Countless investors and market commentators feel we are currently “betwixt and between”:

1) On the one hand, we are very close to setting all-time record new highs on the S&P 500 Index — if we can push through resistance;

2) On the other hand, various members of the Federal Reserve Board (the Fed) have used public speeches to alert the markets regarding the possibility of beginning an “easing” in the monthly quantity of bond buying carried out by the Fed (“tapering”). [1]

These folks feel this way in large part because (at least in theory) no one knows with certainty what the Fed will do in September (or October or November); nor (in theory) does anyone know how the equity market will respond to any slight easing of Fed bond buying in September or thereafter. Therefore, an equity market re-approaching all-time highs could be quite vulnerable to a swoosh downward.[2]

What does an investor do at this particular (potential) flashpoint? Going full-bore into stocks seems risky, and yet going to bonds sounds almost as risky – based on the dire stories about what bonds did during May and June, and the massive withdrawal of funds from funds managed by bond gurus, Bill Gross [3]and Jeffrey Gundlach! The only other obvious alternative (to most) is moving to cash – but that leaves you earning peanuts (but only the economy brand!!).

A number of my clients and friends (even my kids and wife) feel this way – and a few of them have asked me about Preferred Stock!! Since confession is good for the soul, I confess that my initial reaction to such a question tends to be: “Are you kidding me?”

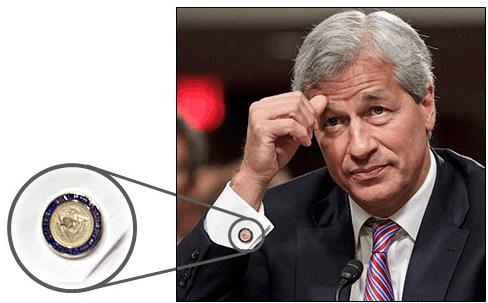

You see, I am quite prejudiced because the most frequent issuers of preferred stock are financial, utility, and telecom companies – with the largest share coming from banks. Therefore, when I hear “preferred stock”, I immediately think “banks”! I especially think of megabank, JP Morgan Chase (JPM), which has been fined $7 billion in just the past two years for various and sundry misdeeds and misrepresentations, and whose egotistic CEO, Jamie Dimon, massages quarterly earnings to exceed expectations through the use of special bank accounting rules that allow him to call “red” really “black”.[4] Sometimes one image can be worth even more than 1,000 words (the cufflinks on Mr. Dimon (see image to the left) display the seal of POTUS)[5]:

You see, I am quite prejudiced because the most frequent issuers of preferred stock are financial, utility, and telecom companies – with the largest share coming from banks. Therefore, when I hear “preferred stock”, I immediately think “banks”! I especially think of megabank, JP Morgan Chase (JPM), which has been fined $7 billion in just the past two years for various and sundry misdeeds and misrepresentations, and whose egotistic CEO, Jamie Dimon, massages quarterly earnings to exceed expectations through the use of special bank accounting rules that allow him to call “red” really “black”.[4] Sometimes one image can be worth even more than 1,000 words (the cufflinks on Mr. Dimon (see image to the left) display the seal of POTUS)[5]:

However, my parents taught me to avoid rude, impertinent responses to innocent questions. So I do not tell my clients and friends: “Are you kidding me?”

Instead, I offer objective facts about preferred stock and let them judge for themselves how to interpret those facts. The first and most basic fact about preferred stock is that it is a hybrid security – it is neither common stock nor a bond; it combines features of both. Similar to a bond, it pays a set and specific amount annually to shareholders, but within the “capital structure” of the issuing company, that obligation (to pay) ranks lower than the obligation to bond holders (while those preferred payments rank higher than any obligation to common stock owners).[6] In addition, preferred stock holders do not directly benefit from the sales and earnings growth within a company, however their annual income payments are categorized as “dividends” rather than “interest”. In addition, like a bond, a preferred share is issued with a “par value” which can increase or decrease as the market dictates. Obviously, given the set and certain annual payment to shareholders, as rates fall, the market value of a preferred share increases, and vice versa. Finally, preferred shares are “callable” [7]– meaning that a preferred stock issued at a 7% rate years ago would most likely have already been “called”. [8]

