One of the most interesting aspects of history is the identification of key “turning points” that mark the start (or acceleration) of a significant new trend. Lately, my attention has been very pleasantly focused upon “Radio Classics” – a satellite radio station I listened to extensively during a 3,000-mile journey to Georgia, Florida, and Oklahoma (then back to Chicago). Not only did I learn some history[1], but I was transported into the “world of my parents” – who “grew up” between 1918 and their wedding in 1944. Radio was their most current, dependable, and readily available source of both news and entertainment, just as television was for me, and now the Internet, cable, Netflix, Hulu, and (yuck) video games are for my children. Trust me, folks, you really cannot grasp the stark contrasts involved unless you devote some concentrated time to actually experiencing radio “the way it was”![2]

This “theme” brings me to Netflix (NFLX), which could provide the inspiration for any number of articles on distinct topics of current interest. However, I want to focus today’s look at NFLX on just two primary themes:

1) It’s place among the “turning points” within communication/entertainment history; and

2) Why it will surely become a case study (within U.S. business schools) for how a major company can “recover” from two huge marketing and PR nightmares!

Let’s start with “A Simplified Summary of 20th Century Communications Turning Points”:

RADIO:

1) The first radio news program was broadcast on August 31, 1920 (in Detroit); on a station owned by the Detroit News;

2) First U.S. commercial radio station was established in 1920 in Pittsburgh (KDKA);

3) First regular radio entertainment programs were broadcast in 1922;

4) The March 10, 1922 issue of Variety carried this headline: “Radio Sweeping Country: 1,000,000 Sets in Use.”

5) The aged ancestor of College Football Saturday, NFL Sunday, Monday Night Football, etc. came in 1923, when the New Year was “kicked off” by the first broadcast of the Rose Bowl game (1/1/1923).

6) As the country moved through the Depression, citizens regularly gathered around the radio to hear President Franklin D. Roosevelt speak to them directly (the “Fireside Chats”);

7) The radio proved to be both an infinitely vital source of news updates during World War II, as well as a salvific source of comfort and relief through radio’s wide variety of entertainment programming. By 1947, the C.E. Hooper Survey reported that 82 out of 100 Americans were “radio listeners.”

8) However, as with all technology, the seeds of its waning future were soon planted and began blossoming in the form of…

TELEVISION: (I have split the TV section into multiple sections, starting with “Network TV”, because the dynamics within each section is quite different)

NETWORK TV–

1) Genuine commercial TV network programming did not begin in the U.S. until 1948, when NBC presented Arturo Toscanini conducting the NBC Symphony Orchestra (he ended up doing nine more such shows);

2) In June of 1948, a show that would soon become a “TV Legend” was broadcast for the first time on NBC – Texaco Star Theater.

a. Three facts tied to this show are suggestive of more general trends in TV:

i. Many, many of the first TV shows were merely TV (live) productions of an existing successful radio show. Texaco Star Theater fell into this category.

ii. The host of the first show was Milton Berle, but NBC was in no way convinced it wanted to “stick” with Berle. They gave him a 4-week contract and “rotated” him with three other hosts. But the next fall, NBC realized they should stick with Berle – and TV history was made.

iii. Texaco Star Theater became TV’s first “mega-hit” – earning TV ratings as high as “80” and making NBC the “King of Tuesday Night” for years! (at least between 8-9 PM ET).[3]

3) Because kids did not have the plethora of “leisure time” activities that they do now, the “Baby Boomer” generation literally grew up sharing a TV heritage – from the “Mickey Mouse Club”[4] and “Adventures of Superman”[5] to “The Adventures of Ozzie and Harriett”, “Leave It to Beaver”, “Father Knows Best”, “Gunsmoke”, “Bonanza”, “Columbo”, the immortal “Star Trek” … and then (as we got older) the American Bandstand (with Dick Clark) and Soul Train, not to mention the super campy “Batman”[6]. (I couldn’t possibly list all the seminal, generation-forming shows; I do not have enough space!).

