In years gone by, I was required to dissect a tapeworm in high school biology. The fact that I vividly recall the tapeworm (after all these decades) attests to the gruesomeness of the task. A tapeworm is a parasite that sets up home in your digestive system, with the longest species able to grow to 65 feet. Combined with the picture (below) of a typical tapeworm, that’s the extent of the yucky details with which I will plague you today.

IMAGE: to the left is a picture of a tapeworm from Wikipedia.com.

I mention the tapeworm because that image has sprung to mind ever since May 22nd, when the financial press’ latest word du jour became “tapering” – referring to Fed Chair Ben Bernanke’s infamous testimony before Congress in response to a question regarding the Fed’s longer-term plan regarding Quantitative Easing. That single word, and the “high anxiety” it provoked within virtually every major market around the world, has been the prime financial news story ever since.

Because Bernanke did not have an appropriate forum through which to offer clear and unequivocal details regarding what “tapering” means, the markets did what markets do under such conditions: overreact! He has said countless times in the past that any weaning of the current $85 billion in monthly liquidity injections will not (in any way) mean a wavering of the Fed’s commitment to an “accommodative” monetary policy. However, the markets proved that anxiety trumps such “reassurances”.

The impact of Bernanke’s use of the term “tapering” has been eye-catching (to say the least). Between May 22nd and the first two weeks of June, the yield on the benchmark 10-year U.S. Treasury Note zoomed upward by approximately 25%, from 1.66% to a high of 2.25%. (The chart of the CBOE 10 year T-Note Rate comes from YahooFinance.com).

The collateral damage in market prices was practically universal:

a) Morningstar reported that the Long-term Treasury Index fell 6.8% in May.

b) iShares FTSE NAREIT Mortgage Plus Cap Index (REM) fell 12.3% in May

c) The biggest mutual fund, Pimco Total Return (PTTAX) declined 1.9%, the largest fall since September of 2008!

d) Any fund using leverage performed worse, such as the Pimco Income Opportunity (PKO) closed-end fund – which fell over 12.6% from high to low in May, and has continued its fall in June (now down over 18% since May 1). (It is invested in a mix of MBS and corporate bonds, along with other bond asset classes and significant borrowing).

Because of this ugly (and precipitous) decline, investors pulled over $12.5 billion out of global bonds during just the first week of June. There is no universally hailed bond composite index. The closest is the Barclay’s U.S. Aggregate Index — which is down over 1% so far this year. That is its worst year-to-date performance since the bond rout in 1994! (It declined by almost 2% in May.) Chris Orndorff (senior portfolio manager at Western Asset Mgt) has categorized May as one of the worst twenty one-month periods for the 10-year T. Note since 1950: “When market rates are 7% or 8%, a 50 basis point move is not a big deal; but when rates are this low, it is!” Several commentators conjecture that if there was a universally accepted “bond composite” index (parallel to the Dow Jones Industrials or the S&P 500) – news reports would include glaring headlines about a “bond mini-crash”… or even a full-fledged “bond crash”.

So what can the average investor do in this wild environment? As we told you in an earlier piece (Money Market Part II) if you want more yield than a money-market account but want to reduce (if not eliminate) interest rate risk, there are a number of alternatives. Today, I am offering you several additional ideas – all from the “Floating Rate” asset class.

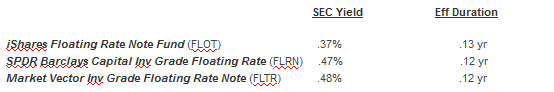

“Floating Rate” ETFs are designed to balance interest rate risk (duration) with desire to capture higher than money-market yield. They invest in U.S. dollar-denominated, investment grade floating rate notes. The effective interest rate on such notes adjusts in accord with then-prevailing rates. Therefore, since the rates “float”, investors are shielded from the full-impact of interest rate increases. For this asset class, key metrics are the 30-day SEC Yield and the Effective Duration.

Since some of you are visual learners, I provide you a comparative graph below, for the period that starts at the inception of the youngest fund (FLRN). (Source: YahooFinance.com). The green line is FLTR, the choice with the highest 30-day yield. The red line is FLRN (notice the spikes during its “infancy”). The slow and steady blue line is FLOT.

Can you guess what struck me visually? I was amazed at the relative comparability (over the 15 months of BOND’s existence) of volatility between FLTR and BOND. Let me hasten to add that 15 months is not long enough to draw firm investment conclusions; however, this graph serves as a helpful “alert” to risk-averse investors regarding the relative risk/reward of these three ETF choices.

[Disclosure: the author owns FLOT. He does not object to FLTR, but he has chosen to put most of his “risk” a little higher up along the yield curve. He also owns BOND.

Finally, just because Bernanke’s “tapering” reference has so destructively riled the investment markets and his term calls to mind the unpleasant image of a “tapeworm” that is capable of “taking over” a whole system, it would be quite rude of you to call Bernanke “a worm”. Don’t lower yourself to that indignity. Allow me to take that burden on my shoulders instead!! Because I am here to serve, I will do the name-calling for both of us!]

Submitted by Thomas Petty

Related Posts

Also on Market Tamer…

Follow Us on Facebook

Billionaires Warren Buffett and Ken Griffin Both Own This Vanguard ETF. Should You?

Billionaires Warren Buffett and Ken Griffin Both Own This Vanguard ETF. Should You?