In Part I, we detailed the “big picture” behind the recent legal challenges confronting JP Morgan Chase and Company (JPM). In this part, we will focus on some of the specifics behind the most “colorful” of these legal quagmires – specifics that could be interpreted as an indicator of a breakdown within corporate risk management (not to mention a public relations faux pas). In addition, as we did in Part I, we will relate current JPM developments to the story of its namesake, the infamous John Pierpont Morgan.

As we know, commentary about so-called “money center banks”[1] often refers to the dangers of “proprietary trading” (prop trading). The “Tale of the Whale” transpired within the bank’s “Chief Investment Office”, which (during 2012) managed about $350 billion of bank deposits.

The particular portfolio directly germane to an understanding of this story is known as the “Synthetic Credit Portfolio” (SCP)[2] – centered upon extremely complex credit derivative products. That strategy experienced its most profitable year in 2009 – delivering in excess of $1 billion of revenue to the bank. In fact, until the losses reported in 2012, the SCP had not experienced a quarterly loss since Q1 of 2009! Prior to 2012, the SCP had generated about $2 billion of cumulative profit. As we know now, the portfolio’s 2012 loss of (an estimated) $6.2 billion more than tripled prior profits.[3]

The particular portfolio directly germane to an understanding of this story is known as the “Synthetic Credit Portfolio” (SCP)[2] – centered upon extremely complex credit derivative products. That strategy experienced its most profitable year in 2009 – delivering in excess of $1 billion of revenue to the bank. In fact, until the losses reported in 2012, the SCP had not experienced a quarterly loss since Q1 of 2009! Prior to 2012, the SCP had generated about $2 billion of cumulative profit. As we know now, the portfolio’s 2012 loss of (an estimated) $6.2 billion more than tripled prior profits.[3]

LONDON OFFICE OF JPM: the photo above shows the location of the infamous “London Whale” trading (and cover-up) activities.

Within the London office, the two most commonly referred to bank leaders were the head of the London office, Chief Investment Officer, Ina Drew, and the lead trader, Bruno Iksil (the “London Whale”). Neither of these persons works at the bank any longer, and Mr. Iksil has a “non-prosecution” agreement with New York legal authorities.

The woman pictured to the left is Ina Drew. I could not find a photo of Mr. Iksil anywhere (even “Google Images” and LinkedIn)!

The woman pictured to the left is Ina Drew. I could not find a photo of Mr. Iksil anywhere (even “Google Images” and LinkedIn)!

The central essence of the “London Whale” story, in my opinion, is as follows:

1) Should a bank that received 2008 taxpayer “Bailout” funds be engaged in high-risk prop trading using customer deposits (or taxpayer funds, as they did in 2008-09)?

2) Once the prop trading strategy “went south”, did JPM management handle the situation with integrity and dispatch?

a. Did management order immediate review of risk management policies and make all necessary changes to ensure the financial stability of the bank?

b. Did management ensure all of the requisite disclosures to U.S. regulatory bodies[4], the Board, and the shareholders?

Unfortunately for shareholders, board directors, depositors, counter-parties, etc. extensive documentation from numerous sources establishes the following:

1) The “London Whale” will be used in business schools for years (decades) to come as a textbook case study — illustrating negligent risk-management and extremely poor “crisis management”; and the case will be referred to (ad infinitum) by politicians and bank regulators as a classic illustration of why “too big to fail” financial institutions should not be permitted to “prop trade”.

a. From CEO Jamie Dimon on down to the traders and managers within the London office, “denial” of reality was pervasive, exponentially increasing the damage to JPM and the “risk” to the integrity of the financial system![5]

b. As though “denial” wasn’t bad enough, traders and administrative staff within the London office began to “move the goal line” once the SCP losses mounted. They threw standard “best practices” and risk management metrics out the window and created rules, valuations and metrics that better suited their plight.[6]

c. One would be justified in suggesting that this “financial system” had “gone rogue”!