CABLE TV—

1) Ted Turner created the first cable news company in 1980 (in Atlanta, Georgia.)

a. Demonstrating remarkable creativity, he called it the Cable News Network (CNN).

b. CNN was the first station to provide 24/7 TV news coverage (at that time, millions thought Turner was crazy for going with the 24/7 news concept!)

2) One of the first times CNN established (conclusively) its “genius” was by covering what became (unfortunately) a tragedy:

a. On January 28th of 1986, CNN carried the only live TV coverage of NASA’s launch of the Space Shuttle Challenger – which blew up on its way toward orbit, killing all onboard.

3) With the expansion and growth of cable network channels (showing a steady uptrend in market penetration) cable networks began to not only purchase programming content (old network shows or new live programming[7]) but also produce new drama and comedy series – eg. Sopranos, South Park, Stargate sg1, etc.

4) The biggest impact on TV from cable was, literally, an explosion of viewing options from which TV viewers could choose each day.

a. Meanwhile, content available on the Internet was expanding exponentially;

b. The Video game space continued its inexorable growth in the breadth of its content and the depth and breadth of its market reach.

i. Many academic studies analyzing major changes in college education, campus “sociology” (interaction), and gender specific behavior bemoan the diminishing engagement of college males.

ii. Many of these studies attribute a major role to video games in (depending on the author) “causing”, “fostering”, or just “enabling” such “macro” changes.[8]

iii. Grand Theft Auto perfectly illustrates the economic power of video games.

1. Both my grown boys were glued to the Internet in September on the first day the new version of GTA became available.

2. They contributed to the total $800 million of sales on its first day.

3. You may not be impressed by that, but try to grasp this… within just two days more:

a. “Grand Theft Auto V has crossed the $1 billion sales mark after three days in stores, a rate faster than any other video game, film or other entertainment product has ever managed.”

c. 2006 data from SNL Kagan showed that over 58% of U.S. homes subscribed to basic cable services.

d. A number of cable shows have become overwhelming hits.

i. Cable’s AMC Channel production, “The Walking Dead”, and the mini-series from the History Channel entitled “The Bible”, each regularly beat most of the network TV shows during their time slot.

ii. Of course, HBO’s “The Sopranos” became a cultural phenomenon – winning both critical acclaim and popular awards.

The inevitable result of all the above – it was a devastating blow to the network TV “business model”. Almost from the beginning in the late 1940’s, the “business” of network TV was seemingly straightforward. The “potential market” was identifiable and executives had advertising rates that were predictable. As the “production” professionals worked with executives and marketers, the formula was clear and ascertainable: “Audience times Ad Rates minus Margin equals Programming Budget!” What could be easier?

The “defauit business template” at the national level of TV broadcasting was “invest in original programming that grabs viewer attention (and loyalty), jack up your ratings (and revenues), develop “buzz”, and then pad those programs with less ambitious (and cheaper) efforts that will restrain costs and increase the bottom line.

How could that possibly go wrong? Well, it has, and as insightful and succinct as any explanation I have seen is that offered by Rishad Tobaccowala of VivaKi[9]. Mr. Tobaccowala has described the essential issue in this manner (paraphrasing): the tidy world of network TV has fallen victim to digital leakage, because virtually all industry borders have become soft and it has become harder and harder to distinguish friend from foe.[10]

It was reported this past May that the 2012-13 network TV season was devastatingly poor economically. The lowest-rated network (ABC) saw its first quarter profit fall 40% (compared to the prior year quarter) and NBC lost $35 million. No less an authority than Goldman Sachs (GS) reports that network ratings (as a whole) witnessed a huge 17% decline within the most economically coveted demographic group – the 18-49 year old viewers (perceived by advertisers as the ones with the most disposable income). There is no doubt that current network executives would (proverbially) “give their eye teeth” for the days (long ago past) when 50 million Americans would gather in front of a television set once each week to watch the same show (guess which one[11]). Those were the days during which it “paid” to be a network TV executive!![12]

Although the above is an utterly inadequate review of 20th Century Communications/Entertainment Trends, it sure covered a lot of major changes in a mere 93 years (from the initial commercial radio broadcast to this year!). At this point, it would be natural for you to ask: “OK, Tom, we get it. You loved Annette. You wanted to be like Superman. You utterly failed to train your sons to treasure the gift of time so much that they would never waste so much of it playing video games! And now (finally) you are beginning to appreciate “Old Time Radio. But what on earth does Netflix (NFLX) have to do with this?”

