, and/or email instead of “telephone” (“Geez, dad, why are you calling me again? Get a life – and get a smartphone that is enabled for social messaging!”)

5) the high cost barriers that must be overcome if one is to secure the most highly regarded/rated human professional financial advice;[6]

6) the emergence and rapid growth of Electronically Traded Funds (ETF) – stocks and/or bonds that are aggregated into a fund that is tradable throughout the trading day (just like a stock)…

a) Just as important as the instrument is the fact that hundreds of these ETF’s charge so little in management fees that the lowest cost among them assess less than 10 basis points a year;

b) In addition, there are platforms on which select ETFs can be traded without commission;

c) Also, ETFs lend themselves to being more tax efficient because, when traded in certain ways, capital gain liability can be avoided until an investor actually withdraws funds.

d) Finally, the variety and range within the ETF universe[7] means that virtually any desired “Asset Allocation” can be achieved through the purchase of a relatively small number of ETF’s.

i) Formerly, diversification within a well allocated portfolio required the purchased of countless handpicked stocks and/or bonds, and required paying all of the accompanying commissions and/or “ask/bid” spreads involved with each transaction.

ii) I remind you that most academic research on stock market performance attribute as much as 97% of one’s return (over a 3-5 year period) to the asset allocation that is selected!

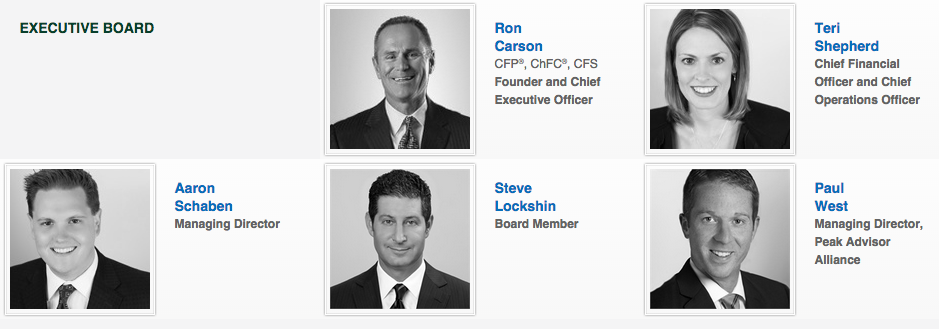

Let me illustrate some of the main issues involved within the development of (and impact of) Robo Advisors as seen through the eyes of an experienced and extremely successful financial advisor – Ron Carson of Carson Wealth Management in Omaha, NE. Ron’s team manages $4.3 billion in assets, and Ron was just named by Barron’s[8] as a financial advisor (among only 15) who has been honored for 10 straight years within the coveted “Top 100” advisor list!

Ron Carson founded and manages an extremely successful wealth management company in Omaha, Nebraska.

However, Ron’s financial success is not why I am starting with Ron’s insights! Instead, among all of those whose commentary on “Robos” I read in my research, Ron offered the most accessible, straight forward, and balanced perspective!

At a June conference of financial professionals, Ron asked the crowd how many were “afraid” of Robo Advisors. Evidently, just a few raised their hands. Ron pointed out that such a lack of concern is not uncommon. In fact, at another conference Ron attended, a group of advisers clustered up on stage observed (paraphrasing): “It's no real threat. These kids, they think they want to use a technology platform. But they're going to want a human being in the end.”[9]

In stark contrast, Ron then lifts up an explicit and clear testament that came from young people attending a financial services consumer panel. They said: “I want my information 365 days a year. If it's 3:30 on Christmas Eve, I want to know how I'm doing. I want the latest information on it.” Clearly, it is not a human financial advisor that these young folks are craving!

Amplifying this point, another Millennial (who actually works within the financial industry) observed: “the last thing anyone I know wants is to have someone call them to small talk. Millennials grew up in an age where the only time they want to talk on the phone with a business is when they’re complaining about a product or service (while writing a bad review in.….Yelp, Facebook… etc.).”