At this point, you might be wondering why you’d be interested in preferred shares. So, next, let’s cover some of the advantages of preferred stock:

1) Tax Advantage: preferred shareholders receive dividends rather than interest. Until tax laws eliminate the tax-break on dividends altogether, that provides an advantage for preferred stock vis-a- vis bonds;

2) Higher Certainty of Income: compared with the common stock dividends, that can be cut or eliminated (as during the 2008-10 period) at any given as determined by company directors, preferred stock dividends are ensured as long as the company earns enough to cover both bond interest and preferred dividends.[9] Therefore, a preferred stock investor’s “return expectations” are much clearer from the point of purchase forward.

3) Diversification: the diversification that comes from owning preferred stock is of a different order than “standard” diversification. This type of diversification springs from the low “correlation” that preferred stock has vis-à-vis bonds and common stock – because preferred stock is a hybrid security.

4) Lower Risk: because preferred shares have a higher priority within a corporate capital structure, they are less risky than common shares. In the event of a financial crisis or bankruptcy, preferred shareholders stand just behind bondholders at the “payout” window, but long before common shareholders!

5) Less Volatility: preferred shares generally trade “around” par value. That makes those shares less volatile than common shares (that can experience greater degrees of “mispricing”) but still more volatile than bonds.

A handy oversimplified description for preferred shares would be: “a middle ground between common stock and bonds.”

Another point to consider as a strong counterpoint to my (already confessed) prejudice regarding banks is the following chart of iShares Dow Jones US Financial Sector (IYF). Note the stark outperformance by financial stocks during the past 12 months! A financial analyst might chastise me: “Tom, in the investment market, it does not pay to be arbitrarily prejudiced. Flexibility and objectivity most often lead to better investment return.”

That being said, the current investment environment still presents a dilemma that, for many, feels like being caught between Scylla and Charybdis[10] — the possibility of stocks moving into a steep decline (on the one hand) and the specter of bonds suffering another “taper swoon” (on the other hand). For those who fear either or both unpleasant scenarios, preferred stocks offer a “middle ground”.

If interest rates rise significantly in the next few months (a possibility I find unlikely) preferred stock shares will suffer from duration risk – but not as much risk as comparable corporate bonds hold. And if common stock prices fall back significantly, preferred shares will feel an impact – but not nearly as great!

One other important note needs to be added about preferred stock. Warren Buffett has turned preferred stock into an amazing instrument – similar to how an inspired, gifted orchestral director can incorporate a generally unglamorous string, reed, percussion, or horn instrument into the centerpiece of a masterful musical performance! Buffett has incorporated the use of preferred stock into any number of his billionaire dollar deals (including his recent acquisition of the H.J. Heinz Company). A typical result from such preferred purchases has been an inflow of steady cash income to Berkshire Hathaway over multiple years, followed by an advantageous offer from the issuing company to exchange preferred shares for common shares (stellar examples are the preferred shares Buffett picked up during the height of the financial crisis from General Electric (GE) ($3 billion) and Goldman Sachs (GS) ($5 billion)). Therefore, even granting that the preferred shares you or I could buy will not have the terms or cache that Buffett commands – one must grant that preferred shares have a place within the pantheon of potentially profitable investment options!

For the reasons above, I cannot, nor will I, preclude any client from moving some assets into preferred shares. However, for those clients whose name is not “Warren Buffett”, I recommend securing preferred shares through a diversified ETF.

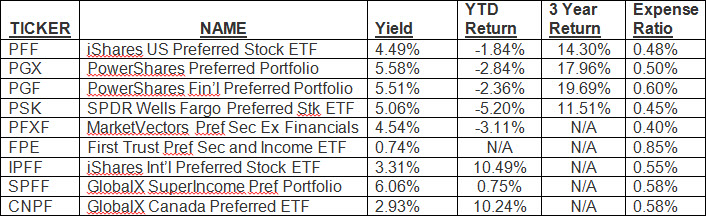

As you would imagine, a number of such ETFs are available. Here is a summary:

It is worth highlighting the following for you:

1) PFF is by far the largest in terms of total assets – with over $11 billion, about five times the size of the next largest (PGX);

2) PGF (as its name suggests) is more heavily invested in bank related companies (over 40%);

3) PFXF (as indicated in the name) excludes financial companies;

4) IPFF focuses on preferred stock from countries other then the U.S.;

5) SPFF uses the “S&P Enhanced Yield North American Preferred Stock Index” as its investment standard;

6) CNPF (obviously) focuses on Canadian preferred stock.