NFLX has been a transformative influence in accelerating the dissolution of the bounds/borders between the various players/segments involved within the “entertainment industry” (network TV, cable TV, DVDs, streaming video, etc.). NFLX started as an Internet-based, technology-driven, speedy, cost efficient competitor to “bricks and mortar” video stores[13]. Much as Amazon (AMZN) radically altered the bookselling business, NFLX has been shaking up how folks obtain a steady stream of “ala carte” programming content.[14]

NFLX has been a transformative influence in accelerating the dissolution of the bounds/borders between the various players/segments involved within the “entertainment industry” (network TV, cable TV, DVDs, streaming video, etc.). NFLX started as an Internet-based, technology-driven, speedy, cost efficient competitor to “bricks and mortar” video stores[13]. Much as Amazon (AMZN) radically altered the bookselling business, NFLX has been shaking up how folks obtain a steady stream of “ala carte” programming content.[14]

Two particular developments occurred this year that serve as harbingers of changes yet to come.[15] First, within the first hour of the huge, traditional annual review and celebration of the TV Industry (formerly dominated almost exclusively by the networks) – the 2013 Emmy Award Show – the main camera actually switched toward the back of the auditorium, where (fictional) Representative Frank Underwood (see image to the left) whispered (very knowingly and confidently) to viewers how everything was playing out just as he had planned it!

I found that moment to be one of those totally unexpected “signal” moments – within which a development that may otherwise have been missed by the “average person” is highlighted, and thereby becomes impossible to continue going unnoticed. Why was that a “signal” moment? Because the TV show in which Frank Underwood is the always-scheming protagonist is “House of Cards” – not produced or broadcast by either a network (CBS, NBC, ABC, Fox, etc.) or a cable channel (HBO, Showtime, etc) – but produced by NFLX and available exclusively through NFLX!

There are so many “firsts” involved here that each is noteworthy:

1) The first time a major distribution channel (NFLX) produced an hour-long first-run drama;

2) The first time such a big-time, first-run show filmed all 13 episodes upfront and made all 13 available for viewing from the start!

3) No “pilot” episode was required before NFLX committed.

4) The first time that major TV programming such as this has been developed with the aid of big data algorithms.

5) Based upon feedback from some participants (Robin Wright in particular), despite the fact that NFLX was taking a huge risk on this show, management was willing to give the creative talent driving the show very unusual latitude to do what they wanted to do.[16]

6) House of Cards received 9 Emmy Award Nominations—attesting to its immediate acceptance within “the industry” and to its widespread critical acclaim.

NFLX has made it a policy to not divulge “ratings” information (which would require, at a minimum, an adjustment in the “standard” ratings methodology due to the unique nature of how viewers access it).[17] However, Ted Sarandos (in charge of NFLX’s creative content), has commented (during a recent interview) on what NFLX management has learned from House of Cards:

“The major international appeal for House of Cards was kind of a surprise because it’s a very American show. What we learned is that American politics is very American, but greed and corruption and all of that is very global. Corrupt politics is not new in Latin America, as it turns out. Within the U.S., you could have argued that most people who watch “Mad Men” would watch House of Cards. But the viewing is much more on par with the large-scale mainstream things like “The Walking Dead.” It was much younger than we thought. One of the things that surprised me was that women love the show because they love Robin Wright. And younger people love Kate Mara. Everyone is able to gravitate to this show for very different reasons.”

Note carefully that Sarandos did not offer ratings figures! However, he skillfully explained why NFLX is so happy with House of Cards – it has almost everything a TV show purveyor wants, including plenty of viewers in the coveted 18-49 demographic, lots of women, and even great interest among international viewers!

