Hopefully, many of you leapt right into this article when you saw it pop up on the MarketTamer website because you are anxious to dig into a bit of “Dow Jones stock history” and get the answers to the Quiz that appeared in Part I. Let’s start with the Quiz “Answer Sheet”, then I’ll supplement that with some of the more interesting historical detail related to these companies.

1. This company’s history began within the “Pittsburgh Reduction Company”? ALCOA INC. (AA)

2. This19th century chemical company (founded by Balthazar Melick in 1823) is the main antecedent to a company that currently boasts a market cap around $200 billion. It originally produced nitric acid, camphor, paints, dyes, and medicines. JPMORGAN CHASE & CO. (JPM)

3. This company (in the Midwest) combined some Irish magic with skilled candle making to create the beginnings of a Dow stock. Sales reached $1 million by 1859! PROCTOR & GAMBLE COMPANY (PG)

4. Early in the 20th Century, this company was started as a way to assist the massively under-served immigrants of its era. Within two years, an earthquake proved to be the catalyst for this company’s expansion. BANK OF AMERICA CORP. (BAC)

5. The current business focus of this company was actually forced upon it by a U.S. regulatory and legal decision in 1934. UNITED TECHNOLOGIES CORPORATION (UTX)

6. This company was originally an abject failure when started in 1902, but its five partners refused to give up. They switched their business focus to sandpaper products. 3M COMPANY (MMM)

7. This company has its roots in oil drilled near San Francisco, as well as in Texas. In the later 20th Century, it was created by the (then) largest ever merger. CHEVRON CORPORATION (CVX)

8. This company has roots going all the way back to 1668! During World War I, this company was confiscated by the U.S. government. Today it is a global business. MERCK & CO. INC. (MRK)

9. This company started in a California one-car garage by two grads from Stanford University. Its first customer was Walt Disney, who purchased an audio oscillator. HEWLETT-PACKARD COMPANY (HPQ)

10. This company proved that (sometimes) capitalism is more powerful than government regulators. In 1911, the U.S. Supreme Court ordered a company disbanded into multiple parts. Eighty-seven years and many corporate restructurings and mergers later, the (by far) largest components from that split-up were re-united into this company. EXXON MOBIL CORPORATION (XOM)

11. This company was created by someone who formerly worked for J.C. Penney (JCP) and decided to purchase a number of “Ben Franklin Stores” from a mail order company. WAL-MART STORES INC. (WMT)

12. This company’s first product was santonin, an anti-parasitic used to expel worms from humans. PFIZER INC. (PFE)

13. The first product of this company’s antecedent resembled a then contemporary French wine. A later reformulation was marketed as a “patent medicine” (dyspepsia, headache, and ED). The company’s true “birth” began through the vision of a man named “Asa”. THE COCA-COLA COMPANY (KO)

14. This company has its roots in one person, and is the biggest of the 14 companies founded by that individual. GENERAL ELECTRIC COMPANY (GE)

15. The first franchise location of this company opened on April 15, 1955, within 9 miles of where I grew up in the Chicago area. McDONALD’S CORP. (MCD)

Yes, I know that a lot of these questions were very difficult, and some were downright tricky. But that’s why trivia quizzes are so much fun!

Let’s start moving through some of the more interesting historical company detail:

![]() Alcoa has a delightful website which provides shareholders, teachers, parents, kids, etc. very interesting “snippets” (videos, slides, text, photos) regarding the history of this company and of aluminum itself. The theme of that site is wonderfully direct: “It all starts with dirt!”[1]. Some of the facts about aluminum that are provided there are ones I did not know, including: a) it is the earth crust’s most abundant metal, and yet does not appear naturally in the form of a metal; b) in part for that reason, it was a semi-precious metal in the 1880’s and was scarcer than silver. An Oberlin College student[2] with a burning passion to make a revolutionary discovery regarding our conception of matter finally succeeded[3] in creating a commercially viable method to extract aluminum from ore.