2) Mr. Dimon and JPM had become so accustomed (in past years) to “sliding through” any challenges on the strength of their network and reputation (as well as political capital) that the “London Whale” pushed them into truly uncharted territory:

a. For decades, JPM had created a power web of entities outside the formal aegis of JPM – led and populated by persons of power and influence.

i. Charities, foundations, etc. all founded and funded by JPM.

ii. Leadership for these entities drew upon retired governmental leaders, former JPM executives, board members, industry leaders.

b. During the 2007-11 period, Fannie Mae and Freddie Mac illustrated the advantages of such a network.

3) In addition to 4) above, JPM enjoyed two priceless advantages—sheer monumental size (the oft vaunted “Fortress Balance Sheet”) and special U.S. accounting rules that allow banks incredible latitude with regard to financial reporting requirements.[7]

a. The size of JPM and the leeway afforded him through liberal bank accounting rules has allowed Mr. Dimon to establish a reputation as a master at “meeting earnings expectations”.

b. Dimon has managed to gloss over many past miscues by drawing utilizing that size and flexibility.

c. However, it is impossible to “gloss over” a $6.2 billion loss, even within the bank’s “Fortress balance sheet”!

Let’s briefly touch upon each area above:

1) The “London Whale” as a paradigm of a financial system gone “rogue”

a. Accountability of the bank to U.S. taxpayers and to shareholders/depositors.

i. The balance sheet of this bank is nearly one-ninth the size of the entire U.S. economy!

ii. That is the epitome of “too big too fail”

iii. Therefore, each time that JPM demonstrates illegal behavior, negligent risk management, and/or careless financial/digital security, it exposes not only shareholders and depositors to significant losses, but also (again) the U.S. taxpayers!

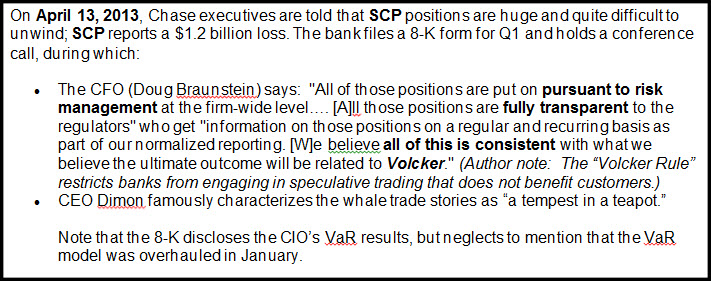

b. Consider this timeline:

i. January, 2012 — Upper management received direct word regarding an escalated magnitude of loss within the operations of the London CIO;

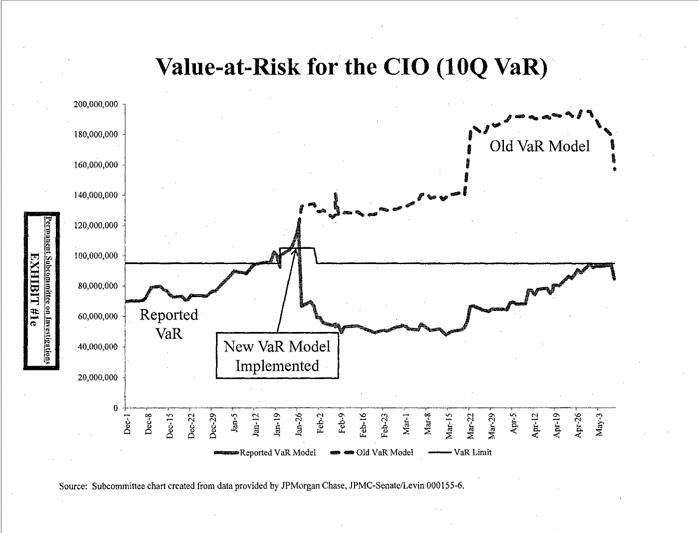

ii. Between Jan 16-20, 2012, the losses cause a four-day breach of a key “risk metric” – Value At Risk (VaR);

iii. January 23-27, a totally revamped VaR model is rushed through and approved by Dimon, which immediately “drops” the CIO’s VaR by 50% (see graph);

iv. By the end of January, one JPM trader called the losses “scary”;

v. By January 27, Dimon directed bank staff to stop sending daily trade data to the OCC;[8]

vi. The OCC was promised that a plan was in place to stem the losses;

vii. CIO Ina Drew reportedly declined to unwind the problematic trade;

- Drew tells traders to not take a loss;

- They “double down”.