To his credit, Ron Carson admits that he is a bit afraid of “Robo Advisors”. He reports that a few of the “Robos” have taken away some of his business. And because of the “Robos”: “My margins have shrunk.” Building on the earlier comments from younger adults, the most likely persons interested in pursuing “Robos” include anyone who: 1) likes Twitter better than reading a newspaper; 2) books a dinner reservation via “Open Table” instead of phoning the restaurant. They are tech savvy and app friendly and are quite different than their parents with regard to how they think, process information, and accomplish tasks. At least on the surface, under present circumstances, getting a phone call about financial matters from anyone even close to their parents’ age is the last thing on their list of “things I want”!!!

Another purpose that Ron Carson serves is to offer a helpful segue into the topic of “venture capital” flowing into “Robo Advisors”. If you search the website of Carson Wealth Management for a list of board members, you will see the following:

Notice anything interesting? The only “Board Member” within the Executive Board” is a gentleman named Steve Lockshin. If we then “Google” his name, we find out that Lockshin is quite a dynamo within financial services:

Notice anything interesting? The only “Board Member” within the Executive Board” is a gentleman named Steve Lockshin. If we then “Google” his name, we find out that Lockshin is quite a dynamo within financial services:

1) Founded Convergent Wealth Advisors in 1994, serving as CEO until 2012, when he retired to become Chairman (Convergent is a top Registered Investment Advisor (RIA) for ultra-affluent investors.)

2) In 1995, he founded CMS Reporting (now Fortigent, LLC) as a provider of top- notch technology for wealth management and reporting; Fortigent has become a key outsourcing vendor of technology within the financial services industry.

3) Lockshin has become a stakeholder (investor) in one of the bigger “Robos” – “Betterment” … and he has partnered with Martin Bicknell in becoming key players within “Betterment Institutional” – making headlines this past week through a partnership with Fidelity to resources advisors who work within the Fidelity network.

4) Lockshin has clearly earned the descriptive phrase most commonly associated with him: “serial entrepreneur.”

Obviously, Lockshin not only has his feet, but his heart as well, on “all sides” of the financial services industry (on the “human” side and on the “robo” side). Who better to discern what “value” lies in either one (or both) than someone who is directly and intimately involved on all sides!

There are a lot of accomplished folks who are either personally invested (through time and position) or financially invested (as an “Angel Investor”) in these “Robo Advisors”. Admittedly, they don’t all have the “financial advising chops” possessed by Lockshin; but they are sharp, insightful, successful, and hardly careless with their time or investment dollars. Just a few names involved with some of the more prominent “Robo Advisors” include:

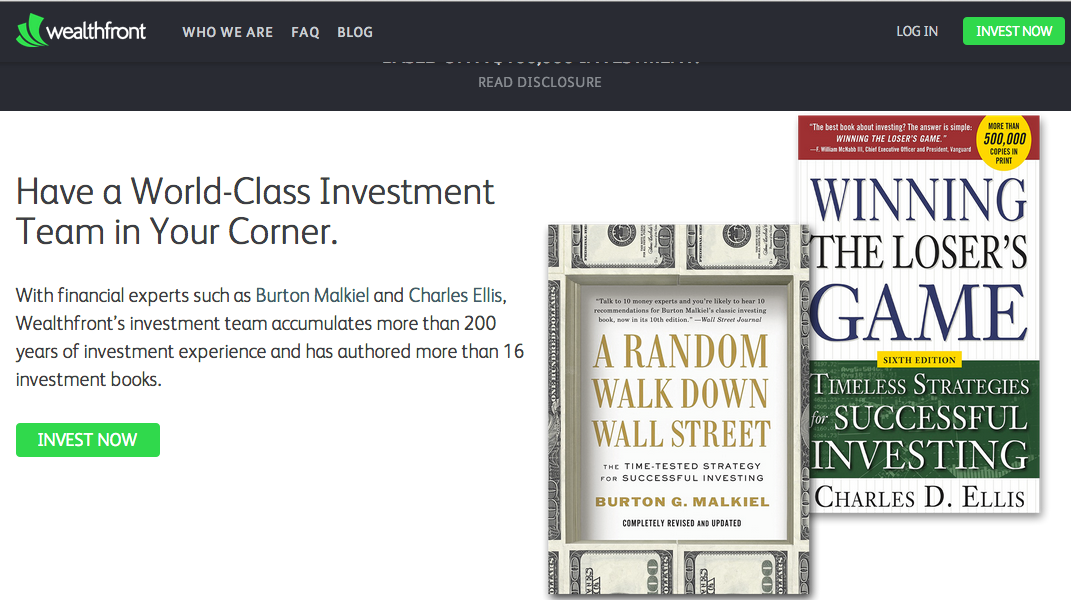

1) Wealthfront: CEO Adam Nash is a veteran of eBay and LinkedIn. This Robo Advisor boasts (as a subtext within its virtual storefront banner) the investment expertise of famed expert and author, Burton Malkiel:

In addition, Marc Andreessen (famed co-author of the first widely used Web browser, Mosaic and Marissa Meyer are “Angel Investors”.

2) Personal Capital: Bill Harris, who is the co-founder and CEO, is described on the Personal Capital website in this fashion:

“Formerly CEO of PayPal and CEO of Intuit and founder of numerous financial technology and security companies, Bill says Personal Capital is the culmination of his career.” So Harris carries the mystique of Elon Musk, the financial credibility of Intuit, and the long-term perspective of someone who has reached the mountaintop.[10]

3) Betterment: Jon Stein, CEO, is a graduate of Harvard and the Columbia Business School who manages to live in New York City without owning a car and has raised $45 million in capital for his firm (which averages out to over $1.3 million/employee!). Interestingly, he says his inspiration for starting this “Robo” was his own abject failure as an investor in college, when he bought a well-known company “at 50% of its original value and I thought I was getting an amazing deal!” However, all too soon, Stein discovered that investing in Enron had been a huge mistake!! You’ll recall that Lockshin is a key investor and player within Betterment!

4) Future Advisor: is backed by Sequoia Capital (a major investment management firm) and has received funding from Keith Rabois (CEO at Square) and Jeremy Stoppelman (founder of Yelp).

5) SigFig: Yahoo.com has secured a strategic partnership with SigFig. It will be interesting to see what that partnership leads to down the road!

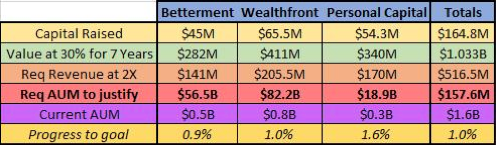

These impressive folks have been joined by countless others in supporting the emergence of Robo Advisors. The following chart (data as of March 2014) offers an utter wealth of information and insight about “Robos” … from the amount of capital raised by three of the biggest, to a projection of key current and future metrics:

1) On the assumption that “venture capital” is invested with an eye toward receiving an average 30% return by the end of 7 years, what would each firm need to be “worth” by then?

2) To support a company that large, how high would average revenue need to be by the seventh year?

3) To generate that revenue level, how many assets must the company have under management (AUM) … given the existing rates/fees assessed?

4) What is the current level of AUM?

5) How far along are they toward their goal?

To update the above AUM figures:

Wealthfront was the first to gather over $1 billion AUM ($1.4 billion as of the end of August);

Betterment reported over $500 million AUM at the end of March, with the expectation of $1 billion by the end of 2014;

Personal Capital reports over $500 million AUM.

Contrary to what was suggested in the Investopedia definition of “Robo Advisor”, two of these “top three” “Robos” have discerned that there is significant value in combining their investment management platform with a person (an advisor or a trained employee) who will interface with each client. But that is just the tip of the iceberg with regard to the many ways in which “Robos” can be differentiated.