Alcoa has a delightful website which provides shareholders, teachers, parents, kids, etc. very interesting “snippets” (videos, slides, text, photos) regarding the history of this company and of aluminum itself. The theme of that site is wonderfully direct: “It all starts with dirt!”[1]. Some of the facts about aluminum that are provided there are ones I did not know, including: a) it is the earth crust’s most abundant metal, and yet does not appear naturally in the form of a metal; b) in part for that reason, it was a semi-precious metal in the 1880’s and was scarcer than silver. An Oberlin College student[2] with a burning passion to make a revolutionary discovery regarding our conception of matter finally succeeded[3] in creating a commercially viable method to extract aluminum from ore.

One “casualty” of the current change in the composition of the Dow Jones Industrial Index will be the long “tradition” of Alcoa being the first Dow stock to report earnings each quarter. For many investment professionals, it will sound strange for AA to no longer “kick off” earnings season (at least not as widely visible).

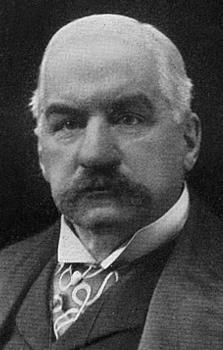

You may have considered this question to be the sneakiest – and perhaps even nefarious. Almost everyone has heard of its namesake, John Pierpont Morgan. Morgan was a 19th century financier who wielded incredibly wide-ranging power within the U.S. economy and was an extremely scary adversary (if you got on his “bad side”). So the natural (perhaps logical) way of conceiving of the current bank’s family tree would involve the “branches” of the tree related to Morgan. (See image at right: Morgan not only was mean-spirited, he even looked mean-spirited!)

You may have considered this question to be the sneakiest – and perhaps even nefarious. Almost everyone has heard of its namesake, John Pierpont Morgan. Morgan was a 19th century financier who wielded incredibly wide-ranging power within the U.S. economy and was an extremely scary adversary (if you got on his “bad side”). So the natural (perhaps logical) way of conceiving of the current bank’s family tree would involve the “branches” of the tree related to Morgan. (See image at right: Morgan not only was mean-spirited, he even looked mean-spirited!)

However, an alternative (and equally valid) perspective from which to understand bank history is to start with the following section of the “Chase tree” (started before J.P. Morgan & Co. itself): Balthazar Melick founded the New York Chemical Manufacturing Company in 1823. The company produced chemicals (alum, nitric acid, camphor), medicines, paints, and dyes. Melick had the company charter amended in 1824 to enable the initiation of banking activities! In doing so, he started the Chemical Bank of New York. By the 20th Century, Chemical Bank had become a major player in U.S. finance. As many banks began to expand and consolidate, Chemical Bank was an active participant – including acquiring the Chase Manhattan Corporation in 1996. Combining with the infamous J.P. Morgan & Co. in 2000, the resulting bank has continued to grow (especially during the financial crisis).

However, an alternative (and equally valid) perspective from which to understand bank history is to start with the following section of the “Chase tree” (started before J.P. Morgan & Co. itself): Balthazar Melick founded the New York Chemical Manufacturing Company in 1823. The company produced chemicals (alum, nitric acid, camphor), medicines, paints, and dyes. Melick had the company charter amended in 1824 to enable the initiation of banking activities! In doing so, he started the Chemical Bank of New York. By the 20th Century, Chemical Bank had become a major player in U.S. finance. As many banks began to expand and consolidate, Chemical Bank was an active participant – including acquiring the Chase Manhattan Corporation in 1996. Combining with the infamous J.P. Morgan & Co. in 2000, the resulting bank has continued to grow (especially during the financial crisis).

This company has been a U.S. staple[4] for 176 years! A soap maker from Ireland (James Gamble) met a candle maker from England (William Procter) met in Cincinnati, Ohio – and were smitten by sisters (Elizabeth and Olivia Norris), whom they married. At that point, the new father-in-law of these two men seized opportunity when he saw it and persuaded them to create a business partnership. The result was the 1837 founding of Procter & Gamble.