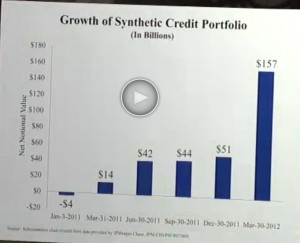

c. Take a look at this graph (left) demonstrating how the trade “ballooned” from a Net Notional Value of $51 billion all the way up to $157 billion:[9]

c. Take a look at this graph (left) demonstrating how the trade “ballooned” from a Net Notional Value of $51 billion all the way up to $157 billion:[9]

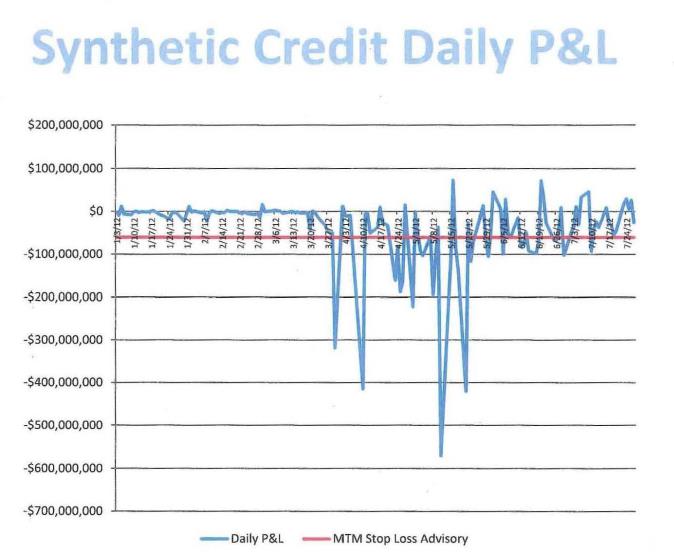

d. By February and March, the train really jumped the tracks — the daily losses mounted as the newly layered trades went sour (See the graph of Daily P&L below — the red line is a risk/loss metric):

e. Becoming increasingly besieged, traders in the London office began to “value” the end of day portfolio using prices at the high end of the spread rather than the industry standard “midpoint”.

i. By mid-March, one SCP trader maintaining a 5-day spreadsheet of EOD valuations projected that SCP values deviated from the midpoint by at least $400 million!

f. On March 2, one Comprehensive Risk Measure (CRM) calculation suggested that SCP could lose as much as $6.3 billion in 2012!

2) The “Sliding By” syndrome:

a. As mentioned earlier, before, during, and just after the mortgage crisis, executives at Fannie Mae and Freddie Mac were not shy about flaunting their connections on Capitol Hill and in the White House[10];

i. However, the excesses and failures demonstrated by Fannie Mae and Freddie Mac were too egregious for even those very well connected entities to survive in tact.

b. Just as (during the late 19th and early 20th century) J.P. Morgan proved himself to be a master of leaning upon (manipulating) his network of business and political connections, so JPM and Dimon counted upon its own carefully cultivated network for support through “thick”, but especially through “thin”.

i. Never forget how fawned over Dimon was between 2007 and 2011.

ii. He had “a seat at the table” during the depths of the near U.S. financial meltdown.

iii. He was touted as a potential candidate for Treasury Secretary.

iv. His Rolodex would be ”Chapter One” in any current book cataloguing the rich and famous.

c. One of the most obvious (and most easily remedied) mistakes made by JPM (and Dimon) may have been the decision during 2012 to structure the requisite internal investigation “Task Force” (released to public in mid-January 2013) in a manner that left it “toothless” (and therefore not credible);

i. Even Freddie Mac recognized it needed a credible outside “expert” to lead the investigation of itself in the aftermath of the meltdown![11]

ii. However, JPM chose to have Michael Cavanagh[12] serve as the Chair of the “Task Force”;

iii. As one reads the “Task Force” report, one is struck by how awkward it is;

- Much of it sounds like after-the-fact “excuses”;

- No direct revelations are made regarding any sense that placing risk management squarely in the hands of the people in the London office may not have been appropriate;

- My strong hunch that the bank was quite happy for the London office to do whatever it chose to do, as long as profits were flowing to the Chase bottom-line;

- “Risk Management” only became a germane issue once the train had jumped the rails.

