Since our Market Tamer readers are among the Crème de la crème[1] (you are the “Cream of the Cream”!), I am quite certain that there are days when, as you hear or read the news, you shake your head and mutter: “You’ve got to be kidding me? Really?!!”

Well that occurs to me on a regular basis, but particularly during the past few weeks. What I intend here is to summarize the most essential reasons I have been muttering to myself… with regard to three issues:

1) Alibaba Group Holding Ltd. (Friday’s IPO (on 9/19/14) on the New York Stock Exchange will show its ticker as BABA);

2) The quite amusing series of exchanges this past week between Darden Restaurants, Inc. (DRI) and a major shareholder

3) The heightened outcry from Washington D.C. (and other misinformed parties -including most journalists, local news reporters, and bar and coffee shop conversationalists) regarding the decision by Burger King Worldwide Inc. (BKW) to acquire Canadian fast-casual restaurant chain, Tim Hortons Inc. (TSX: THI; traded on NYSE with same ticker) for $11 billion and move its tax domicile to Canada.

Putting all three into one article would be far too much, so we’ll tackle them ad seriatum… with Friday’s big Alibaba IPO kicking things off!

If you do not know what an “Alibaba” is, you must not read the financial news or watch CNBC, Fox Business, or Bloomberg! To help you get up to speed, I commend these earlier articles from Market Tamer:[2]

https://www.markettamer.com/blog/warning-warning-beware-wall-street-hype

https://www.markettamer.com/blog/how-to-value-an-anomaly-of-market-share-and-growth

Putting it mildly, BABA is a mega, mega-sized e-commerce site based in China (but offering its products worldwide). As we projected weeks ago, BABA is also set to become the world’s largest-ever Initial Public Offering.

The current (but soon to be “former”) largest U.S. IPO was that of Visa Inc. (V) in 2008, which totaled just under $18 billion.

In our second BABA article (see above), I detailed the expert valuation work on BABA by noted valuation authority, Professor Aswath Damodaran. Working through a mammoth spreadsheet, Damodaran estimated BABA’s intrinsic value at $61.46/share. I always find Damodaran’s valuation methodology much more sound and credible than Wall Street’s, so I prefer to “hang my hat” with the professor!!

That being said, it is worth remembering that “market price” is not determined by “valuation”… but by investor perception, the mechanics of supply and demand, and/or Wall Street/Financial Media Hype! Therefore, based upon the history demonstrated by Wall Street of pulling out all “stops” to make any of its “mega events” a success, I went out on a limb and said this in the article:

“At the risk of becoming branded as an unrepentant cynic, I can virtually guarantee that the IPO price announced just before the IPO date will be significantly higher than that.”

Well, give credit to BABA visionary and founder (and Executive Chairman) Jack Ma (aka Ma Yun in Chinese)! He has been out stumping the world on behalf of the IPO, stirring up in the investment professionals in Hong Kong this past Monday. He does know how to “work a crowd”!

For example, in response to a question regarding why BABA has been (recently) spending large sums investing in other business sectors, Ma Yun replied that Alibaba wants to be a: “zoo that houses many animals rather than a farm which just has one animal.”[3] That response was a “hit” among the crowd.

When ask what he “worries about”[4], he is reported to have offered two interesting thoughts:

1) “I never think about competitors. There is a Chinese saying: ‘If you don't have [an] enemy in your heart, then you don't have an enemy.’” That reply certainly resulted in many “nods of the head” within the crowd.

2) Ma Yun identified the concern about which he worries the most as being this: “How can we make sure our culture can help attract, train and develop enough young people that can help small businesses do business easier in the world!” I hardly think anyone could agree with the wisdom of that insight.

At any rate, through his captivating presence and persuasive ability, Ma Yun is reminding us all that a charismatic corporate leader can easily boost the price investors are willing to pay for company stock! Add to that the economics of BABA, namely such metrics as:

1) Unlike so many other recent IPO issues, BABA has actually been reporting genuine “profits”!!

2) Its ability to generate revenue is staggering, and growing. For example, for the quarter that ended June 30th of this year, BABA revenue rose 46% … jumping to $2.5 billion.

All of these factors have greater something of a “perfect storm” for the IPO[5]. Therefore, sure enough, on Monday it was announced that the price range for the IPO had been raised!! Initially it was a range of $60-$66/share. Now it will be $66-$68/share!!

If the IPO “goes off” (for example) at $68/share, its total IPO value will be $21.8 billion, easily crushing the only record from 2008. The little referenced development to watch for will be if its total value (if the underwriting banks exercise an option to buy more stock) eclipses the $22 billion mark! Why is that level significant? Because at that level, the BABA IPO would be greater than that of the Agricultural Bank of China [6]

Trust me, if BABA managed to accomplish that feat, it will be a big deal in China! (So one might expect that Wall Street may try to help Ma Yun achieve that notoriety.)

There are three other interesting points that bear mentioning here:

1) You might wonder why BABA is not listing on the Hong Kong Exchange. There is a simple reason –

The Hong Kong Exchange (abbreviated: HKE) has some standards with which a listed company must comply. The partnership structure under which BABA operates does not comply with those standards; and Ma Yun and the BABA Board were not willing to adjust the structure. Therefore, BABA had to list elsewhere.