This company has been a U.S. staple[4] for 176 years! A soap maker from Ireland (James Gamble) met a candle maker from England (William Procter) met in Cincinnati, Ohio – and were smitten by sisters (Elizabeth and Olivia Norris), whom they married. At that point, the new father-in-law of these two men seized opportunity when he saw it and persuaded them to create a business partnership. The result was the 1837 founding of Procter & Gamble.

From the start, this partnership was a great success, growing the business toward $1 million in sales before the Civil War. When P&G won the contracts to supply the Union Army with candles and soap during the war, that huge business volume ensured even greater prosperity. By the advent of the 20th Century, products we now take for granted began to be introduced – such as Crisco, Tide, and Pampers.[5]

Amadeo Giannini is a classic example of an enterprising immigrant with a vision and a willingness to take risks. In 1904, Giannini founded the Bank of Italy in San Francisco because he recognized a vastly underserved immigrant population (they weren’t wealthy enough for “mainline” banks to bother with). As we know, that area was stricken in 1906 by a devastating earthquake, which forced Giannini to recover his records and funds and then “reopen” his office. Illustrating his spunk and determination, two barrels and a few planks became that “office”… from which Giannini continued to make loans to folks desperate to rebuild from the rubble all around!

Amadeo Giannini is a classic example of an enterprising immigrant with a vision and a willingness to take risks. In 1904, Giannini founded the Bank of Italy in San Francisco because he recognized a vastly underserved immigrant population (they weren’t wealthy enough for “mainline” banks to bother with). As we know, that area was stricken in 1906 by a devastating earthquake, which forced Giannini to recover his records and funds and then “reopen” his office. Illustrating his spunk and determination, two barrels and a few planks became that “office”… from which Giannini continued to make loans to folks desperate to rebuild from the rubble all around!

By 1922, Giannini established a “Bank of America and Italy” in Italy. Then in 1928, he merged his bank with the “Bank of America” in Los Angeles. The resulting institution was the country’s largest bank. With the acquisition of Seattle-First National Bank (1983), a series of mergers began to expand the bank nationwide. Today, BAC is one of the “big banks” always referred to when Basel III standards and government regulation are discussed.[6]

Here is another tidbit of history related to government tinkering – tinkering that often molds and shapes U.S. corporate history. Before 1934, United Aircraft and Transport Corporation was an air carrier (flying freight and passengers) and it was an aviation manufacturer (building planes and aviation equipment).

Here is another tidbit of history related to government tinkering – tinkering that often molds and shapes U.S. corporate history. Before 1934, United Aircraft and Transport Corporation was an air carrier (flying freight and passengers) and it was an aviation manufacturer (building planes and aviation equipment).

Perhaps success made the government uncomfortable. In 1934 the “Air Mail Act of 1934” prohibited the combination of a carrier with a manufacturer – resulting in the split up of the original company. Within seven years, of course, United Aircraft became a huge strategic asset in the effort to win World War II[7]. In the postwar era, aviation technology advanced by leaps and bounds, spurred by insights from former German scientists, as well as by competition among many tech companies. As aviation tech was transformed, Harry Gray (CEO) expanded the identity of this company in 1975 through a name change: United Aircraft Technologies Corporation. Since then, it has evolved into: United Technologies (UTX). Obviously, the air carrier that was once linked to UTX is now known as United Airlines (UAL).

Few people think of 3M Company (MMM) as the “Never Give Up” company[8]. In fact, I am willing to bet that a great deal of the U.S. populace no longer thinks of 3M as “Minnesota Mining and Manufacturing” (it’s name before being condensed).

Few people think of 3M Company (MMM) as the “Never Give Up” company[8]. In fact, I am willing to bet that a great deal of the U.S. populace no longer thinks of 3M as “Minnesota Mining and Manufacturing” (it’s name before being condensed).