- In a strange footnote, the report indicates: “Footnote 86: Mr. Dimon had not been in the office from April 2 until his return on April 12.”

- “Huh?”

- Is that supposed to somehow let Dimon “off the hook” for his “tempest in a teapot” statement?

- Despite the extensive JPM power network, by the end of 2012, the self-evident failings of the bank and of Dimon himself had resulted in chronic front page “exposes” related to bank misdeeds, public humiliation, and a 50% salary cut for Dimon. Any support the “network” provided was limited to private expressions of concern, and perhaps pressure brought on the board to not fire Dimon as CEO.

3) It has been written: “Everyone to whom much was given, of him much will be required, and from him to whom they entrusted much, they will demand the more.”[13]

a. One intriguing measure of a person, or an institution, is how those who possess outsized advantages (resources, power, esteem, etc.) handle those advantages.

i. As we know through history and literature, some use them to attain even greater power, influence, riches – no matter what the cost to others;

ii. In like measure, time has demonstrated that others use them in ways that not only abide by the law and accrue to their benefit, but also accrue to some “greater good”.

b. As we have pointed out, JPM has grown (as much due to the 2007-08 financial crisis as any other reason) to be (by far) the largest U.S. bank. It also benefits mightily by accounting rules so flexible that a financial report could show either a gain or loss in most quarters and fall within the bounds of “generally accepted accounting principles”.

i. However, neither the “Fortress B/S” nor those accounting rules could disguise a “whale” the size of that which developed within the London office!

ii. Quite frankly, that is the real reason JPM has become an issue of national importance.

c. This issue is complicated and subjective enough so that each one of us must discern on our own whether JPM has managed its countless advantages responsibly or irresponsibly.

In order to better equip you for that task, I offer just a few more pieces of the JPM “puzzle” for your consideration.

I cannot count the number of times I have heard, during the past year and a half, experts and commentators pose a rhetorical question: “Were these developments within JP Morgan Chase and Company examples of willful acts[14] or were they symptoms of sheer incompetence?” The most intriguing dimension of that question is that whatever answer is offered in reply can only be considered disturbingly bad news!

I strongly suggest that you review the list of legal infractions I provided in What is JP Morgan’s Total Litigation Expense article. What strikes you about that list? At a minimum, we should be struck by how diverse the violations are – they cover a broad spectrum of misdeeds. However, also self-evident is the recurrence of certain violations that bank management agreed to “remedy”. In light of that pattern, isn’t it interesting that, on February 4th of this year, Jamie Dimon offered this assertion to the Miami Chamber of Commerce – “[when JP Morgan makes mistakes] we try and fix those mistakes!”

Now consider the range of regulations related to the “Bank Secrecy Act/Anti-Money Laundering” (BSA/AML)[15], mandates regarding the absolute need for proper segregation of customer funds (ala MF Global, Peregrine Financial Group), and CFTC and SEC rules regarding exchange trading, etc.:

1) The government fined JPM for an undisclosed transfer of 32,000 ounces of gold bullion for the benefit of an Iranian bank;[16]

2) On 9/9/09, the CFTC sanctioned JPM for failing to properly segregate customer funds and for failing to report that “under segregation” in timely fashion;[17]

3) In June of 2010, the British Financial Services Authority fined JPM a then record 33.32 British Pounds for failing to “adequately protect between $1.9 billion and $23 billion of client money between November 2002 and July 2009.”

4) On April 4, 2012, the CFTC found JPM to be in violation of segregation rules.

5) In connection with the dark days of the Lehman Brothers collapse, consider this:

a. The CFTC found that from at least November 2006 though September 2008, JPM accepted deposits of customer funds from Lehman Brothers, Inc.

b. In violation of law JPM extended credit to Lehman Brothers for 22 months based on these customer funds because JPM determined, wrongfully, those funds were to be included in Lehman Brothers’ net free equity.

c. After the bankruptcy of Lehman Brothers, again in violation of law, JPM refused repeated requests by the Trustee and the Commission to release those Lehman customer funds to the Trustee of Lehman’s estate.

