Let’s go through a few scenarios to better understand what the intent is of seasonal analysis.

Say you want to rob a bank. You learn that extra cash to cover payroll for the local ping pong ball manufacturing plant is usually delivered to the bank on Thursday mornings. Why would you rob the bank on Wednesday? Wouldn’t it make far more sense to wait until Thursday? You will likely get a larger ‘return on your investment’ while the risk stays the same.

Now, what time Thursday should you rob the bank? In the morning when it’s quiet, there will be fewer customers to get in your way and to identify you to police. Pick lunchtime to rob the bank, when many customers are cashing their paychecks, and your risk will be higher while the ‘return on your investment’ will be the same.

Finally, let’s say you’re not the lone-robber type. You’re an introvert, and well, more of a follower, not a leader. But you learn that the bank is often robbed on Thursdays. So you decide to stand outside the bank next Thursday morning, waiting for some type-A bank robber to do the job.

You aim to pick up some of the cash being dropped outside as the other robber flees (since they don’t print convenient $1,000 bills anymore, spillage upon escape is much more common). You are merely deciding to take advantage of a much bigger player’s actions in this scheme, if such a robbery happens to take place.

If a robber doesn’t show up, you go home – no gain, but no loss. If a robbery goes down, the odds are pretty good you are going to benefit. Doesn’t everyone extol the value of being in the right place at the right time? Why not trade that way? What you would be doing is ‘riding the coattails’ of bigger players.

The equivalent short-term stock trading decision process, relating to the first two scenarios, is covered regularly in Seasonal Forecaster. This article will focus on being in the right trade at the right time.

What are we after here? The reality is returns from short-term trading are seldom steady and regular. If you are doing “income” trades, such as credit spreads, you may have mostly small, regular profits with only an occasional big loss.

But debit trades can produce track records all over the spectrum. What typically happens over a year of time is the profits from the more typical trades slightly exceed (or trail) the losses. It will be just a few large-gain trades that really produced a noticeable profit for the year.

You can test this yourself. Many of the trade recommendation services being sold publish track records on the Web. They will often hype their service claiming they produced 120% or so returns last year. Ok, ignore that. Look closely at their track records and you will usually see that most of the trades cancel each other out. It will typically be only a few trades that produce the large gains that bring up the year’s net results (I don’t have the time here to get in to whether the track records are usually accurate or meaningful representations, but the pattern of a few trades accounting for most of the profits is typical of most trading systems).

If your net results will be mostly influenced by just a few trades with big gains, wouldn’t you want to concentrate not on trading as often as possible, but on increasing the chances for those big gains to happen, and happen more regularly, with less risk? (A side advantage is you’ll give away less of your profits as commissions)

Now back to robbing banks, or better yet, getting into the right trades at the right times. Quite simply, we’re going to learn how to use something to our advantage that happens anyhow. Certain stocks will make certain moves around the same time each year for a host of very solid reasons.

A seasonal is the historical track record of a stock, typically analyzing the same time period each year. The most common way this information is presented is in monthly seasonals. For instance, let’s look at the most recent 25 years that Exxon (and since 1999, Exxon Mobil) has traded.

If you had bought Exxon on the first trading day of December each year and sold it on the last trading day of December, you would have averaged a 2.1% gain each year. You would have had gains in 19 out of those 25 years, giving you an overall 76% success rate.

Sounds pretty good, doesn’t it? If someone from the future sent a message back to you in 1987, and you had made these trades, you would have had a very good trading system. How many of your trades typically return an average 2.1% in 31 days, an effective annual rate of 24.7%, for so little research, planning, and trade management?

Now what if over the past 25 years you had purchased Exxon on the first trading day of January and sold it on the last trading day of January each year? You would have averaged a slight gain each year (0.3%) and you would have had gains in only 9 out of the 25 years (just a 36% success rate). Good thing you knew that December is far better for XOM than January.

If there were just a few years this happened, you would be skeptical. But, over 25 years, with 19 of those Decembers resulting in gains, you might start thinking there may be something behind it.

Indeed there is. Seasonal analysis isn’t new. A lot of the early seasonal analysis was done by commodity traders, and in the 1980′s, trader/researchers like Larry Williams and Jake Bernstein applied those newfangled computers to their research and published numerous books. The Commodity Trader’s Almanac, and later the Stock Trader’s Almanac, began making this knowledge available to individual traders.

Nowadays CNBC, and even the evening news, constantly remind us that energy prices typically rise through the winter into spring as winter products inventory (such as heating oil) get used up and summer driving patterns typically produce demand for gasoline. Wheat prices tend to fall going in to summer as the promise of the fall harvest infers there will be far more supply for the demand, and so forth.

A large number of stocks follow a seasonal pattern because they are often related to products dependent on weather patterns, back-to-school/holiday retail sales, product cycles, vacation patterns, and more. And not just a few oddball analysts have recognized these patterns. Do you think these multiple-degreed analysts paid six-figure salaries, trying to compete for every advantage against the thousands of other multiple-degreed Masters-of-the-Universe (MOTU) want-a-bees coming out of the B-schools every year, don’t bother with seasonal analysis? You can bet the smart ones know about seasonals.