For example, the “low cost leader” is Wealthfront, charging a mere .25% of AUM to provide its total investment management services. At almost 1% of AUM, Personal Capital sits toward the top of the range in “Robo” fees – but it is designed to be used in conjunction with a contact person, and specifically targets customers with assets at the upper end of the typical “Robo” client wealth range[11]. Betterment just inked a huge deal with Fidelity Investments (the Advisor division) so it will be seeing a huge boost in its business as RIA’s begin using their platform. And FutureAdvisor may be one of the most intriguing models within the “Robo” space – since it appears to be the most flexible with regard to the range and cost of its services.

The “Robos” mentioned thus far constitute, as you might imagine, only a small portion of the total universe of existing “Robo Advisors”. A report from MyPrivateBanking Research studied eight firms in the U.S. and six firms from Europe. Among those “Robos” were the following:

I) U.S. based (Alpha order): AssetBuilder, Betterment, FutureAdvisor; Jemstep, MoneyFarm, Money on Toast, Nutmeg, Personal Capital.

II) Europe: Quirion, Rebalance IRA, Swissquote ePrivateBanking, Vaamo, Wealthfront, WiseBanyan.

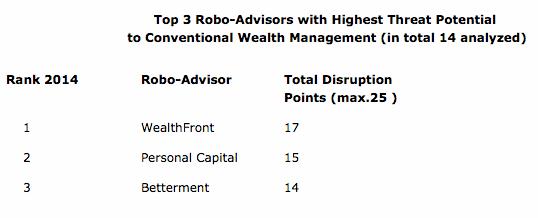

The researchers built this study on a definition of “Robo Advisor” that includes automated investment services (including algorithm-based risk assessment), automated portfolio selection, and automatic portfolio rebalancing. They studied the publicly available interfaces of each of the 14 advisors and interviewed members of senior management. For perspective, they also interviewed a number of conventional wealth managers (ie. “non Robo”). These researchers placed a particular emphasis upon each Robo Advisor’s potential “threat to conventional wealth management”… and within that context, they tried to rank the degree of “threat” from each “Robo”.

Here is what the report offers:

1) Global assets under management (AUM) of the Robo-Advisor services will reach $14 billion by the end of 2014.

2) 83% of those assets will be managed by Robo-Advisors based in the United States.

3) By 2019… the global AUM of Robo-Advisors is forecast to grow to an estimated $255 billion.

According to these researchers, this is an evaluation of which “Robos” pose the greatest potential threat to “Conventional Wealth Management”

Finally, to provide more context for this look at “Robos”, here is an encapsulated summary of the vision driving Wealthfront’s business model as the low-cost provider:

Wealthfront is the largest online adviser (digital adviser) – boasting over 13,000 clients.

To anyone who suggests they are underpricing the market, Adam Nash (CEO) responds: “This is a part of our mission, that everyone deserves sophisticated financial advice.” As Wealthfront sees their primary target client, it is the average Millennial… a group which Nash estimates incorporates some 90 million folks in the U.S., holding a combined net worth of more than $2 trillion… a total that Nash hopes Wealthfront will help grow into $7 trillion by 2018!

And in case you wonder how the scale of the “Robos” compares with the advising industry at large, an October 15th report of AUM among SEC-registered advisers within the U.S. totaled $61.7 trillion (as of the April reporting period) – 12.6% higher than the year before.

Assets under management among SEC-registered advisors nationwide increased 12.6% to $61.7 trillion!

INVESTOR TAKEAWAY:

I must admit that there are a number of the “Robos” that impress me. I have even committed myself to determine which “Robo” I will use in the future to manage a portion of my assets! (As I learn more during that discovery process, I will share it with you.)

Why would a C.F.P. consider using a “Robo Advisor”? Once you understand that the popularly used term (“Robo Advisor”) is really a misnomer (since the essential service that most “Robos” provide is automated, algo-based investment management, not true financial planning) the answer is fairly clear:

This image from iStock is what is conjured up by the popular name given to "Digital Wealth Management". Everything that is delivered by a "Robo Advisor" has been created by humans through algorithms and specific programming that determines the parameters and criteria used within each "Robo" system.