6) On 9/27/12, the CFTC issued an order asserting that JPM violated Section 4a(b)(2) of the Commodity Exchange Act (CEA).

a. According to the CFTC, a “deficiency in its newly created automated position limit monitoring system for the commodity business” caused JPM to violate position limits in cotton futures.

b. Even more troubling than a systems failure, the CFTC reported that: “after learning of this deficiency, JPM utilized a manual position limit monitoring procedure pending correction of the automated monitoring system. Despite adoption of this manual position limit monitoring procedure, JPM violated its short-side speculative position limit on several occasions.”

c. The CFTC noted that this “system” was used across a spectrum of the JPM commodity trading activities.

7) In December of 2012, the NYMEX Business Conduct Committee reported that JPM: “’inadvertently’ overstated open interest in a crude futures contract by 46.9%… “

8) On 3/8/12, the CFTC asserted that JPM violated Section 4c(a)(l) of the CEA by knowingly executing a fictitious trade to see and buy 11,642 ten-year spreads on behalf of a client. The customer was on both sides of the transaction and JPM was aware of that.

9) In June 2012 the NYMEX found that on 10 separate occasions between January and June 2011, JPM executed wash trades in West Texas Intermediate Crude Oil (or gasoline) between entities with the same beneficial ownership.

a. In each instance the company’s trader was the sole decision maker for both the buy and sell side of the trade.

To be fair, I can imagine some folks reacting to all of these details by observing something like this: “What do you expect, Tom? Of course there will be violations. Nobody is perfect! After all, JP Morgan Chase and Company is absolutely gigantic, massive, humongous, and gargantuan. It is involved in almost every aspect of the economy.”

To that apologetic for JPM, I respond: “Bingo!” It might well be that the sheer overwhelming size and overarching reach of JPM makes it nearly as unmanageable for one CEO and one Board of Directors as the United States government would be for such a small group. Given that, perhaps (unless this lengthy history of recidivism within the realm of legal and regulatory violations is totally reversed going forward) JPM might need to be “broken up”.

Of course, there is another apologetic that might be offered to justify the recent history of JPM – to the effect that: “Tom, the past and future success of our economic system is predicated upon free markets, within which participants engage in activities likely to result in profit to them and/or their company! All of these regulatory “actions” simply spring from well-intentioned employees doing their best to impress “the boss”, keep a job, and (if possible) earn a raise/bonus! That’s the essence of our free market system.”

I cannot argue with the “reality” of that argument. It is a true statement (excluding that final sentence.). However, it leaves out the very important matter of having an agreed upon set of rules that guides economic activity and ensures a “more level” playing field.[18] Every activity from school to Sunday football depends upon rules – that is why NFL referees have whistles and can call penalties. The question is, how do we call our corporations into account for adherence to those rules?[19]

The days of John Pierpont Morgan were days of largely unbridled aggrandizement! Within a wide range of latitude, Morgan said, acted, and did as he pleased. He became enormously wealthy as a result. However, he simultaneously became arrogant, manipulative, and untrustworthy… and so forth!

Recall the “civil war rifle story” from Part I – how Morgan profiteered by marking up and selling defective guns that shot off the soldier’s thumb. Recall how he foreshadowed the contemporary philosophy of Rahm Emanuel[20] by appearing to “save” the country in 1895 and 1907 while really, in essence, what he did was “line his own pocket”.

In fact, Morgan is often referred to as the “Machiavelli of Finance”. He is famously quoted as having said: “A man generally has two reasons for doing things – one that sounds good and a real one!”

To what extent does J.P. Morgan live on within the bank that bears his name? Has Jamie Dimon (figuratively speaking) been cloned from the DNA of Mr. Morgan? After all, as one small sliver of an example:

Despite being informed of the growing magnitude of SCP losses as early as January 2012;

Despite direct involvement in an expedited overhaul of a central risk measure (VaR) that same month;

Despite the losses becoming so great that he instructs a cessation of daily P/L reports to OCC…

On April 13, 2012, Dimon characterized the London SCP trading situation as “a tempest in a teapot”.