In 1902, five men joined into a business venture to mine corundum near Two Harbors, Minnesota. There was just one rather damaging impediment – the property they were mining did not have any corundum. Instead, it was filled with anorthosite – which carried no commercial value. To the credit of these five Minnesotans, they refused to give up – moving to Duluth to produce sandpaper products. Given their drive and hard work, they became successful enough to start paying dividends by 1916. As the decades wore on, the company researched, developed, and marketed great consumer products – among which have been masking tape, waterproof sandpaper, and the ubiquitous Scotch tape.

However, one particular product exemplifies the unshakeable resolve of the company’s founders. In 1968, a 3M chemist named Spencer Silver developed a brand new adhesive that could bond, then release, bond, then release, etc. He was excited and enthused, but no one else at 3M seemed interested.

Silver refused to give up. He kept talking the discovery up and spreading the word, but the years began passing by without any commercial use for it. Then finally, in 1974 fellow 3M employee, Art Fry, was sitting in choir practice, bedeviled by the curse of needing to mark up the church bulletin and hymnal for each week’s worship service. Suddenly inspiration struck[9], and Fry visualized transforming Silver’s discovery into “Post-It Notes” – a true gift to the organized, semi-organized, and unorganized alike!! So 3M is the “Never Give Up” company!

In the event that you get really, really bored some day and are in desperate need of trying to put together a complicated corporate family tree, just take a look at this website offering details regarding the long, intricate history of Chevron Corporation (CVX).[10] Starting with an oil discovery by California Star Oil Works in 1876, Chevron antecedents became pioneers within the budding California oil business. Once the Pacific Coast Oil Co. purchased California Star Oil, Coast Oil became the prime mover.

In the event that you get really, really bored some day and are in desperate need of trying to put together a complicated corporate family tree, just take a look at this website offering details regarding the long, intricate history of Chevron Corporation (CVX).[10] Starting with an oil discovery by California Star Oil Works in 1876, Chevron antecedents became pioneers within the budding California oil business. Once the Pacific Coast Oil Co. purchased California Star Oil, Coast Oil became the prime mover.

Not very long thereafter, Standard Oil (Iowa) managed to establish an outpost on the West Coast. In fact, by 1900, Standard controlled over 96% of the Western market in light oils. Not surprisingly, the 1911 breakup of Standard Oil played havoc with the oil industry for decades thereafter. Between 1911 and 1985, portions of what are now Chevron’s West Coast antecedents moved through various changes and restructurings. All of that culminated in a huge merger that joined Gulf Oil with Standard Oil of California –forming Chevron.

Not very long thereafter, Standard Oil (Iowa) managed to establish an outpost on the West Coast. In fact, by 1900, Standard controlled over 96% of the Western market in light oils. Not surprisingly, the 1911 breakup of Standard Oil played havoc with the oil industry for decades thereafter. Between 1911 and 1985, portions of what are now Chevron’s West Coast antecedents moved through various changes and restructurings. All of that culminated in a huge merger that joined Gulf Oil with Standard Oil of California –forming Chevron.

But that is not quite the end of the story! Move back over 100 years… to Texas. In 1901, near Beaumont, Texas, four business partners struck oil at Spindletop, thereafter founding the Texas Fuel Company. Their business expanded rapidly and, for quite a number of years, Texaco (as it became known) was the only company selling gasoline under a single brand in all 50 U.S. states and Canada.[11] It sponsored countless TV shows through the 1950’s and 60’s – inculcating forever in young memories the lyrical theme: “You can trust your car to the man who wears the star….. the big bright Texaco star!”[12]

But that is not quite the end of the story! Move back over 100 years… to Texas. In 1901, near Beaumont, Texas, four business partners struck oil at Spindletop, thereafter founding the Texas Fuel Company. Their business expanded rapidly and, for quite a number of years, Texaco (as it became known) was the only company selling gasoline under a single brand in all 50 U.S. states and Canada.[11] It sponsored countless TV shows through the 1950’s and 60’s – inculcating forever in young memories the lyrical theme: “You can trust your car to the man who wears the star….. the big bright Texaco star!”[12]

By 2001, the huge refinery business of Texaco was merged into Chevron to create the international integrated oil business we know today.