Here is a three-month look at iShares S&P US Preferred Stock Index (PFF)(blue) and the S&P 500 Index (red) – illustrating how they fared during the crucial May-June “swoon” period.

Over longer periods, the relative performance between the two has been more comparable. (Bear in mind that PFF yields over 4% while the average S&P 500 Index yield is about 2%.)

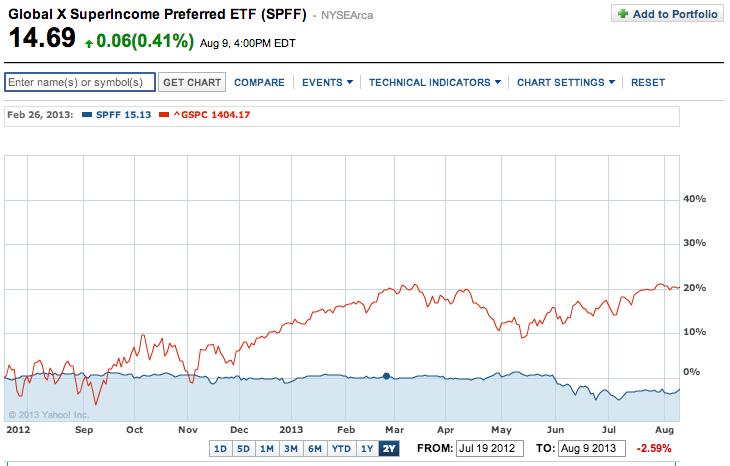

Finally, to assist you in evaluating the “North American” preferred ETF, here is a 13-month view of SPFF[11] relative to the S&P 500 Index:

Finally, here is a 26-month look at the Canadian preferred ETF:

INVESTOR TAKEAWAY: The background information provided above should be a part of every investor’s knowledge base, whether or not the investor has current interest in preferred stock ownership. Depending on any particular investor’s market outlook, reward expectations, and risk tolerance, one or more of these preferred stock ETFs could be an appropriate component within an asset allocation plan. And, of course, it is always interesting to read about the investment machinations of Warren Buffett – whose command of the Berkshire Hathaway (BRK-B) portfolio is as masterful as Leonard Bernstein’s command of the New York Philharmonic Orchestra was during his lifetime!

DISCLOSURE: The author does not own any of the ETFs or stocks mentioned above. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Submitted by Thomas Petty MBA CFP

[1] Certain pundits suggest that could occur as early as September.

[2] In case you are wondering, “swoosh” is not a technical term.

[3] Through early August, investors have pulled out almost $400 million from Bill Gross’ famous Total Return Bond ETF (BOND).

[4] It is more complicated than that, but I am not far from an accurate description.

[5] Image from ZeroHedge.com: http://www.zerohedge.com/news/2013-07-30/jpmorgan-7-billion-fines-just-past-two-years. “POTUS” stands for President of the U.S..

[6] Also similar to a bond, preferred stock owners do not have “voting rights” within the company.

[7] Unless otherwise indicated.

[8] This means that the issuing company would have paid the shareholder a pre-defined redemption price per share and thereby ended any further obligation

[9] It must be noted that some preferred shares are “Rate reset” shares, for which the company can change the promised rate at a specific point in time.

[10] The reference is to Greek mythology—a tale that depicts being caught between two unpleasant alternatives. See http://www.britannica.com/EBchecked/topic/530331/Scylla-and-Charybdis

Related Posts

Also on Market Tamer…

Follow Us on Facebook

2 Fantastic Growth Stocks to Buy Right Now

2 Fantastic Growth Stocks to Buy Right Now