A “Robo” can invest my assets within a risk appropriate asset allocation and perform regular portfolio rebalancing, tax optimization, and reporting functions;

More importantly, it will execute all of the above devoid of human fear (panic) or greed!! In addition, it will have no incentive to “over trade” (to earn additional commissions) or contact me in an attempt to convince me to invest in some new “revolutionary” company with a product that is sure to be the “next iPhone”!

I don’t know about you, but this service sounds appealing to me. The visionaries who have “birthed” this service have exemplified the leadership referred to often by the “i-Conic Visionary” himself, Steven Jobs: “Innovation distinguishes between a leader and a follower!”

Perhaps most impressive of all, this type of technology can be put to work for you for as little as 25 basis points!

Yes, I still have reservations. I remain skeptical that a risk profile process that incorporates just 10-15 questions can adequately discern my optimum asset allocation configuration. However, it is worth a try.

I also realize that the typical “Robo” cannot offer me cogent counsel on complex tax matters (such as Section 107 of the IRS Tax Code), estate planning, or insurance. But then, those are the areas within which I am especially educated and equipped to provide myself, or any client, with value-added expertise beyond the keen of any “Robo”.

DISCLOSURE: None of these “Robo Advisors” are (as yet) publically traded. Therefore, I hold no stock in any of them. Nor do I have any personal interest in promoting any of them. In fact, I am writing this article at the request of an ordinary investor who was intrigued by the concept.

FOOTNOTES:

[1] I must offer the caveat that the “left behind the curve” characterization of Investopedia.com is strictly my own opinion regarding this one specific area. In general, I find their material extremely helpful and elucidating!

[2] This is a “community” that is actually quite large and comprehensive. According to the U.S. Financial Industry Regulatory Authority (FINRA), terms such as financial adviser and financial planner are general terms or job titles used by investment professionals and do not denote any specific designations.[1] FINRA describes the main groups of investment professionals who may use the term financial advisor to be: brokers, investment advisers, accountants, lawyers, insurance agents and financial planners. That encompasses as diverse and differentiated group as the “million dollar producers” at wire houses (such as Bank of America Merrill Lynch, Morgan Stanley, Wells Fargo Advisers, UBS) and the small town advisors that carpet the U.S. through companies such as Edward Jones, all the way down to much more modest, independent folks such as me (I have been a C.F.P. for 20 years).

[3] Which I consider to be the advisor equivalent of “Self Aware” in the analogy likening HAL, Skynet, Sonny, etc. to “Robo Advisors”

[4] Similar to the process used in the famous Market Tamer “Algos”

[5] Long ago and far away … when I was in college, in fact.

[6] The long-time standard hedge fund fee structure is a 2% management fee and 20% of all profits. Most professionals who are not still compensated strictly through “commissions” either command a hefty fee and commissions or a standard “wrap fee” (ranging between 5 basis points on up to 100 basis points or more – common wraps are .25% to .75%) assessed on all assets managed.

[7] By which I mean the availability of one or more ETFs that meet virtually anyone’s desired investment target or strategy… and cover virtually any known, widely used “Asset Class”

[9] Countless advisers point out (repeatedly in fact) that the almost relentless bull market since 2009 has overly dulled the common sensibility regarding what financial “panic” feels like. They remember (vividly) the hand holding that clients needed through the worst of the “Dot.com Crash” and the “Financial Crisis Meltdown”. Who is going to hold the hand of clients served by “Robo Advisors”??

[10] This is an indirect (and definitely stretched) reference to Moses, who at the end of his “career” looked down from the mountaintop at the culmination of his long journey. However, this wording on the website immediately made me think of Moses.

[11] It is Personal Capital’s higher “margins” that make it the “leader” relative to “progress to goal” in the chart!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

3 Ways to Save Big on Medicare in Retirement

3 Ways to Save Big on Medicare in Retirement