However, less than one month later, Dimon acknowledges a $2 billion loss and says: “These were egregious mistakes. They were self-inflicted, we were accountable and what happened violates our own standards and principles by how we want to operate the company. This is not how we want to run a business.”

Will the “real” Jamie Dimon please stand up?

Is the “real” Jamie Dimon the “tempest in a teapot” Dimon… the Dimon who has boasted “[when JP Morgan makes mistakes] we try and fix those mistakes!” That Dimon fits the mold of J.P. Morgan!

Or is the “real “Jamie Dimon” the suddenly transparent, vulnerable, repentant Dimon, the Dimon who admits to “egregious mistakes”??

Only time will tell. But let me wrap up by sharing one email message that I found midway through some 500 pages of U.S. Senate testimony. The message comes from May 18, 2012, written by Mike Kirk to Elwyn Wong, and makes reference to the SCP trading plan model: “That’s the problem with using historical data and assuming mean reversion. It will work a lot of times, but one has to be mindful of paradigm shifts and the LTRO[21] is a paradigm shift for the markets in the short run. Issue is JPM never stressed components of the trades beyond historical… Had they looked at the components of the risks and stressed them to say 4-5-6 sds[22] they would have the impacts of low probability events. Although my guess is they would have ignored that too! Arrogance drove this bus!”

INVESTOR TAKEAWAY: I must admit that, despite its rather prodigious length, this two-part article might have very little to do with investing/trading. As pointed out in What is JP Morgan’s Total Litigation Expense?, for the most part, “the Market”[23] cares little about integrity, regulatory compliance, or economic history. It only cares about earnings, price performance, and/or “a compelling story”[24].

However, it is inevitable that we will hear more and more about U.S. and European banks as we move forward. “Too big to fail” has imprinted too lasting a mark upon the U.S. economy and is far too compelling a tagline for crusading politicians and financial commentators for us to ever escape reading and hearing about the issue more than we would otherwise choose.

Heaven forbid a forthcoming banking crisis. However, when/if such an event occurs, it behooves us to have our “eyes wide open”. I hope that, in some small way, this article has helped you see (in one place) a fairly comprehensive picture of how big banking really operates. If the only long-term takeaway you can claim is that you will never again lose your skepticism regarding what any given bank CEO says to the press or testifies before Congress, this will have been worthwhile.