What we lowly individual short-term traders want to do is to ride the coattails of the MOTU’s. By analyzing the same patterns, by thinking the same way they do, we’ll let them move the market but we’ll go along for the ride. By identifying a reliable seasonal pattern and trading it properly, we increase the likelihood of a larger trade gain. The big boys don’t get into Coca-Cola intending to capture a 1.2% gain and then sell their position. They can spend weeks just building their position, slowly accumulating smaller blocks so they don’t cause the price to rise sharply.

They are looking for bigger gains. As short-term traders using advanced option strategies we know that larger moves are what provide many of our option strategies with the big gains. And because we intend to stand outside the banks they’ve entered with obvious intentions, we look to benefit, with higher returns and higher trade success rates.

To increase our odds, we want to build an arsenal of several stocks with good seasonals at various times of the year. We want to focus on big-name stocks, the kind that will interest a number of big traders and institutions. However, it may not make sense to trade every stock with a good seasonal every year. Basic technical analysis applied to the current price charts will help us make those decisions. Let’s see how it works…

How to trade seasonals

Seasonals are not something you trade blindly, like a well-defined trading system. The best way is to closely watch stocks that have good seasonals coming up. Apply your usual methods of technical analysis. When you have a good setup on the daily chart that normally would provide a good low-risk trade opportunity, AND a seasonal lines up with the intended direction of the trade, then you have an even higher probability trade candidate. Let’s look at one of the best examples I can give of a stock with a good seasonal.

Disney is a big-name stock with a seasonal that just makes sense – those tend to be the best, most reliable seasonals, where there’s a logical reason the company’s stock moves at a certain time each year. For Disney, the seasonal begins in late October, lasting into the early part of the following year. Disney’s summer-time theme park revenue shows up in the third quarter’s earnings, Disney products are selling for the approaching holiday season, and Disney usually schedules major movie releases in the fall. The MOTU’s know all this and it just makes sense that they will play a rise in DIS through the end of the year.

It is fall of 2009. Through our own diligent research (or some helpful third party like Seasonal Forecaster), we know that Disney has a strong seasonal starting. This means that historically if we had bought Disney in mid to late October, and held it for several weeks, we would have had a gain in most of the years and the average, even with the losing years, would have been pretty good.

So we look at the daily chart of DIS to see what, if any, patterns or setups are being presented. A good trade setup, coupled with the good track record of doing bullish DIS trades this time of year, is the type of higher-probability trade we want to make.

We see that DIS recently set a new 12-month high, but on declining volume. Then it pulled back to its 50-day moving average (MA). It rebounded off the MA on increased up-side volume:

The previous two touches of the 50-day MA formed a cycle about one month long, and it has been a month since that, so it is quite possible DIS may be forming another cycle low.

What does a ‘seasonal’ look like?

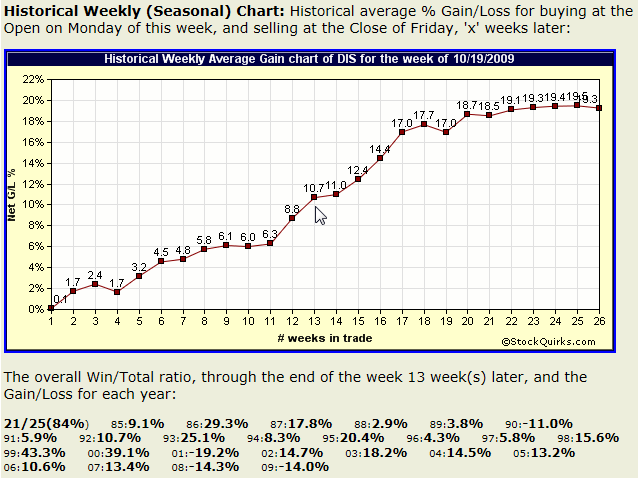

In October 2009, if we went back over the last 25 years in DIS stock history, calculating the net gain of theoretically entering a long DIS trade on the next to last week of October and closing it one week later, then two, three, and so on, we could graph the results. It would look like:

My chart allows moving the cursor over each weekly time period and seeing the results of each individual year, so I’ve highlighted the 13-week period. For a good seasonal, we’re looking for a steadily rising chart over time, like the DIS chart above. We’re also looking for a limited amount of variance in the individual years – we won’t want all of the net results to have come from only a few big gain years. The DIS numbers, for the 13-week period, show good gains during most of the years with gains.

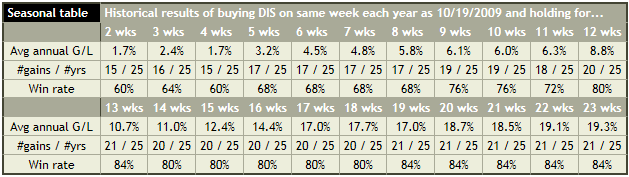

The 13-week period shows an average 10.7% gain each year, with gains in 21 out of 25 years, for a win/total ratio of 84% (also called a success ratio) – that’s very good. We usually want to see at least a 75% ratio for a good seasonal. The above chart shows the win/total ratio of only the 13-week period. We also want to see similarly good success rates for other weekly periods. Displaying the data in a table format shows the consistently high success rate over several different weekly periods:

Also, the average gain over most weekly periods is large enough where many advanced option strategies, such as Bull Call spreads, could reach their full profit potential.