One other source of acclaim for the show has been Capitol Hill staffers, political reporters and commentators, and retired politicians — who have expressed great appreciation for the show’s willingness to portray a more realistic sense of how things “really work”. If we combine this “acclaim” from Capitol Hill with the remarkable success NFLX has achieved getting millions to watch House of Cards, we can unconditionally declare that someone has finally discovered a productive purpose for the U.S. Congress! It has provided the inspiration for a seminal TV series – one in which the only source of true suspense is wondering just how low Underwood can descend into the pit of diabolic scheming. This show proves that (as one observer expressed it) an entire group of people wallowing in dirt and dysfunction is actually quite watchable and entertaining.

Of course, ultimately, the best reason to watch House of Cards is to admire the lead actress, Robin Wright, whose breathtaking grace, poise, and talent has transported me back to those days when Annette Funicello was every adolescent male’s idea of perfection!

Of course, ultimately, the best reason to watch House of Cards is to admire the lead actress, Robin Wright, whose breathtaking grace, poise, and talent has transported me back to those days when Annette Funicello was every adolescent male’s idea of perfection!

The second major development related to NFLX (and TV in general) is the acceleration of new and enhanced ways to access this rapidly expanding sea of program content:

1) Anyone who has a cable box at home is aware of various “extra features” and “internet hookups” that are included on them. However, thus far, most such boxes do not include access to Netflix (the service)[18].

a. However, according to a recent story in the Wall Street Journal, NFLX is in the process of renegotiating the terms of many of the contracts they hold with both content providers and cable companies so its streaming service can become accessible through one’s cable box!

b. Comcast has been mentioned as one with whom NFLX is currently talking, as well as Suddenlink.

i. As a side note, that report also mentions that Time Warner Cable and Cox Cable have been discussing adding a “YouTube” application to its boxes.

2) The technological development of what I would describe[19] as A/V Communication Media Technology is absolutely fascinating – being as it is an accelerating evolution upward with regard to maximizing and balancing essential elements and metrics[20].

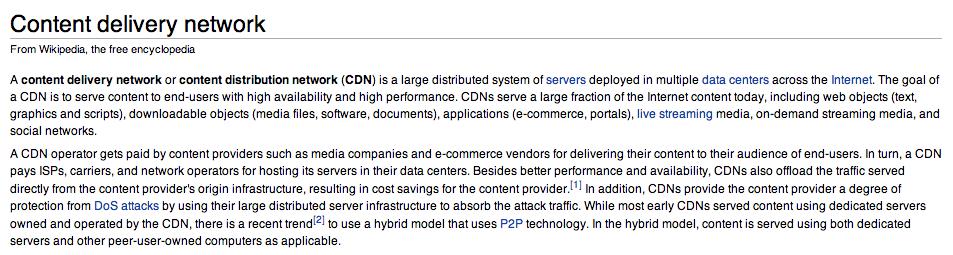

a. One of the commonly used current terms for the above topic is “Content Distribution Network” or “Content Delivery Network” (CDN)

b. Anyone motivated to discover more about this “technical side” of NFLX is encouraged to download a power point file with “case studies” outlining tech developments related to YouTube and to Netflix located at: http://www-users.cselabs.umn.edu/classes/Spring-2013/csci5221/LecNotes/csci5221-youtube-netflix.ppt

c. It is well worth noting that Netflix has been available in a number of locations overseas via “Chromecast” (a HDMI Stick (or “dongle”) that brings Web content to your TV screen while staying behind the scene).

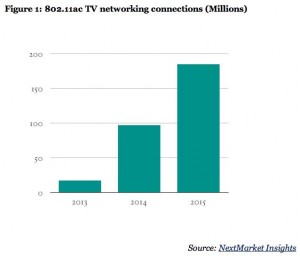

3) Another key ingredient that is “in place” already, but for which neither penetration nor utilization has as yet even started to peak, is so-called “Smart TV” (802.11ac).