You may have wondered how a DOW component had roots extending back 1668. Merck & Co. (MRK) can be traced all the way back to Friedrich Merck, when he purchased a German drug store in that year. Son Emanuel expanded Merck’s business into producing drugs.

You may have wondered how a DOW component had roots extending back 1668. Merck & Co. (MRK) can be traced all the way back to Friedrich Merck, when he purchased a German drug store in that year. Son Emanuel expanded Merck’s business into producing drugs.

By 1891, Emanuel and his son (George) emigrated to the U.S. to found the U.S. business. The most interesting[13] chapter of Merck history cam when the U.S. federal government confiscated the company during World War I. Learning their “lesson” (the hard way) the Mercks re-established Merck after the war as an independent U.S. company. When it merged with Sharp and Dohme in 1953, it became the largest pharmaceutical concern in the U.S.

HEWLETT-PACKARD COMPANY (HPQ) is a compelling example of how quickly a series of management miscues, misjudgments, and misdeeds can undo a successful company. For a time, HPQ had captured the position of top U.S. computer seller, and its other businesses (especially printers) were rolling smoothly along. However, it started to appear as though management was intent upon shooting themselves in the foot – repeatedly. That led to HPQ’s considerable struggles in recent years, which resulted in a cratering of its stock price.

HEWLETT-PACKARD COMPANY (HPQ) is a compelling example of how quickly a series of management miscues, misjudgments, and misdeeds can undo a successful company. For a time, HPQ had captured the position of top U.S. computer seller, and its other businesses (especially printers) were rolling smoothly along. However, it started to appear as though management was intent upon shooting themselves in the foot – repeatedly. That led to HPQ’s considerable struggles in recent years, which resulted in a cratering of its stock price.

Between April of 2010 and late last year, the HPQ stock price dropped from over $54 down to just below $12. (See graph below):

Of course, as you learned in Part I, these struggles endured by HPQ shareholders, which precipitated that steep price decline, are the very reasons that (as of September 23rd), HPQ will no longer be a part of the Dow Index.

Management weakness was not always an issue for HPQ. Its founders were exceptionally sharp, creative individuals – and enterprising during a difficult era. In fact, Bill Hewett and Dave Packard were Stanford University engineering grads working out of a one-car garage in Palo Alto, California during the Great Depression when they founded the company. Being committed to fairness, the two men flipped a coin in order to determine which name came first.[14]

Significantly, their first commercially successful product was a precision audio oscillator, and HPQ’s first customer was Walt Disney Productions! In fact, until the 1990’s, it focused on a broad spectrum of electronic test equipment. Most recently, the market has responded positively to HPQ’s strategy to grow its “services” business.

Since we are running out of room, I will cover just one more of the companies referred to in the quiz. That company is almost universally recognized as the world’s best-known “brand”.

Since we are running out of room, I will cover just one more of the companies referred to in the quiz. That company is almost universally recognized as the world’s best-known “brand”.

Within the long story of the Coca Cola Company (KO), an interested reader can find corporate intrigue, the possibility of past shenanigans, a “mystery”[15], and the record of various corporate/marketing strategies that resulted in “Coke” becoming known virtually everywhere.

The oldest days of Coca Cola are rooted in the story of a severely wounded Civil War officer (John Pemberton) who became addicted to morphine and committed himself to a quest to discover a less deleterious substitute for morphine. His Columbus, Georgia drugstore[16] was the location from which he sold the “first” Coke recipe – which he entitled a “Coca Wine”.

The oldest days of Coca Cola are rooted in the story of a severely wounded Civil War officer (John Pemberton) who became addicted to morphine and committed himself to a quest to discover a less deleterious substitute for morphine. His Columbus, Georgia drugstore[16] was the location from which he sold the “first” Coke recipe – which he entitled a “Coca Wine”.