So we decide that with the daily chart showing 50-day MA support and a possible good reversal, and the seasonal chart suggesting similar buying may be due to come in to Disney, we take a chance on a bullish trade, planing a low-risk strategy with well-defined stop-loss points and a good reward-to-risk ratio.

Let’s say we went long at the next open, buying at 28.14. Do we hold the stock through the entire period that had the good track record, in this case 13 weeks? Remaining in the trade as long as the stock continues to rise and shows no sign of losing strength is a good way to play trades like this, as long as you are comfortable with that style of trading.

Stick to your typical trade approach. If on your regular stock trades in the past you’ve been successful exiting upon hitting a 10% gain, stick with that goal. If your typical trade strategy takes into account time and volume, such as exiting a trade if it stops moving for 5 days and/or large down-close volume shows up, do the same with seasonally-justified trades.

How did DIS turn out? On December 31st, after being in a tight trading range for nearly two weeks, DIS opened up, traded upwards but couldn’t hold the gains and closed down near the low for the day. High volume accompanied the action, leaving a large red bar on the day. This would have made me uncomfortable at what may lie ahead, so my trading plan normally allows for closing a profitable trade early on days like this. Normally, I would catch this near the close and exit before the end of the trading day. December 31st’s close was 32.25, for a 15% gain over two months. Certain option strategies would have shown a very healthy gain.

Ok, that worked that year. In October 2010, we start watching DIS again. DIS has come up to the 2-month ago high. The volume pattern is quite interesting – several up-close days within the past month with above average volume:

Now, with a track record of 22 out of 26 years, or 85%, DIS still has a great seasonal. So we wait for DIS to either pull back to around the 50-day MA, which would give a good setup for another low-risk, good Reward-to-Risk trade, or to break above previous resistance from the 2-month ago high. On October 25th, it gaps up through resistance, giving a good entry:

On November 10th, DIS reported earnings one penny shy of estimates. The stock dropped 3% for the day. Normally I try to be out before earnings announcements, but on more conservative stocks, that are showing evidence of accumulation, I’ll hold on. It was only one penny short. The next day, DIS rockets upwards on high volume again. But on November 23rd, DIS seems to have lost upward momentum, and begins to fall below the trading range of the past several days:

Assuming we got out at the close (36.12), that would have been a 3% gain this time.

In early October 2011, once again we start following DIS stock. We see that DIS broke out of a descending channel and moved above its 50-day MA. It pulled back slightly on October 17th but closed up again the next day. With a strong seasonal still going for it (now 23 out of 27 years), we decide to enter the next day at the open, with a stop-loss just below the 50-day MA. Once again we have a low-risk setup with good potential reward.

This time the earnings announcement on November 10th was $.05 above estimates and DIS gapped up the next day. It subsequently pulled back to the 50-day MA, then resumed its upward path.

On January 10th, it seems to be forming a shot-term high, and the following morning DIS opens on a gap-down. It’s been about 13 weeks since entering this trade, and this matches the original time period whose seasonal convinced us to enter this trade. Volume is also picking up on the down-close days. Good time to take profits.

Getting out around the morning’s open (39.39) would give us about a 16% gain this year.

This is how seasonals CAN work. They don’t work every year, every time, and like any other trade you initiate, you should plan a loss-minimization exit strategy along with a profit-capturing strategy.

It is worth finding out the seasonals, or track records, on all the stocks on your active watchlist. It can be a bit of work if you calculate them yourself, but the rewards can be significant, especially when you apply seasonal analysis to increase the odds of advanced option strategies.

I’ll refer to seasonals in many of my future articles and will give you many more to take note of besides Disney.

Oh – the bank robbery examples were for instructional purposes only. Please do not rob any banks without consulting your financial adviser and past robbery performance is no guarantee of future results (smile).

Of course, there's much more you need to know and many more stocks you can capitalize upon each and every day. To find out more, Click Here: www.markettamer.com/newsletters

By Gregg Harris, MarketTamer Chief Technical Strategist

Copyright (C) 2013 Stock & Options Training LLC

Unless indicated otherwise, at the time of this writing, the author has no positions in any of the above-mentioned securities.

Gregg Harris is the Chief Technical Strategist at MarketTamer.com with extensive experience in the financial sector.

Gregg started out as an Engineer and brings a rigorous thinking to his financial research. Gregg's passion for finance resulted in the creation of a real-time quote system and his work has been featured nationally in publications, such as the Investment Guide magazine.

As an avid researcher, Gregg concentrates on leveraging what institutional and big money players are doing to move the market and create seasonal trend patterns. Using custom research tools, Gregg identifies stocks that are optimal for stock and options traders to exploit these trends and find the tailwinds that can propel stocks to levels that are hidden to the average trader.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why O'Reilly Automotive Stock Sank Today

Why O'Reilly Automotive Stock Sank Today