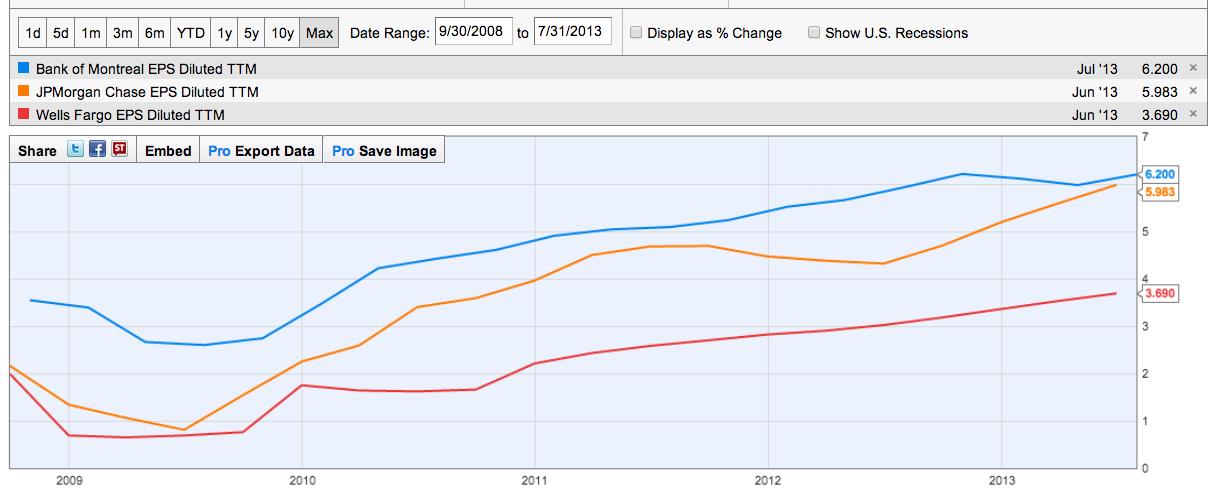

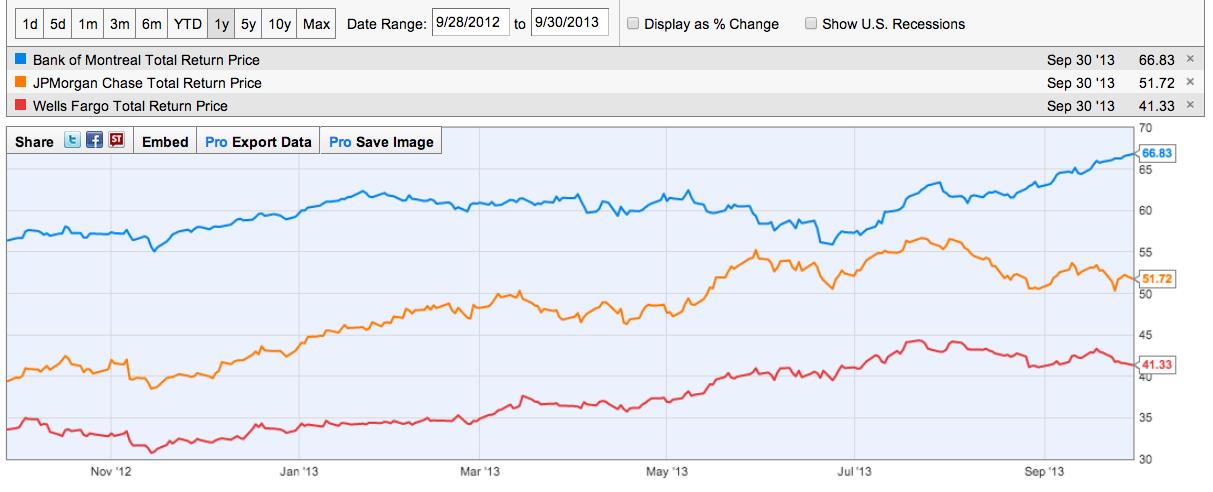

That said, let me offer one unsolicited idea to you. Take a look at these two charts of bank financial metrics, comparing JPM with Wells Fargo (WFC) and the Bank of Montreal (BMO) (the graphs are courtesy of YCharts.com):

Note that “Total Return Price” is a theoretical price that helps investors look at their returns over time, accounting for both price appreciation and dividends received rather than price alone. It is the most accurate comparative measure of performance over time.

With regard to big banks, we all hear (most often) about the virtues of JPM and WFC. Countless investors swear by JPM, while Warren Buffett is a huge fan of WFC – within whose earnings mortgages play a major role.

However, as you can see above, BMO is comparable to JPM on a Trailing Twelve Months Dilute Earnings Per Share basis, and actually beats out WFC. In addition, BMO has pretty handily outperformed each of the other banks on total return.

So perhaps we should expand the field of banks we consider for trading or investing so it includes those banks that are not “U.S.-based”. It is certainly worth some thought. And, oh, by the way, BMO has an extremely significantly presence in the Midwest United States, having recently incorporated a major Wisconsin bank into its long-held Harris Bank subsidiary. Harris Bank has been a major bank within the Chicago area for decades – going back to long before what is now Chase was First Chicago Bank, then NBD, and then Bank One (then finally purchased by Chase)!

Finally, there is a powerful trading lesson within the London Whale story for every one of us. When a trade goes bad, your primary goal should not be to “avoid a loss at all costs”. That was the tact chosen by JPM CIO, Ina Drew. Only she knows the full reason(s) for that decision. But I suspect it was to avoid a significant blemish on her career record.[25]

However, consider the consequences. A loss that began at the beginning of the year in the $200-400 million range soon ballooned to over $6 billion. I grant you that none of us will be in a position to ever make that colossal of a trading mistake. But it does illustrate for us in dramatic fashion the high stakes risk involved in “doubling down”.

We should always resist the temptation to “go there”. Instead, we should commit ourselves to a trading discipline that applies a fresh look at every “sour” trade – examining it relative to the market conditions and considering available adjustments. We should only put on a “trade adjustment” if the risk/reward parameters appear to be warranted, and fall within our standard “trading rules”. Otherwise, we should face reality and take the loss. It is much better to take that loss than to risk being shut out of trading altogether because we have lost our capital!