By 1885, he registered the formula as the “French Wine Coca Nerve Tonic”. Alas, a new county law one year later that proscribed one of its main ingredients required Pemberton to reformulate his creation. The result was “Coca-Cola” – a non-alcoholic version of the original. Recognizing the benefits it had provided to Pemberton, as well as the common belief from that day that carbonated water was beneficial to human health – the Coca-Cola beverage began to be sold as a patent medicine at soda fountains for five cents a glass. Among the diseases Pemberton claimed that Coca-Cola could help cure were: morphine addiction, dyspepsia, neurasthenia, headache, and impotence.

From that point forward, the story of Coke becomes almost infinitely more complicated – as Asa Candler’s business dealings with Pemberton and his son (Charley) have been the subject of some contention. Suffice it to say that Asa eventually (and I mean “eventually”) gained full control of the brand. It is safe to say that Asa’s bold vision, connections, and sheer will became the driving force for the growth of Coca-Cola from a Georgia drug store “feature” to a worldwide phenomenon.

Most recently, there has been a significant issue with Coca-Cola stock. Take a look at this graph (to the left):

Between April of 2012 and today, KO has been “boring”… ranging steadily between 36 and about 42. Of course, one trader’s “boring” is another investor’s “dream”. Warren Buffett has loved KO for ages – it is a steady performer, a solid company, an outstanding world-class brand, and provides a 2.9% dividend[17]

Finally, we all know that Santa Claus has loved Coke from the start, right? (Or are Warren Buffett and Santa Claus the same?)

Finally, we all know that Santa Claus has loved Coke from the start, right? (Or are Warren Buffett and Santa Claus the same?)

INVESTOR TAKEAWAY: I know that reviewing corporate history does not help us make any money in the market. However, reviewing these bits of our national and corporate legacy can:

1) Teach us life lessons;

2) Put us on notice that over-sized egos, abuse of power, and “shenanigans” are not new within the provinces of Wall Street;[18]

3) Help us recognize that the most successful business people learned self-discipline, perseverance, and flexibility/adaptability along the path of their career! (Those are characteristics that are equally helpful for success as an investor or trader!)

DISCLOSURE: Nothing in this article is intended as a recommendation to buy or sell anything. The author has owned DIA and SPY in the past, as well as various stocks within the Dow Jones Industrial Index. However, he currently owns none of them. Always consult with your financial advisor regarding changes in your portfolio – either subtractions or additions.

Submitted by Thomas Petty MBA CFP

[1] You can find it at: http://www.alcoa.com/usa/en/alcoa_usa/dirt.asp

[2] Charles Martin Hall

[3] He started his search as a teenager in his family’s garage.

[4] The pun is intended. P&G is usually identified as a “consumer staple” stock that has defensive characteristics, since folks still need soap, toothpaste, etc. during economic downturns.

[5] I was surprised to see that Pampers were not introduced until 1961!

[6] That is, BAC is a “too big too fail” bank.

[7] They built planes for the U.S. Army and U.S. Navy.

[8] That is my characterization, not a 3M-approved description!

[9] (like a gentle bolt of lightning)

[10] See http://www.chevron.com/about/history/

[11] As a result, many called Texaco “America’s oil company.”

[12] http://www.youtube.com/watch?v=RkhqSKF5bwQ

[13] Possibly shameful (with regard to US government action)

[14] Good thing Packard did not win. Can you imagine how awkward Packard-Hewlett would have been? J [Maybe in an alternate universe!]

[15] Namely: what the original ingredients were, and to what extent they contained a now banned drug

[16] Pemberton’s Eagle Drug and Chemical House

[17] One they raise regularly. In June 2003, each share received a quarterly dividend of $0.22; in June of 2013, each share received a (split adjusted) $0.56!!

[18] In fact, it is a bit hard to picture many folks as thoroughly “cut throat” like as J.P. Morgan and his coterie.

Related Posts

Also on Market Tamer…

Follow Us on Facebook

2 Everlasting Big Pharma Stocks to Buy Today and Hold Forever

2 Everlasting Big Pharma Stocks to Buy Today and Hold Forever