3) Another key ingredient that is “in place” already, but for which neither penetration nor utilization has as yet even started to peak, is so-called “Smart TV” (802.11ac).

a. Through last year, “Smart TV’s” tended to be slower than needed for optimal functioning of a home TV as a (so-called) all encompassing display for network TV, cable TV, YouTube, Netflix, video games, Internet, etc.

b. Fortunately, chipmakers[21] have made significant strides in speed and quality for the newest chips going into Smart TV’s.

c. Combined with the fact that a speedier form of Wi-Fi is about to become standard on most devices, this means that more and more homes will be buying and more fully utilizing the 802.11ac technology!! (See graph to the left of projected sales.)

THE INVESTMENT CASE FOR NFLX:

I can almost hear your audible sigh of relief that the “history lesson” is over. I hope it was not entirely without interest for you; but even more importantly, I hope that you fully agree with me that NFLX has made a radical shift from merely turning bricks and mortar video stores into modern (retail) “dinosaurs” … into proactively generating seismic shifts in the way entertainment content is produced, promoted, networked, delivered, etc.

I can almost hear your audible sigh of relief that the “history lesson” is over. I hope it was not entirely without interest for you; but even more importantly, I hope that you fully agree with me that NFLX has made a radical shift from merely turning bricks and mortar video stores into modern (retail) “dinosaurs” … into proactively generating seismic shifts in the way entertainment content is produced, promoted, networked, delivered, etc.

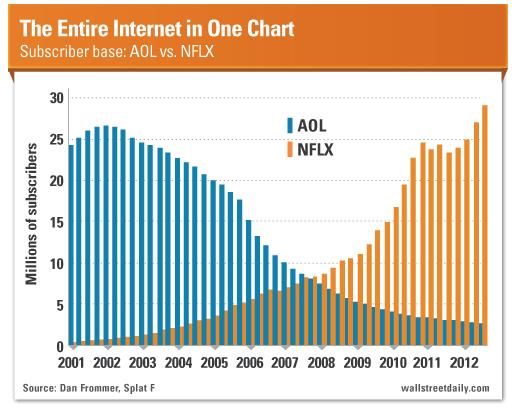

Although the following graph has limited significance, because it does not offer an “apples to apples” comparison… it does at least hint at the importance of never taking “dominance” in a business niche for granted. Those of you older than your mid to late 20’s surely remember the (long ago) dominance of AOL within the internet space – so dominant, in fact, that its signature “sign on” sounds and recorded alert regarding incoming mail inspired a major motion picture.[22]

NFLX now has more subscribers than AOL ever had, and will likely continue growing as the developments I outlined above are played out in the months and years ahead. This graph is both a “business school case study” of a company on top of the world (AOL) which let rapid technological change (and consumer preferences) get way ahead of them and a “cautionary tale” for Reed Hastings (NFLX CEO) and his company regarding what could be in store for them IF the company doesn’t stay current with (or ahead of) the “tech curve” and In touch with the ever-evolving consumer!

NFLX now has more subscribers than AOL ever had, and will likely continue growing as the developments I outlined above are played out in the months and years ahead. This graph is both a “business school case study” of a company on top of the world (AOL) which let rapid technological change (and consumer preferences) get way ahead of them and a “cautionary tale” for Reed Hastings (NFLX CEO) and his company regarding what could be in store for them IF the company doesn’t stay current with (or ahead of) the “tech curve” and In touch with the ever-evolving consumer!

Mentioning Mr. Hastings leads right into the premise I promised to elaborate upon at the beginning of this piece: NFLX will surely become a business school case study about how a major company can recover from a major marketing and PR nightmare. In fact, Mr. Hastings and his team led NFLX right into two major marketing boondoggles during the second half of 2011!

In July of 2011, the company announced it was changing its subscription price structure. Up until then, monthly subscribers in the (original) DVD rental by mail service received free access to the budding NFLX video streaming service! So imagine (or remember) the reaction when the company’s new policy included charging for the streaming service! Granted, the company tried to soften the blow by dropping DVD rental prices by 20% — but for those customers who utilized both the physical DVD rental and streaming, the new price structure amounted to a 60% increase! “Marketing 101” teaches us that customers deplore price increases (especially upward from “free”); and further, in the midst of our “Great Recession”, a 60% cost increase seemed (to customers and commentators) monstrous.