DISCLOSURE: The author does not currently own JPM, WFC, or BMO. However, in an instance of extremely rare Buffett-like Brilliance, he did buy JPM in 2008 below $17/share. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Submitted by Thomas Petty MBA CFP

[1] That effectively serves as code for the biggest banks: JPM, Citigroup Inc. (C), Bank of America (BAC), Wells Fargo and Company (WFC), etc.

[2] The SPC was created in 2006.

[3] That does not account for the recent regulatory fines related to the “London Whale.”

[4] Including the OCC, the Fed, and the SEC.

[5] Why do I express this point so dramatically? Because the pattern of denial seen within JPM mirrors in eerie and disturbing ways the very same patterns that occurred within Lehman Brothers, Washington Mutual, AIG, Countrywide Mortgage, Bank of America/Merrill Lynch, etc. between 2006 and 2009!

[6] In other words, one could say they “lied”, “cheated”, “obfuscated”, and/or “covered up” to buy time and delay discovery of the crisis. (Imagine if a NFL placekicker could move the goalpost closer if his kick would otherwise fall short! That is similar to what the folks in London did!)

[7] In the space available here, I could not begin to describe the magnitude of that latitude. Suffice it to say that CFO’s of non-bank corporations would think she/he “had died and gone to heaven” if provided similar latitude!

[8] The Office of the Comptroller of the Currency (OCC) objected to the cessation of this data. The CFO reinstated it. Dimon was reportedly angered by that development.

[9] The graph is an exhibit included within testimony offered during U.S. Senate hearings. The graph was displayed at the odd angle you see above.

[10] Perhaps the most obvious example was Barney Frank, who cultivated a power center in the “affordable housing” field and may have been as responsible as any one official for the enabling of the mortgage crisis.

[11] In addition, they made it an agency wide policy that employees must be open and honest when questioned by investigators.

[12] Cavanagh serves as the bank’s Vice-Chairman (thereby acting as Dimon’s “lieutenant”) and is widely viewed as Dimon’s eventual successor. As a result, he was placed in the untenable position of overseeing an evaluation of his own boss and all of his colleagues who (also) directly report to Dimon. In addition, how does he recuse himself from information he likely knew (especially regarding risk management) as early as 2010, any or all of which might bear on the eventual losses in London? With regard to investigatory structure, former SEC Chair Harvey Pitt observed: “It's incomprehensible to me that they did these reports internally… it's like asking Joe Paterno to do the Penn State [sexual abuse] investigation instead of [former FBI director] Louis Freeh… Having picked Cavanagh to do this strikes me as potentially foolish in the extreme, the only reason you do a review this way is because you don't want to find anything unduly damaging.”

[13] This is a verse from Luke 12:48 (English Standard Version). However, it is so well known within Western culture that it is often referred to in many contexts. Given the abundant blessings that have accrued to JPM – including a “Fortress Balance Sheet” and extraordinary accounting leeway — it is quite fitting for inclusion here.

[14] Willful acts of deception, fraud, flaunting of regulatory requirements, etc.

[15] http://www.ffiec.gov/bsa_aml_infobase/pages_manual/OLM_008.htm

[16] Some sources report JPM involvement within the Vatican bank scandal, at least one drug cartel money-laundering scandal, and of course the Bernie Madoff affair.

[17] The magnitude of that “under segregation” reached well over $500 million.

[18] Note that I qualified “level playing field”. We will never have a truly level playing field. What we strive for is “more level”.

[19] And hopefully, for a modicum of integrity.

[20] “Never let a crisis go to waste”

[21] LTRO refers to the “Long Term Refinancing Operation” – created by the European Central Bank to provide financing to Eurozone banks.

[22] Standard Deviations (sds)

[23] Much like John Pierpont Morgan.

[24] Such as Tesla (TSLA), Solar City (SCTY), Twitter, etc.

[25] It was likely a matter of professional pride as well. No one likes to “lose face”.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Here's Why Spotify Stock Jumped Today

Here's Why Spotify Stock Jumped Today