The problematic issue at work here is that BABA’s bylaws allow Ma Yun and other executives to nominate more than half of the company’s board members! Ma Yun’s public comment about that is to the effect that BABA thereby missed a “great opportunity” to list on the HKE; however, “We respect Hong Kong's decision…. Hong Kong shouldn't change its principle for one company.”

2) Even at the lower IPO price range, the resulting “implied market cap” for BABA would be approximately $170 billion… which is significantly higher than Amazon (AMZN) (at $151 billion per Google Finance).

3) ConvergEx[7] just reported a survey of clients and partners very conversant with details of the BABA stock offering. Two interesting “results” emerged:

a) The majority of institutional investors expect the IPO price to be above $66;

b) However, in their opinion the upside beyond the initial energy of the IPO will be somewhat limited.

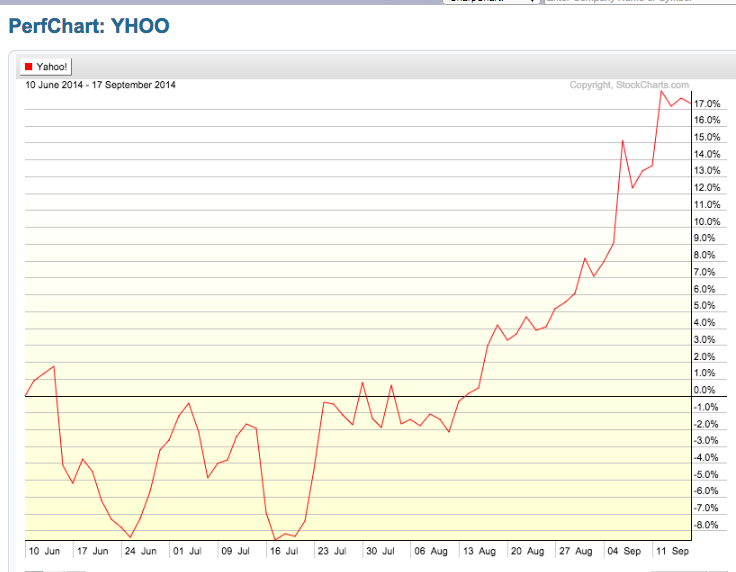

4) Recall that Yahoo (YHOO) still owns about 23%+ of BABA shares, so it stands to gain from a big IPO success. We gave you the details in:

https://www.markettamer.com/blog/what-stock-could-be-a-winning-proxy-when-alibaba-goes-public

INVESTOR TAKEAWAY:

Anyone who is surprised in the least by the 10% hike in the IPO price range for BABA is either a novice to the world of investing and high finance, or extremely naïve, or just plain not paying attention. Wall Street has demonstrated a strong track record of being able to engineer their “mega events” in such a way that they result in a great deal of hype for investors, brokers, and advisors… and an even greater amount of juicy fees for the underwriting investment firms (and their “partners”).[8]

So I suggest… that just for entertainment purposes… you keep an eye on that BABA IPO on Friday (and thereafter). In particular, look for the following:

1) What the initial price is.

2) Listen for the final total value of the IPO. If it is over $22 billion, you’ll be one of the few to recognize just what a big deal that is in China!

3) Pay attention to what is said on CNBC, Fox Business, Bloomberg, etc. and informally keep track of how many times some inane, uninformed (or under informed) comment is made to which the only logical response by you or me would be: “Really??!

Finally, I suggest you resist the temptation to buy shares on Friday or thereafter. Reread what the institutional experts reported about likely “upside” following the IPO (there is likely not to be much upside). And recall what I outlined about the dangers of trading immediately following an IPO:

https://www.markettamer.com/blog/what-should-the-facebook-ipo-teach-you-about-alibabas-ipo

I personally think you could do better buying a plane ticket to Las Vegas and playing the one-arm bandit, roulette, craps, or just about anything else.

DISCLOSURE

The author currently owns YHOO options… benefitting from the run-up to the BABA IPO. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

FOOTNOTES:

[1] Which significantly means, with reference to cooking, “Cream undergoing a deluxe treatment”

[2] I grant that seems self-serving, but the articles do provide a wealth of content all in one easy to consume package!

[3] I interpret that as meaning: Alibaba needs to be diversified within its own rather wide “space”. (It already combines many e-commerce business modes and functions into the company … including units that compare with Amazon.com, eBay.com, and PayPal.

[4] Such as challengers, competition, the government, etc.

[5] Even if it was (in part) engineered by Wall Street)

[6] Listed on the Hong Kong and Shanghai Exchanges.

[7] ConvergEx is a provider of global brokerage and trading-related services for institutional investors and financial intermediaries.

[8] The glaring exception in recent years was the Facebook (FB) IPO… that remains a dark stain on the NASDAQ Exchange and the FB underwriters. The IPO was an unforgettable nightmare… starting with a mind-blowing demonstration of just how horrible a trading technology malfunction can be!! However, be that as it may, the underwriters, brokers, and Wall Street in general still made a ton of money!

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Bitcoin Just Did Something It Has Only Done 3 Times Before. The Cryptocurrency Usually Does This Next.

Bitcoin Just Did Something It Has Only Done 3 Times Before. The Cryptocurrency Usually Does This Next.