As a consequence, management started to experience significant “blowback” (to put it mildly). “Corporate Management 101” teaches us that, in the midst of recovering from a PR crisis, management must focus (first and foremost) on “wooing customers back” and restoring a positive environment. NFLX management did admit to very poor PR management of its new pricing plan, but it declined to reduce or eliminate the price increase.[23]

That should have been bad enough. However, a psychologist would have a field day analyzing what was coursing through management’s mind when, just two months later, it trotted out a corporate restructuring plan. Management’s brilliant plan was to spinoff the DVD disk rental business into a new company called “Qwikster” – essentially throwing away 14 years of accumulated “brand awareness” related to its (by then) almost universally-known DVD mail rental service called Netflix![24] Customers, analysts, and commentators joined as one in heaping howls of protest upon Hastings and his team. It was even suggested that Hastings should resign.[25]

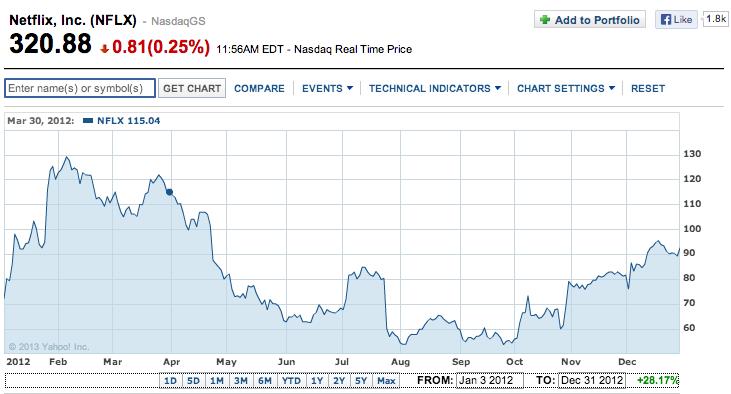

What did NFLX stock do during this tumultuous period? Obviously, it experienced (putting it mildly) considerable “headwinds”. Take a look at this price chart:

From the closing high on July 13, 2011 to the low (closing basis) prior to year-end, NFLX’s price collapsed by almost 79%! No wonder cries were being made for Hastings’ removal as CEO! The shareholders were united with subscribers and commentators in skewering the management team. It’s always a bad sign when late night TV comedians turn a company into a laughingstock, and that was certainly an additional indignity heaped upon a very bad year for NFLX!

From the closing high on July 13, 2011 to the low (closing basis) prior to year-end, NFLX’s price collapsed by almost 79%! No wonder cries were being made for Hastings’ removal as CEO! The shareholders were united with subscribers and commentators in skewering the management team. It’s always a bad sign when late night TV comedians turn a company into a laughingstock, and that was certainly an additional indignity heaped upon a very bad year for NFLX!

However, by February of 2012, the stock price almost doubled from its November low. Alas, that recovery was short-lived (as you can see below). In fact, by August 2, the stock reached (on close) the $53.87 price level! During this period, the market perception of NFLX had become so negative that the stock was removed from the NASDAQ 100 Index in December of 2012. So although the stock price moved over $90 by December, things looked bleak in “Netflix-land”.

However, there is a saying that is often helpful: “It is always darkest before the dawn!”[26] Within the corporate world, NFLX has become living proof of the veracity of that proverb! Look at the price chart for 2013:

For those of you trying to calculate the move from the low to the high, NFLX moved up over 510% from the August 2012 low to the most recent high! That could qualify NFLX for a place in the Merriam-Webster Dictionary as a visual representation of “recovery”. Isn’t it amazing what moving beyond PR/marketing nightmares by accelerating progress in content acquisition/production, technology, and content delivery can accomplish! As an added bonus, in a news item from last week, Jeffrey Katzenberg (executive at DreamWorks) called Netflix a “Patron Saint”!! That is a long, long way from two years ago, when the “mob” (shareholders/customers, etc.) was ready to lynch Reed Hastings![27]

Regarding NFLX valuation, I do not pretend to possess the requisite expertise. But analyst Laura Martin of Needham & Company has torn apart the financials and declares that NFLX is “one of the best ways to play the global growth of broadband penetration.”

We don’t have the space to offer her full analysis, but it is fair to say her thesis regarding valuation is based upon her opinion that the market is undervaluing the prospective marginal returns from the company’s overseas operations. As Martin works the figures, she has found that “many countries in which Netflix offers its streaming product are growing broadband penetrations 3-4 times faster than the U.S.” If NFLX can ride that wave, its international revenues/earnings should exceed current market projections.

Building upon that thesis, Martin has reviewed the progression of existing overseas operations from start-up through “breakeven” (BE) and notices a stronger story within the time required to reach BE than the market recognizes. Part of this greater “efficiency” is accounted for through cheaper content costs is many of those countries, as well as the “transferability” of some content from (already paid for) U.S. sources into other areas (and vice versa).[28] The bottom line is that Martin’s calculated “target price”[29] is $425.

INVESTOR TAKEAWAY: It may not often seem like it, but “history” has many lessons to teach. With regard to this story, lessons could include the following:

1) Our entertainment/communication technologies are reaching a feverish pace in their evolution. Companies that can keep their “eye on the ball” in the present and deliver product/services quickly and cost effectively, AND simultaneously anticipate (and become prepared to market within) the trends/needs of the future will succeed.

a. The others, like AOL, will struggle, fade, and eventually die.

2) It is difficult enough to handle the challenges presented above by rapidly evolving technological changes. Adding several layers of complexity on top of that task is the challenge of being nimble enough to adjust your “business model” (production, supply chain, marketing (from which “channels” to emphasize to prioritizing the allocation of each dollar of the sales budget), which companies to choose as “partners” and which as “competitors”, what metrics to use in measuring success, etc.) to ensure optimum success.

3) NFLX has demonstrated exceptional skill and resourcefulness in evolving this far in its 16-year history.

a. How will it handle the challenges that lie ahead for it?

b. As just one small hint of such a challenge, consider this:

i. It has significantly expanded the resources it has committed to content acquisition and production.

ii. One could reasonably assume it will need to begin initiating ways to expand revenue and profit.

iii. Increasing the subscriber base is the most obvious choice.

iv. Cross-marketing is another potential source of value

v. Content-linked products are a possibility (dolls/toys based on characters from future Dreamworks cartoons; or products based on House of Cards, etc.

vi. You can imagine your own ways of generating new revenues.

- The question I pose is this — how will they handle the almost inevitable internally generated designs for a new, revised pricing plan?

- I suspect that its “history” in regard to pricing plans will “haunt” it for at least a few years to come… and will cause whatever reaction “the market” has to it to be amplified and colored by that history!

4) That said, NFLX is an extraordinary story. If you are tempted to trade it, I merely caution you to be judicious. Do not “chase it”. Look for technical areas of support around which you feel comfortable trading it. And always have your risk management plan in place (position size; stop price; exit plan; etc.).

a. Ms. Martin of Needham would be the first to echo the following sentiment – Just because she believes a fair valuation target is $425 is no guarantee that the price will ever get there. If it does get there, there is no guarantee that the price will “stop” there. The “Market” does what the “Market” does, and none of us has a crystal ball!

DISCLOSURE: The author has owned NFLX in the past but does not currently own NFLX. As is obvious from the above, the author does have a subscription with Netflix. Nothing in this article is intended as a recommendation to buy or sell anything. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Submitted by Thomas Petty MBA CFP

[1] I did not know that NBC was ruled (by the U.S. government) in violation of anti-monopoly regulations in the early 1940’s, resulting in a forced sale of about half its broadcast empire to what became the “American Broadcasting Company” (now an integral part of the Disney/ESPN/ABC entertainment empire).

[2] One other fascinating fact I picked up by listening to one radio drama after another radio drama is how frequently the “voice” of a particular radio character (even the popular ones) was changed during the life of any given radio series. However, when I thought about that (many of the shows were done “live”, complicating schedules, and the listener never “saw” the character’s face, so the impact of a change was not nearly as stark or disturbing as a change today in the casting of a key character on TV(such as “The Mentalist”, or the commissioner on “Blue Bloods”, etc.) would be!

[3] I used to watch that show with my dad on our very small black and white TV (with no remote control, which my kids to this day cannot comprehend). I was not a fan of Milton Berle, but dad thought he was hilarious. And remember: “You can trust your car to the ma who wears the star, the big bright Texaco star!”

[4] Every boy under 18 fell in love with Annette Funicello, the most captivating of the Mouseketeers.

[5] “Look, up in the sky… is it a bird, is it a plane… NO, it’s SUPERMAN… strange visitor from another planet…”.

[6] “Holy moving averages, Batman, look at that move in Tesla (TSLA)!”

[7] Covering a wide range of themes, from cooking shows and “product pitch” programming to “talk and variety shows”, sports reporting, home remodeling demonstrations, history, etc.

[8] I attended one weekend “seminar” on “The Male and College Education” which (while trying to suppress smiles) described the typical weekend on campus being “guys in their dorm rooms playing video games” while females are out serving as volunteers or studying in the library.

[9] VivaKi is a company specializing in global digital advertising solutions.

[10] In many ways, TV has become an “Alice in Wonderland” (up is down, down is up) in which Comcast (a cable provider) now owns one of the original networks (NBC), Disney (a movie producer and amusement park giant, now owns both a cable channel (ESPN) and an old network (ABC), and a mail order book company (AMZN), two old computer firms (MSFT and AAPL), and a search engine (GOOG) are all getting into TV or reported to be interested in it.

[11] “I Love Lucy”

[12] Consider this eye-opener: network TV’s top-rated show (NCIS) garners just a bit more than 40% of the audience “I Love Lucy” regularly gathered! Countless current network shows are lucky to pull in even 1/10th of the folks that “Lucy” did!

[13] Yes, it’s been so long that it is rather difficult to remember “Blockbuster Video” – until, that is, you remembered how you felt when they charged you one of the dreaded “late fees”!

[14] By “ala carte”, I mean that the viewer is empowered to watch what she/he wants, when she/he prefers to view it, for as long as she/he prefers to “linger” over it – taking us beyond physical DVDs, recording hardware (BetaMax, DVR, Tivo, etc.) or any other older method of gaining true “content flexibility”.

[15] They could easily prove to become “turning points”

[16] That contrasts sharply with countless stories bandied about regarding network executives who tend to “see a problem around every corner” and tend to either stifle creativity or “bail” on programs that don’t produce speedy “results” (viewers/ad revenue).

[17] One huge variable regarding a “ratings” measure is that only NFLX subscribers can access House of Cards, and there are “only” 30 million of those.

[18] I access Netflix via Wii, and one of my sons accesses it via Xbox

[19] Using my out-of-dated “Baby Boomer” terminology…

[20] Such as band-width, processing speed, storage, virus and hacking security, etc.

[21] Broadcom, Marvell, Intel.

[22] “You’ve Got Mail”.

[23] Hastings’ refusal to modify anything in the midst of customer revolt reminds me of Civil War Admiral, David Farragut, who (on August 5, 1864) with his fleet facing heavy enemy fire, shouted: “Damn the torpedoes. Full speed ahead.” (That is the popular paraphrase of what he actually said.)

[24] The company was founded in 1997.

[25] Hastings responded to an interviewer: “I founded Netflix. I've built it steadily over 12 years… [and] this is the first time there have been material missteps. If you look at the cumulative track record, it's extremely positive.”

[26] Variously attributed to either theologian, Thomas Fuller (1650), or to Irish peasants (per Samuel Lover in his Songs and Ballads (1858)).

[27] NFLX signed a deal with Dreamworks’ animation studio to provide 300 hours of original family content for streaming… another “first”.

[28] As a small example, some of my favorite NFLX shows have come from Ireland, England, and Canada.

[29] Using all the standards, including weighted average cost of capital (WACC), discounted cash flow (DCF), etc.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Why Meta Platforms Stock Flopped on Friday

Why Meta Platforms Stock Flopped on Friday